HP (NYSE:HPQ) stock declined 3.3% in the after-market session on Tuesday following the release of its fiscal fourth quarter results. The company delivered lower-than-expected top-line results, while its earnings matched estimates. The demand-constrained environment in the Commercial PC and Printing divisions weighed on its sales. However, the company expects a recovery in PC demand within the upcoming year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The technology company develops and sells a wide range of personal computing and printing products worldwide.

Q4 Snapshot

Adjusted earnings per share came in at $0.90, which increased 9.8% year-over-year and was in line with analysts’ consensus estimate. Meanwhile, sales decreased by 6% year-over-year and hit $13.8 billion. The reported figure missed analysts’ expectations of $13.91 billion.

HPQ’s revenue growth is being impacted by industry-wide challenges such as corporate spending cuts and waning demand in China. Further, competitive pricing remains a drag. Revenues in the Personal Systems segment, which includes PCs and notebooks, declined 8% year-over-year to $9.4 billion. At the same time, the Printing segment, encompassing printers and ink cartridges, witnessed a 3% drop in revenue to $4.4 billion.

HP refrained from stock repurchases in the most recent quarter but anticipates resuming buybacks in the current period and maintaining an active presence in the market throughout the year.

Recovery Ahead

The company anticipates a resurgence in PC demand in Fiscal 2024, buoyed by stabilizing corporate demand trends and an uptick in consumer spending.

HPQ further anticipates that the launch of new PCs with artificial intelligence (AI) capabilities, slated for the second half of 2024, will serve as a key catalyst for PC growth. HP CEO Enrique Lores revealed that the company is utilizing processors from Intel (INTC), Advanced Micro Devices (AMD), and Qualcomm (QCOM) to develop its AI PCs.

The company anticipates fiscal first-quarter adjusted earnings to fall within the range of $0.76 to $0.86 per share. Additionally, HP maintained its Fiscal 2024 adjusted EPS guidance of $3.25 to $3.65.

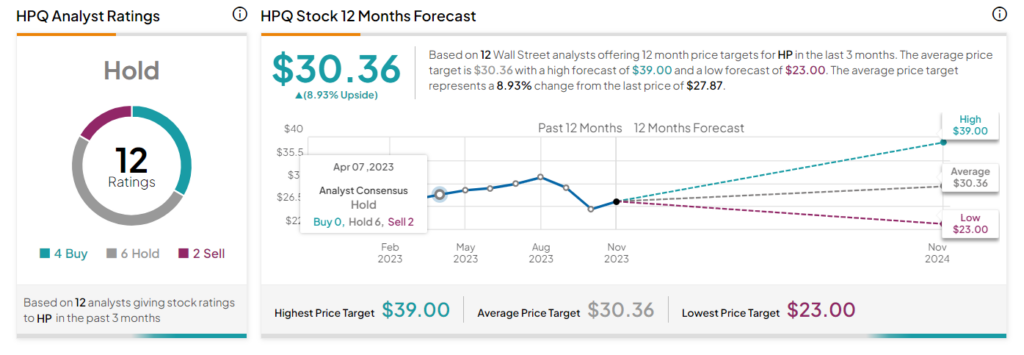

Is HPQ a Buy or Sell?

Given the current slowdown in demand, Wall Street remains sidelined on HPQ stock. It has received four Buy, six Hold, and two Sell recommendations for a Hold consensus rating. Further, analysts’ 12-month average price target of $30.36 implies 8.93% upside potential from current levels.