Broadcom (AVGO) just got a green light from HSBC (HSBC). Analyst Frank Lee upgraded the stock to Buy on Tuesday, saying the company’s AI chip revenues are likely to “significantly beat market expectations.” In his note, he also bumped the price target from $240 to $400, a serious jump that implies more upside ahead, even after a 13% year-to-date gain.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AVGO shares rose 3.5% on the back of the call, trading at $262.68 Tuesday morning.

Custom AI Chip Deals Give Broadcom a New Edge

The upside argument revolves around Broadcom’s deepening role in AI infrastructure, specifically custom silicon. It’s a dominant player in the world of AI ASICs (application-specific integrated circuits), which are tailor-made chips for big cloud players building their own AI engines. That means better visibility, higher prices, and bigger margins.

“We believe that hyperscaler capex will drive ASIC growth,” Lee wrote, pointing out that nearly all the major cloud players are now investing in proprietary silicon. Translation? Broadcom isn’t just riding the AI wave — it’s powering the surfboard.

The Market’s Missing the Upside

According to HSBC, the Street isn’t fully pricing in how much AI custom chip revenue Broadcom could rake in over the next two years. With more design wins and stronger-than-expected average selling prices (ASPs), that revenue could blow past current estimates.

In other words, Wall Street’s math is wrong. And HSBC thinks that mispricing is your opportunity.

CEO Hock Tan Hinted at this Earlier

During Broadcom’s most recent earnings call, CEO Hock Tan made a subtle but telling forecast: he expects demand for AI inference — that’s the part where models generate answers, not train — to pick up in the second half of 2026. That implies more ASIC deployment, and possibly more wins for Broadcom.

Is Broadcom a Buy, Sell, or Hold?

HSBC is betting on fundamentals, not hype: pricing power, growing capex from cloud giants, and a custom-chip model that’s sticky and hard to disrupt. Add it all up, and the firm says Broadcom’s AI story is getting stronger by the day.

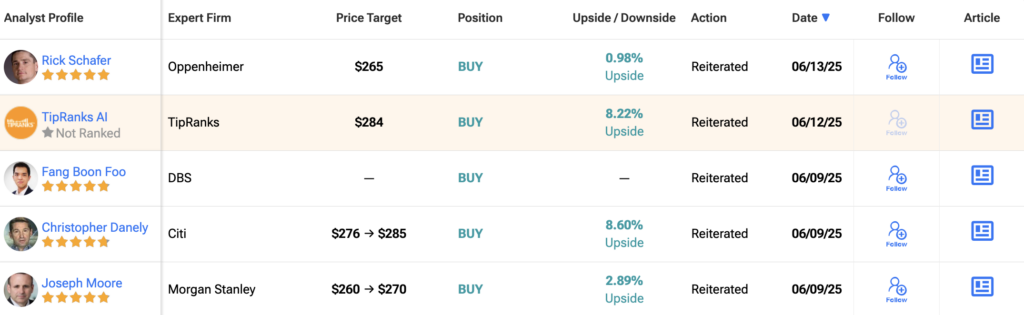

Overall, Wall Street seems to agree. On TipRanks, Broadcom (AVGO) is rated a Strong Buy based on 29 analyst reviews in the past three months. That breaks down into 27 Buys, two Holds, and zero Sells, a bullish consensus that echoes HSBC’s optimism.

The average AVGO price target sits at $286.60, which suggests a 9.3% upside from the current level of $262.34.