TJX Companies’ (TJX) TJ Maxx department store chain is in a unique position that allows it to avoid paying tariffs on its goods. This lets it circumvent the increased tariffs President Donald Trump has placed on China. The company does so by buying its products from other companies in the U.S.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

By buying its products from U.S. companies, TJ Maxx doesn’t have to deal with tariffs. However, that doesn’t make it completely immune to their effects. Instead, those U.S. companies pay the tariffs before selling the goods to TJ Maxx. However, it avoids additional costs by buying leftover stock or returned items, ensuring it can nab them at discounted prices.

What This Means for TJ Maxx Stock

TJ Maxx’s ability to evade tariffs means it’s well-positioned to weather the trade war between the U.S. and China. The company even noted that President Trump’s tariffs will benefit its business model. UBS analyst Jay Sole supports this idea, claiming TJ Maxx and similar companies “typically outperform in times of dislocation.”

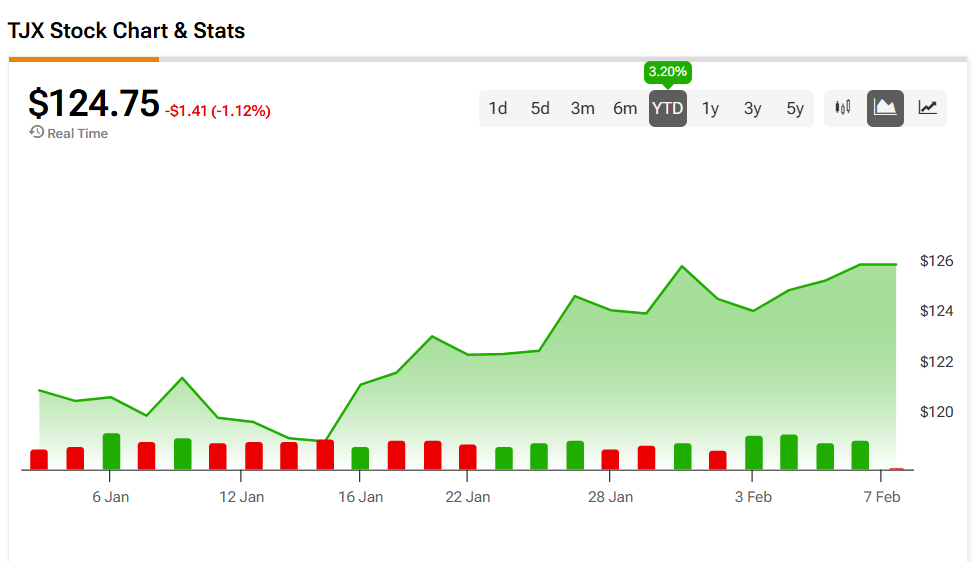

While TJX stock might be poised for long-term success, investors aren’t feeling it today. The shares are down 1.12% as of this writing, compared to a 3.2% increase year-to-date. Granted, this is more likely due to the stock market falling alongside the January 2025 Jobs Report than anything done by TJ Maxx.

Is TJX Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for TJX Companies is Strong Buy based on 16 Buy and two Hold ratings over the past three months. With that comes an average price target of $137.72, a high of $151, and a low of $120. This represents a potential 10.34% upside for TJX stock.