Marketing software platform HubSpot (HUBS) is set to release its third-quarter earnings results on Wednesday after the U.S. market closes. As the day knocks at the door, analysts are debating whether its stock is poised to benefit from or be doomed by the AI boom.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

What does Wall Street expect from HubSpot?

Analysts on Wall Street are upbeat about HubSpot’s performance in the third quarter. The Massachusetts-based company is expected to earn $2.59 per share, up 19% from $2.18 per share during the same period last year.

Furthermore, the cloud-based marketing technology provider’s revenue is expected to jump by more than 17% to approximately $787 million, up from about $669.72 million seen during the same period last year.

Is AI a Boom or Doom for HubSpot?

While Wall Street appears upbeat about HubSpot’s Q3 earnings, it is divided on where it is headed beyond the recent quarter.

Wells Fargo analyst Ryan MacWilliams recently listed HUBS stock as one of its top three picks to benefit from the new AI boom, particularly in agentic coding — AI that can write code to build another AI based on inputs such as plain-text prompts. However, BofA analyst Bradley Sills appears less optimistic.

Sills, who trimmed his HUBS price target by about 14% from $740 to $640, noted that HubSpot’s stock “continues to languish” due to concerns about how disruptions in agentic AI — artificial intelligence that acts as an agent and handles tasks autonomously — will impact its business. HUBS stock is currently down more than 29% since the start of the year.

Furthermore, Sills pointed to HubSpot’s weakness in search engine optimization. However, the analyst is “comfortable concluding” that the company’s new pricing model, based on client credit purchases, will help it monetize Breeze, HubSpot’s AI assistant designed for its platform.

In addition, the BofA analyst observed that multiple compression — investors paying less for each unit of a company’s earnings — is emerging across similar companies in the apps business. Nonetheless, the analyst keeps a Buy rating on HubSpot’s shares.

Is HUBS Stock a Good Buy?

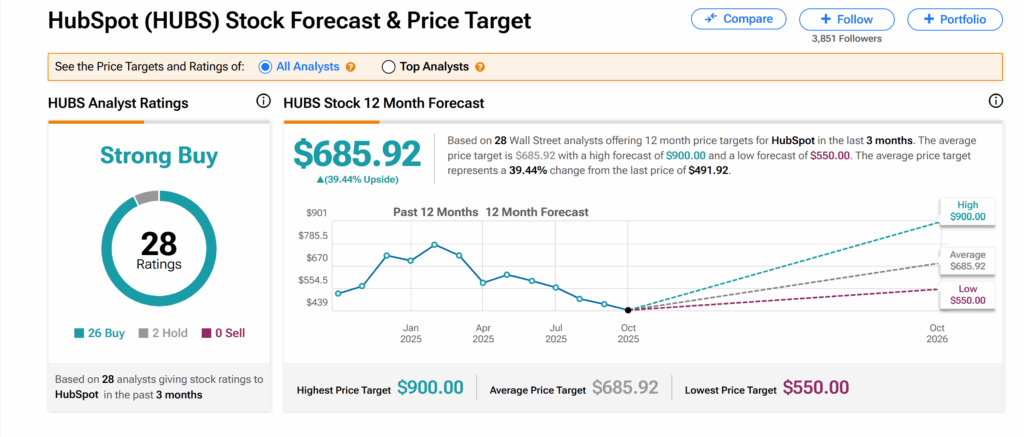

Across the broader Street, the attitude towards HubSpot is predominantly bullish.

HubSpot’s shares currently boast a Strong Buy consensus rating based on 26 Buys and two Holds issued by analysts over the past 3 months. Moreover, the average HUBS price target of $685.92 indicates more than 39% upside from the current level.