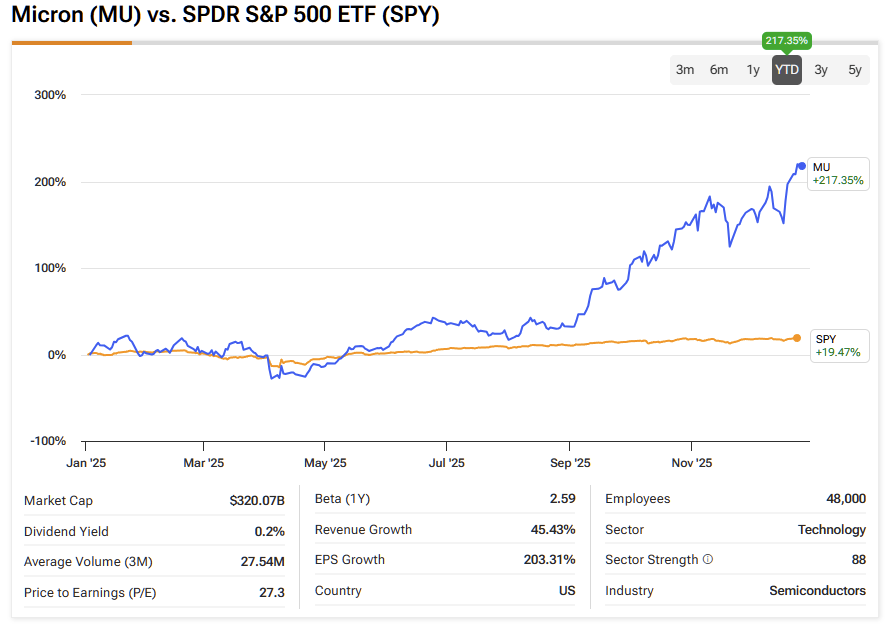

Micron Technology (MU) has already delivered one of the most dramatic stock performances in the market this year. Shares are up more than 217% year to date, massively outperforming the S&P 500 (SPX), and the stock is now trading at all-time highs. Even after this extraordinary run, I believe Micron still has meaningful upside ahead.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The reason is simple: Micron is at the center of a powerful, multi-year AI-driven memory supercycle. Demand for high-performance memory is accelerating faster than supply can respond, and Micron’s exposure to AI data centers—particularly through high-bandwidth memory (HBM) and advanced DRAM—positions the company to deliver record revenue, expanding margins, and outsized free cash flow well beyond 2026.

Q1 2026 Earnings: A Step-Change Quarter

Micron’s fiscal Q1 2026 earnings marked a clear inflection point for the business. Shares surged more than 27% in just a week following the report, reflecting how decisively results exceeded expectations.

Revenue rose 56.6% year over year to a record $13.64 billion, driven by explosive AI data-center demand, rapid adoption of HBM and DDR5, and a tight supply environment across both DRAM and NAND. Profitability followed suit, with record margins and free cash flow underscoring the operating leverage now embedded in Micron’s model.

DRAM was the standout. Revenue in the segment jumped 69% year over year to a record $10.8 billion, fueled by hyperscalers ramping next-generation GPU clusters and AI-ASIC deployments. HBM and high-capacity DDR5 modules are now core building blocks for modern AI infrastructure, and Micron is one of the few suppliers capable of delivering at scale.

NAND also contributed meaningfully. Enterprise SSD demand tied to AI servers and storage-heavy workloads supported growth, while client, mobile, and automotive markets showed improving trends. Together, these dynamics confirm that AI is not just lifting one product line—it is reshaping Micron’s entire revenue mix.

HBM: The Strategic Chokepoint in AI Infrastructure

A critical takeaway from the quarter is Micron’s position in HBM. Management confirmed that its HBM capacity for calendar 2026 is effectively sold out, including next-generation HBM4. The company expects the HBM total addressable market to grow at roughly a 40% CAGR over the next several years, reaching about $100 billion by 2028—nearly three times today’s level and two years ahead of prior expectations.

HBM is also extremely wafer-intensive, consuming roughly three times the wafer area of standard DDR5. As AI workloads absorb an increasing share of leading-edge capacity, effective DRAM supply tightens, enhancing pricing power across the memory complex. In this environment, memory is becoming a strategic bottleneck that dictates the pace and economics of AI data-center expansion.

With global AI server and infrastructure spending expected to grow 20–30% annually into the 2030s, Micron’s HBM roadmap places it squarely at the center of this build-out. The company is no longer just a cyclical memory supplier—it is a gatekeeper to AI scalability.

Supply Constraints Support the Upcycle

Micron’s forward guidance reinforces the bullish thesis. For fiscal Q2 2026, the company expects revenue of $18.7 billion at the midpoint, more than double the $8 billion generated in Q2 2025. That implies year-over-year growth of roughly 132%, a remarkable acceleration even after a strong Q1.

On the supply side, management expects memory markets to remain undersupplied through calendar 2026 and into 2027. AI data center buildouts continue to push demand forecasts higher, while supply additions are constrained by limited cleanroom availability and long lead times for new fabrication capacity. Even with Micron raising its capital expenditure outlook to around $20 billion, physical constraints are limiting the pace at which new supply can come online.

Looking ahead to 2026, both DRAM and NAND bit supply are expected to grow by around 20%, which management believes will still be insufficient to meet accelerating AI-driven demand.

Importantly, Micron has indicated it can currently fulfill only about half to two-thirds of the requirements for some key customers. Historically, supply additions have been the biggest threat to memory upcycles. This time, structural constraints suggest tight conditions could persist much longer than in prior cycles.

Micron Margins Reach New High

Profitability is also entering uncharted territory. Micron guided to a non-GAAP gross margin of approximately 68% in Q2, marking a new all-time high and surpassing the peak levels reached during the 2018 cycle.

The margin expansion is being driven by revenue growth skewed toward DRAM, strong pricing, favorable product mix, and ongoing cost improvements. HBM margins, in particular, are accretive not only to DRAM but to corporate gross margins overall, while data-center SSDs continue to support NAND profitability.

Given how much stronger Micron’s technology position is today versus prior cycles, I see a credible path toward mid-70% gross margins over time. Compared with 2018, Micron now benefits from structurally higher-value products, tighter industry discipline, and AI-driven demand that is far less price-elastic.

Valuation Still Leaves Room For Expansion

Despite the stock’s massive rally, Micron’s valuation remains reasonable relative to its growth profile. The company trades at a P/E ratio of 27.20x and an EV/EBITDA of 14.53, compared with sector medians of 31.31x and 18.77x, respectively.

Using a combination of valuation approaches—including earnings multiples and discounted cash flow models—I estimate fair value around $330 per share, implying roughly 15% upside from current levels.

Is MU a Buy, Sell, or Hold?

Wall Street remains firmly bullish. The consensus rating is Strong Buy, with 26 Buy, 2 Hold, and 0 Sell recommendations. The average price target stands at $316.81, representing over 10% upside potential from the current stock price.

Why the AI Memory Supercycle Can Push MU to New Highs

Micron has already delivered extraordinary gains, but the fundamentals suggest the story is far from over. AI is reshaping memory demand, HBM is emerging as a strategic bottleneck, and supply constraints are extending the upcycle well into 2027.

With record revenue, expanding margins, and unparalleled exposure to the AI infrastructure build-out, Micron is no longer just riding a cyclical rebound—it is participating in a structural transformation of the memory industry. Even at all-time highs, I remain bullish on Micron and believe further upside remains ahead.