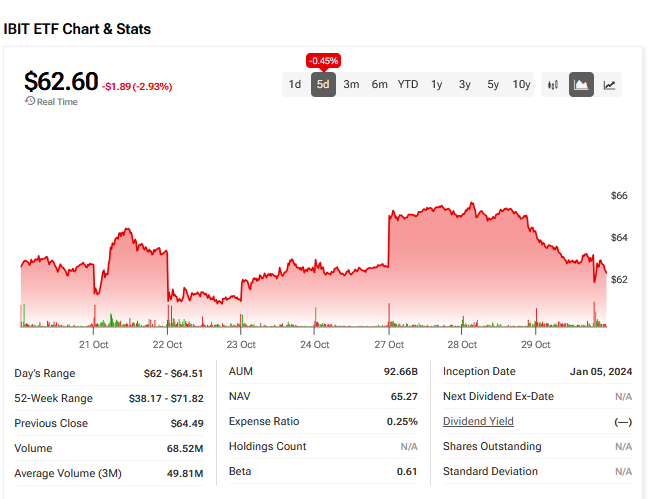

How is IBIT stock faring? The iShares Bitcoin Trust (IBIT) had a tough period today. It is now down 0.45% over the past 5 days, and is 23.05% higher in the year-to-date.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

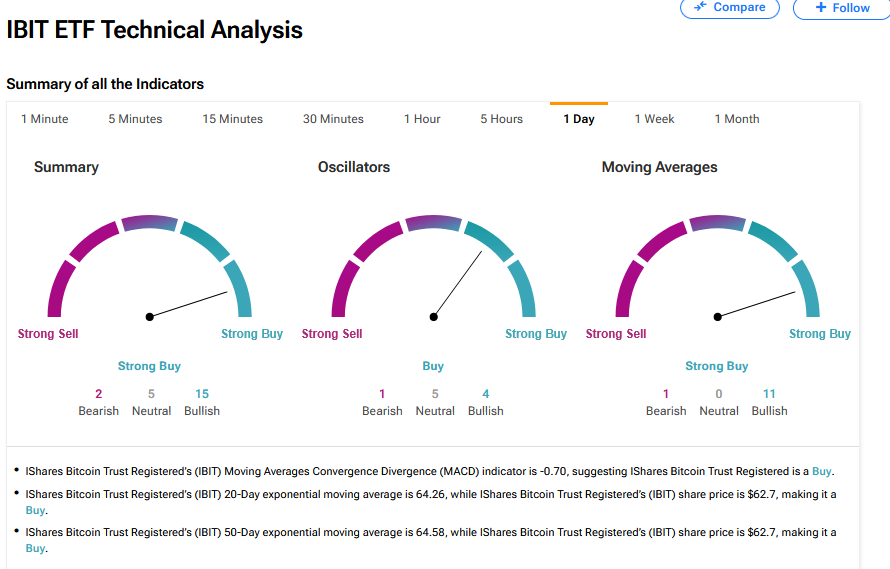

According to TipRanks technical analysis, the IBIT is now at a Strong Buy consensus based on 2 Bearish, 5 Neutral and 15 Bullish ratings.

Based on the activity of 825,071 investors in the recent quarter, it has scored above-sector-average very positive sentiment. Those investors aged between 35 and 55 have been the most active buyers.

In total, 1.9% of all portfolios hold IBIT.

Today’s IBIT Performance

Today, the IBIT was down 2.72% at $62.74 in mid-trading. The main drag was the price of bitcoin, which decreased 1.90% to $110,967.35.

The Federal Reserve’s move to cut interest rates today knocked Bitcoin. Analysts believe that Bitcoin traders may have been spooked by what a cut means for the economic health of the U.S. particularly inflation and jobs.

However, analysts at Hyblock, a crypto analytics company, told TradingView that the move downwards for Bitcoin might only be temporary.

“Recent history has shown that the FOMC leads to a price drop in BTC, followed by a move up. This was the case in both the no rate change and rate cut (last one) scenarios. If price does dip post-FOMC and signs of bullish confluence emerge, such as bid-heavy orderbooks, it would likely present good opportunities for investors,” Hyblock said.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.