BioTech ETFs (exchange-traded funds) offer investors exposure to the biotechnology sector. This sector is known for medical breakthroughs and technological advances and hence has the potential for strong gains. Today, we have shortlisted two such ETFs – IBB and XBI – with over 30% upside potential projected by analysts over the next twelve months.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a closer look at what Wall Street thinks about these two ETFs.

iShares Biotechnology ETF (IBB)

The iShares Biotechnology ETF seeks to track the performance of the NYSE Biotechnology Index, which contains U.S.-listed stocks from the biotech sector. IBB has $7.40 billion in assets under management (AUM), with its top 10 holdings contributing 52.06% of the portfolio. Importantly, it has a low expense ratio of 0.45%. The IBB ETF has returned 1.13% so far in 2024.

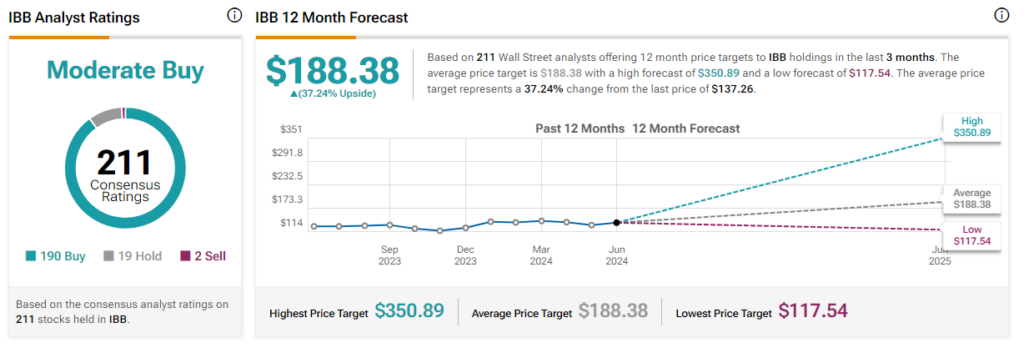

On TipRanks, the IBB ETF has a Moderate Buy consensus rating. Of the 211 stocks held, 190 have Buys, 19 have a Hold rating, and two have a Sell rating. The analysts’ average price target on the IBB ETF of $188.38 implies a 37.24% upside potential from the current levels.

SPDR S&P Biotech ETF (XBI)

The SPDR S&P Biotech ETF replicates the performance of the S&P Biotechnology Select Industry index. XBI has $7.13 billion in AUM, with its top 10 holdings contributing 28.46% of the portfolio. Its expense ratio stands at 0.35%. Interestingly, XBI has generated a return of 4% year-to-date.

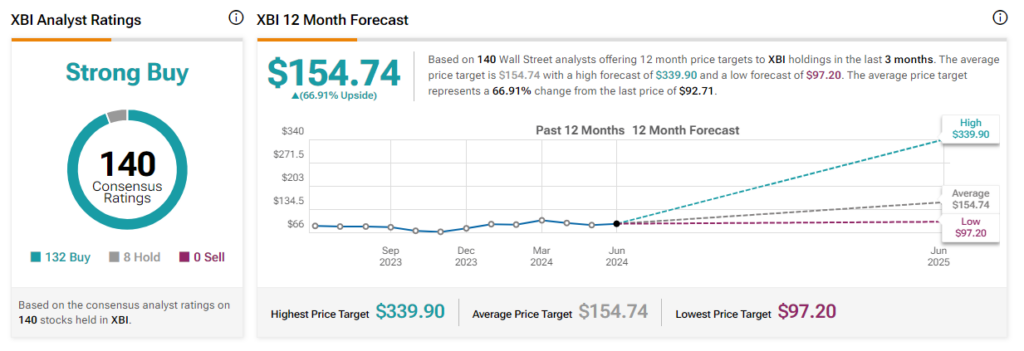

On TipRanks, the XBI ETF has a Strong Buy consensus rating. Of the 140 stocks held, 132 have Buy ratings, and eight have Hold ratings. The analysts’ average price target on the XBI ETF of $154.74 implies a 66.91% upside potential from the current levels.

Concluding Thoughts

ETFs are a low-cost, diversified, and transparent way to participate in the market. Investors looking for potential ETF recommendations could consider IBB and XBI due to the massive upside projected by analysts.