Electric vehicle (EV) maker Tesla (TSLA) is expected to announce its third-quarter deliveries on Thursday. Heading into the key update, HSBC analyst Michael Tyndall increased his price target for TSLA stock to $127 from $120 but maintained a Sell rating. Meanwhile, Benchmark analyst Mickey Legg reiterated a Buy rating with a price target of $475. Let’s look at the views of these analysts on TSLA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

HSBC Weighs in on Tesla’s Q3 Deliveries

Tyndall noted that based on high-frequency data (daily and weekly run rates in China and Europe), he expects Tesla to deliver strong quarter-over-quarter growth of 23% in Q3 volumes, which is seven percentage points ahead of the company-collated numbers. The analyst highlighted that the consensus estimates for Q3 deliveries are in the range of 437,000 to 441,000 units, compared to his estimate of 471,000. Notably, the end of the EV tax credits is likely to have pulled forward demand in Q3 2025.

Tyndall added that Tesla’s Q3 volumes also benefited from favorable tax treatment in Türkiye for battery electric vehicles (BEVs) and the Model Y refresh. In fact, the strength in TSLA volumes in Türkiye was enough to more than offset the lower volumes observed in broader Europe. However, favorable tax treatment has since been amended, and Tyndall expects TSLA’s volume growth in Türkiye to ease. Further, the analyst contends that while Tesla has seen growth in Spain, it was mainly due to “generous” incentives, which sparks doubts about the longevity of such demand in this market.

Benchmark Analyst’s Views on TSLA Stock

Meanwhile, Benchmark’s Legg expects Tesla to report Q3 deliveries of 442,000 units compared to the FactSet consensus of 448,000 vehicles, with some high-side calls in the mid-460,000s range. The analyst noted that while the Q3 deliveries estimate reflects strong sequential growth, the setup into the year-end seems cautious due to uneven incentives and pricing.

Given the spike in TSLA stock in September, Legg contends that it may take a big upside surprise to drive it higher, while a weak regional mix or average selling prices (ASPs) could spark volatility. He expects policy-related choppiness after the third quarter, as certain EV incentives/credits will tighten or roll off in select markets, possibly resulting in Q4 “demand air pockets and order-book lumpiness.”

Is TSLA Stock a Buy, Sell, or Hold?

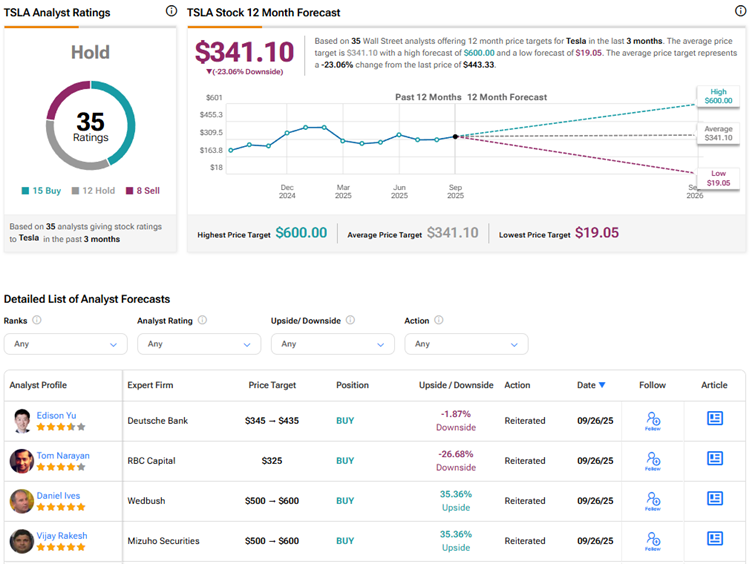

Wall Street has a Hold consensus rating on Tesla stock based on 15 Buys, 12 Holds, and eight Sell recommendations. The average TSLA stock price target of $341.10 indicates a possible downside of 23.1% from current levels. TSLA stock has risen 33% over the past month and is up about 10% year-to-date.