On paper, cloud-based software company Salesforce (CRM) has done enough to justify investor confidence. Last month, the company disclosed its results for the first quarter, which saw revenue hit $9.83 billion. This tally marked an 8% increase year-over-year, driven in part by a 9% rise in subscription and support revenue in constant currency. Further, AgentForce, a standout product, surpassed the $100 million mark in annual recurring revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, the print didn’t impress Erste Group, which downgraded CRM stock to Hold from Buy. Experts at the firm cited concerns over slower sales and profit growth in the current year. To be fair, Erste acknowledged that Salesforce remains a leader in customer service, marketing automation, and AI-driven data analysis. Unfortunately, besides the slowed growth, the competition is catching up. Additionally, the top and bottom lines are expected to be lower than they were last year.

Other analysts stated that Salesforce merely cleared a “low bar” and that the company hasn’t demonstrated convincingly that it can address broader concerns, particularly macroeconomic headwinds. As such, CRM stock may not appear attractive to some investors. Since the start of the year, the stock has fallen 18%.

Despite the challenging backdrop, the market will ultimately decide where CRM stock heads next, and there may be an underappreciated quantitative signal that could be favoring the bulls.

Narratives Provide Color, Not Certainty

While it may be tempting to dismiss CRM stock based on analysts’ opinions, it should be noted that narratives generally provide context and color. However, they typically represent poor predictors of forward valuation. Even when applying the traditional methodologies of fundamental and technical analysis, they can’t reliably forecast the future.

To be clear, technical and fundamental methodologies may provide subjective guideposts, thus potentially offering some heuristic value. Still, the core vulnerability of standard market analysis is that the underlying framework suffers from what’s known as the “non-stationarity problem.” That’s a fancy way of saying that the metric of comparison drifts — and often wildly — across vast periods and sentiment regimes.

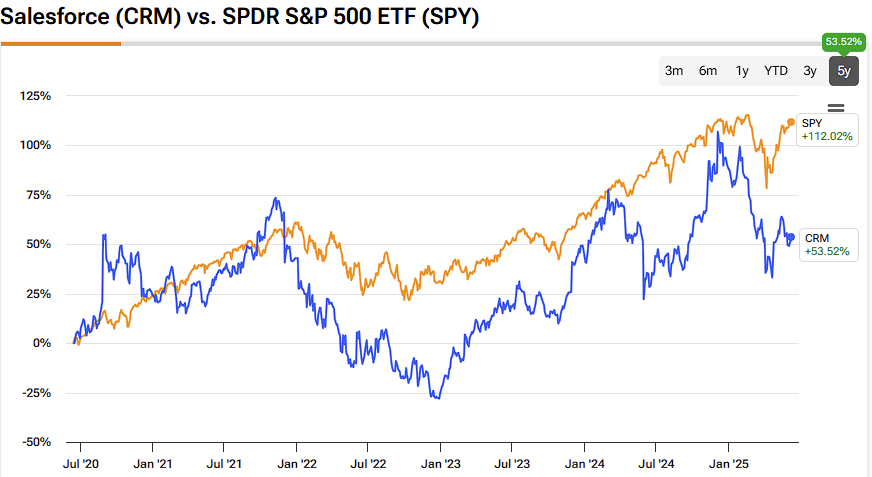

For example, CRM stock trades hands for roughly $275 at the time of writing. Five years ago, the equity could be had for about $174. Ten years ago, the price per share was around $72. Therefore, it would be nonsensical to conduct statistical analyses, such as price clustering, on such vast price ranges. In other words, the price action of a decade ago has no bearing on contemporary price discovery. Over time, CRM can underperform or outperform, so the critical factor is timing.

The same problem can be observed on the fundamental side. One could argue that CRM stock is priced at nearly 34x trailing earnings, but there is no first-order principle that such a metric holds any significance. Moreover, several catalysts can significantly alter this ratio, including business expansion, industry transitions, share dilution, and buybacks.

Essentially, these analytical frameworks don’t share a unified language throughout the dataset, which contributes to the fragility of their forward projections. To provide a better solution, one must impose stationarity — and that’s where market breadth comes into the picture.

Using Statistics to Capitalize on CRM Stock

At its core, market breadth is the pattern of accumulation and distribution. In other words, market breadth is a representation of demand, and demand is binary — it’s either happening or it’s not. Plus, from a statistical standpoint, demand is a discrete event that is easily categorizable and quantifiable across time.

The key advantage of utilizing discrete events is that they facilitate comparative analysis. A demand profile that materialized a decade ago remains relevant if it appears today. That’s the benefit of compressing — or abstracting to use the proper lexicon — price discovery into a binary code: analysts can develop probability matrices, focusing on how one demand profile (or behavioral state) transitions to another.

With CRM stock, in the past two months, the security printed a “6-4-U” sequence: six up weeks, four down weeks, with a net positive trajectory across the 10-week period. Notably, in 61.21% of cases, the following week’s price action results in upside, with a median return of 2.23%.

If the implications of the 6-4-U pan out as projected, CRM stock could potentially hit $280.63 by the end of June. To note, CRM isn’t the most exciting entity from a kinetic point of view. However, if the bulls maintain control of the market, the security could swing toward the $282 to $285 range over the next four weeks.

Primarily, the setup incentivizes a bullish posture because of the baseline probability. On any given week, the chance that CRM stock will rise is 55.5%, which is a solid upward bias. However, the 6-4-U sequence adds almost six percentage points of “free odds” for the bullish speculator.

Tightening the Grip on Salesforce Options

For those interested in playing the numbers game, the 275/280 bull call spread expiring June 20 is a tempting proposition. This transaction involves buying the $275 call and simultaneously selling the $280 call, for a net debit paid of $248. Should CRM stock rise through the short strike price at expiration, the maximum reward is $252, a payout of almost 102%.

Mainly, this trade is attractive because of the statistical response to the 6-4-U sequence. As a betting person, the odds suggest that the coming week will be a positive one. From a median performance view, the 2.23% return would drive CRM stock above the $280 short strike target.

Of course, probabilities are precisely that — probabilities, not guarantees. If you want additional time for the trade to pan out, you may consider the 275/280 bull spread expiring a week later. However, keep in mind that the net debit required at the time of writing is $290, and the maximum payout is significantly lower, at around 72%.

Is Salesforce a Buy, Sell, or Hold?

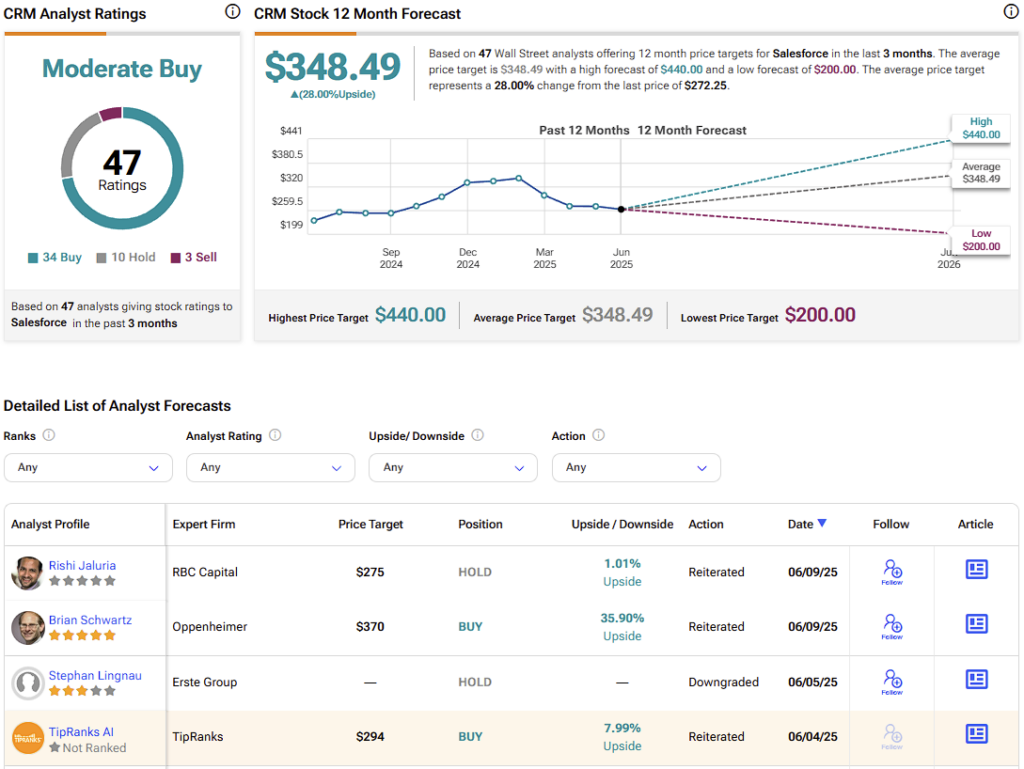

Among professional market analysts, CRM stock carries a Moderate Buy consensus rating based on 34 Buys, 10 Holds, and three Sell ratings accrued over the past three months. The average CRM stock price target is $348.49, implying 28% upside potential over the next year.

Statistical Approach Can Deliver Returns Despite Wall Street Doubts

From an investment perspective, Salesforce may face some challenges amid increasing scrutiny on Wall Street. However, from a trading standpoint, CRM stock could present a compelling opportunity. The key consideration is the thesis that market breadth and demand dynamics predominantly influence CRM’s share price. By applying rigorous statistical analysis to these factors, options traders can identify a meaningful edge.