The market woke up on Friday to a slew of new tariff measures.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The first is a fresh 100% tariff on foreign drugs announced by President Donald Trump himself late Thursday, giving a slight boost to the stocks of American pharma heavyweights. The second one is a rumoured new 1:1 chip tariff rule that would require American chip companies to track the origin of all their chips and coordinate with manufacturers to balance the number of U.S.-made and foreign-originated products over time. The third is related to trucks.

The trigger for the chip tariff is economic and national security concerns, according to media reports. American tech companies still rely heavily on chips made abroad—especially in Taiwan—despite the CHIPS and Science Act of 2022 providing billions in subsidies.

Chip Sales on Track for $1 Trillion by 2030

Global sales of semiconductors are expected to hit over $700 billion at the end of this year, marking a new all-time high, according to the Semiconductor Industry Association (SIA). This is even as the industry is projected to generate $1 trillion in chip sales by 2030.

However, the U.S. only manufactured about 12% of the world’s semiconductors last year, according to the SIA. This is despite the country contributing about 25 to 30% of the world’s final consumption, per the Bank of America’s (BofA) (BAC) estimate.

So, the key question is: How will such a new tariff impact the U.S. market? Will it turn things around?

BofA Flags Risk for Hardware Makers

According to BofA analyst Vivek Arya, American personal computer, smartphone, and server makers are likely to be more vulnerable to such a policy. These are markets where Apple (AAPL), Dell Technologies (DELL), HP (HPQ), Hewlett Packard Enterprise Co (HPE), and Cisco (CSCO), among others, are active.

An Upside for Foundries?

On the other hand, BofA expects that such a policy would give “some stock boost” for American chip-makers such as Intel (INTC), GlobalFoundries (GFS), Micron (MU), and Texas Instruments (TXN).

However, it believes that semiconductor capital equipment companies–firms that build the machines used to manufacture chips–in the long run are likely to emerge as the real beneficiaries of such a rule. Companies active in this space include ASML (ASML), Lam Research (LRCX), Applied Materials (AMAT), and KLA (KLAC), among others.

Furthermore, BofA believes that fabless vendors–which do not own or operate their own chip fabrication facilities–are more likely to direct more of their orders to the U.S. manufacturing unit of Taiwan Semiconductor Manufacturing (TSM). This is where the likes of Nvidia (NVDA), Broadcom (AVGO), Advanced Micro Devices (AMD), and Marvell (MRVL) come in.

The new plan is likely to face other challenges that could add more complexity to the market. However, it remains to be seen if such a policy will see the light of day.

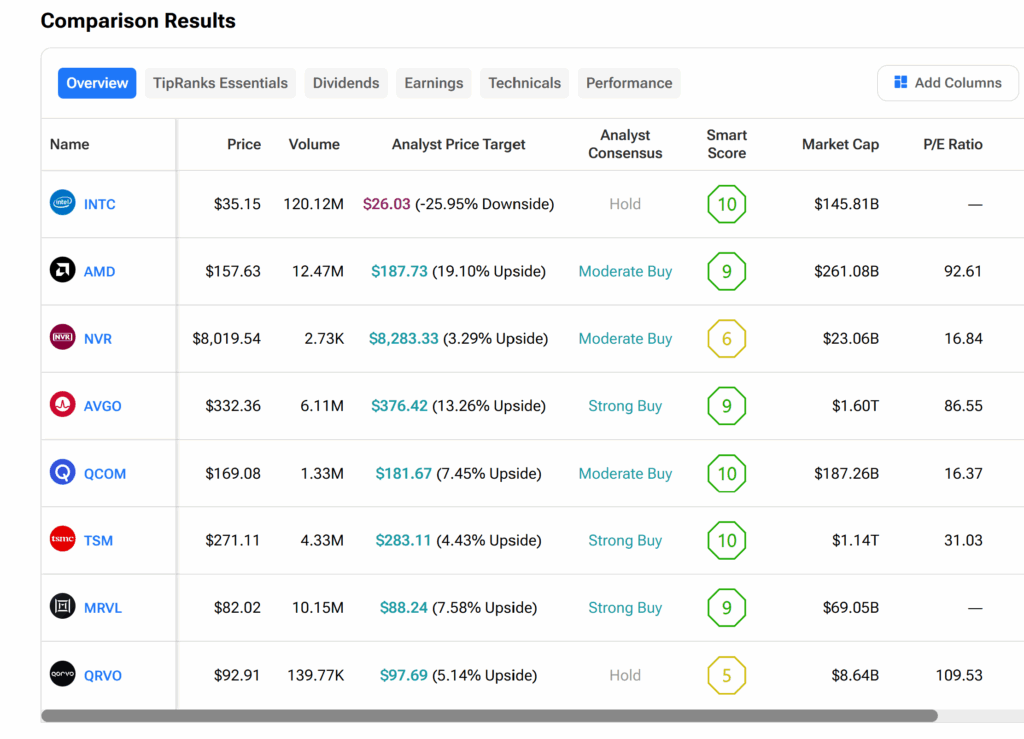

What are the Best Chip Stocks to Buy?

The addition of a newer tariff regime has implications for the chip industry, making deciding what chip stocks to buy a critical moment for investors. The TipRanks Stock Comparison Tool provides insight into which chip stocks are highly rated by analysts. Kindly see the graphics below.