Tesla (TSLA) stock declined 2.6% on Friday after the electric vehicle (EV) giant reported about a 16% year-over-year decline in its fourth-quarter deliveries to 418,227 units. For the full year 2025, the Elon Musk-led company’s deliveries declined 8.6% to 1.64 million EVs, marking the second straight year of lower deliveries. In reaction to the lower-than-expected Q4 deliveries, HSBC reiterated a Sell rating on TSLA stock with a price target of $131.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

HSBC Remains Bearish on TSLA Stock

HSBC analyst Michael Tyndall noted that Tesla’s Q4 deliveries missed his estimate by 5.2% and the company-compiled consensus estimate by 1.1%. The analyst explained that the end of the $7,500 EV credits in the U.S. must have impacted Tesla’s Q4 deliveries, while the more affordable Standard models failed to address the gap.

Furthermore, Tyndall highlighted that Tesla is not facing pressure only in the U.S., as high-frequency data for Europe and China indicate weakness in volumes in both the key EV markets. On the positive side, the analyst noted that Tesla’s energy storage deployment of 14.2 GWh in Q4 2025 was 7.5% above HSBC’s expectations.

Meanwhile, Tyndall observed that Tesla produced more than 434,000 vehicles in Q4 2025, about 16,000 more than deliveries, suggesting that the company expects demand to improve in Q1 2026. However, the analyst added that it’s unclear what will drive the improvement in Q1 deliveries.

Interestingly, Tyndall noted that the global EV market is becoming more “regionalized,” with the adoption in the U.S. slowing and competition rising in both China and Europe. The analyst expects the Chinese government’s steps to reduce price wars and extend trade-in subsidies to drive demand. However, Tyndall expects Tesla to continue to lose market share in Europe, given stiff competition from local and foreign brands.

Is Tesla Stock a Buy, Sell, or Hold?

While several analysts are cautious on Tesla stock due to ongoing pressures, bulls are confident about the company’s growth potential based on its FSD (full self-driving) technology, robotaxi business, and Optimus humanoid robot.

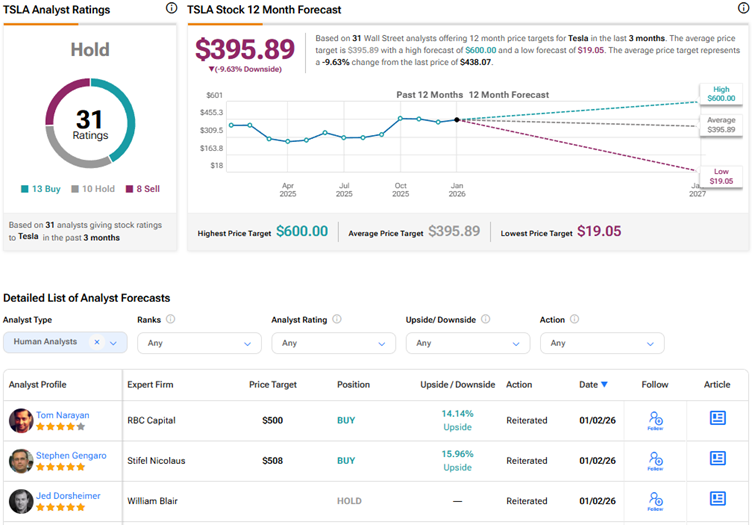

Overall, Tesla stock scores a Hold consensus rating based on 13 Buys, 10 Holds, and eight Sell recommendations. At $395.89, the average TSLA stock price target indicates about 10% downside risk.