It’s beginning to look like China is advancing in humanoid robotics, while the U.S. is still in early testing. According to various reports, this gap was visible at a recent robotics event in Silicon Valley, where Chinese robots filled much of the floor. Many researchers use low-cost models from Chinese firms because the hardware is already available. As a result, China is gaining a first-mover advantage in data faster than its U.S. peers.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

At the same time, Chinese firms are producing robots at scale. UBTECH Robotics (HK:9880) recently shipped its 1,000th humanoid robot and plans to reach 10,000 units by 2026. In addition, Chinese factories added about 300,000 new robots last year, compared with about 34,000 in the U.S. The Chinese government’s backing also plays a role, with more than $14 billion set aside for AI and robotics projects.

As a result, several publicly traded Chinese firms are tied to this trend. XPeng (XPEV) is developing humanoid robots alongside its electric vehicle business. Xiaomi Corporation (XIACF) has also entered robotics as part of its broader AI strategy. Meanwhile, ABB Ltd. (ABBNY) and Fanuc Corporation (FANUY) remain key suppliers of industrial robots used across China.

U.S. Firms Are Still Piloting

In contrast, most U.S. efforts remain at the pilot stage. Tesla (TSLA) continues to develop its Optimus robot, but large-scale output has not begun. The company has highlighted long-term value, yet no firm launch date has been set. Similarly, Figure AI and Agility Robotics are running limited tests in factories and warehouses.

Also, other major players are still in the early stages. Boston Dynamics, owned by Hyundai Motor Company (HYMLF), has begun new testing phases but has not confirmed mass output. Amazon (AMZN) is using robots in logistics, though not in a full humanoid form. Alphabet (GOOGL) supports AI research, while Nvidia (NVDA) supplies chips used by many robot makers.

Overall, the divide is clear. China is building, shipping, and learning through use. The U.S. is refining ideas and running small trials. For investors, the key point is pace, since scale often shapes cost, adoption, and long-term returns.

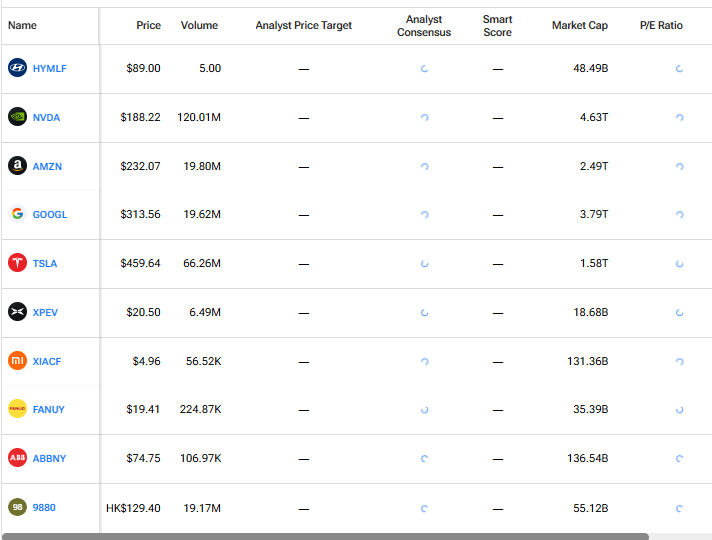

We used TipRanks’ Comparison Tool to compare all the tickers appearing in the piece to gain a broader perspective on each stock and the overall robotics industry.