Buying stocks of businesses that provide essential goods and services, and pay a hefty dividend, is an effective strategy for building passive income. That’s because those businesses generate reliable cash flow to maintain their dividend payments. Having increased its dividend payout for 29 consecutive years, Canadian pipeline and energy concern Enbridge (ENB) is a great example of a dividend powerhouse.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The midstream energy company’s fundamentals have me feeling confident in its prospects as an income investment. This is even more true following Enbridge’s recent quarterly results. Let’s dig into Enbridge’s operating fundamentals and valuation for a better understanding of why I rate this stock a Buy.

A Strong Third Quarter

Enbridge announced third-quarter results on November 1 that fueled my bullish sentiment. The company’s total operating revenue surged 51.2% higher year-over-year to C$14.9 billion (US$10.66 billion). Mainline system volume remained steady at around three million barrels per day during the quarter. The driving factors behind this topline growth were acquisitions. On May 31, Enbridge completed its acquisitions of public gas utility Questar and gas reserve developer Wexpro for C$4.1 billion.

Enbridge’s adjusted EBITDA rose by 8.5% over the year earlier period to C$4.2 billion. Higher revenue was largely offset by higher interest expense and greater depreciation. Adjusting for the 6.3% increase in the weighted average diluted share count in the quarter, adjusted EBITDA per share also moved higher.

More Growth Ahead for Enbridge

Another reason for my bullish thesis on Enbridge is that its growth profile should remain decent for the foreseeable future. The integration of its Questar and Wexpro acquisitions in future quarters should provide a lift to the business. Enbridge also closed on its Public Service Company of North Carolina deal on September 30. This should be a catalyst in the coming quarters as well.

Enbridge also has C$27 billion in secured capital projects that are undergoing construction. That includes C$3.7 billion in U.S. utility growth capital for 2025 through 2027 in the Gas Distribution & Storage business. The T-South Expansion of gas transmission capabilities in the Gas Transmission business accounts for another C$4 billion in capital spending and is expected to be placed into service in 2028.

Marginal headwinds from tax legislation helps explain why Enbridge is projecting 3% annual distributable cash flow per share growth from 2023 through 2026. Beyond that time, the company expects its cash flow to compound by 5% annually.

A Passive Income Machine

Enbridge’s market-smashing income is another reason to be bullish. The 6.3% dividend yield registers at roughly five times that of the S&P 500 index’s (SPX) 1.2% yield. This dividend is also safe, which is evidenced by the fact that the payout ratio is positioned to be in the low to high-60% range in 2024. That’s within the 60% to 70% payout ratio targeted by the company.

This puts the company in a spot to deliver dividend growth in line with per share growth. For my money, that’s an emphatic way for Enbridge to build on an already impressive 29-year dividend growth streak. This is very enticing income growth potential.

Enbridge’s financial strength also ensures that the company is at a low risk of becoming insolvent. Its debt to EBITDA ratio is within its targeted range of 4.5 to 5 times. That’s a manageable leverage ratio for a company that derives 98% of its cash flow from long-term contracts. This is why S&P Global (SPGI) awards the company an investment grade, BBB+ credit rating.

Enbridge’s Valuation Is Discounted

The strength of Enbridge’s results don’t seem to fully reflect its valuation, which is another positive for the stock. Shares of the midstream company are trading at a price to operating cash flow ratio of 9.5. For context, that’s moderately below the 15-year average P/OCF ratio of 11.6.

This is despite Enbridge’s growth prospects remaining intact. The company’s acquisitions of utilities also could make it even more defensive and could justify a multiple re-rating as they are successfully incorporated into its business moving forward.

Is ENB Stock a Buy?

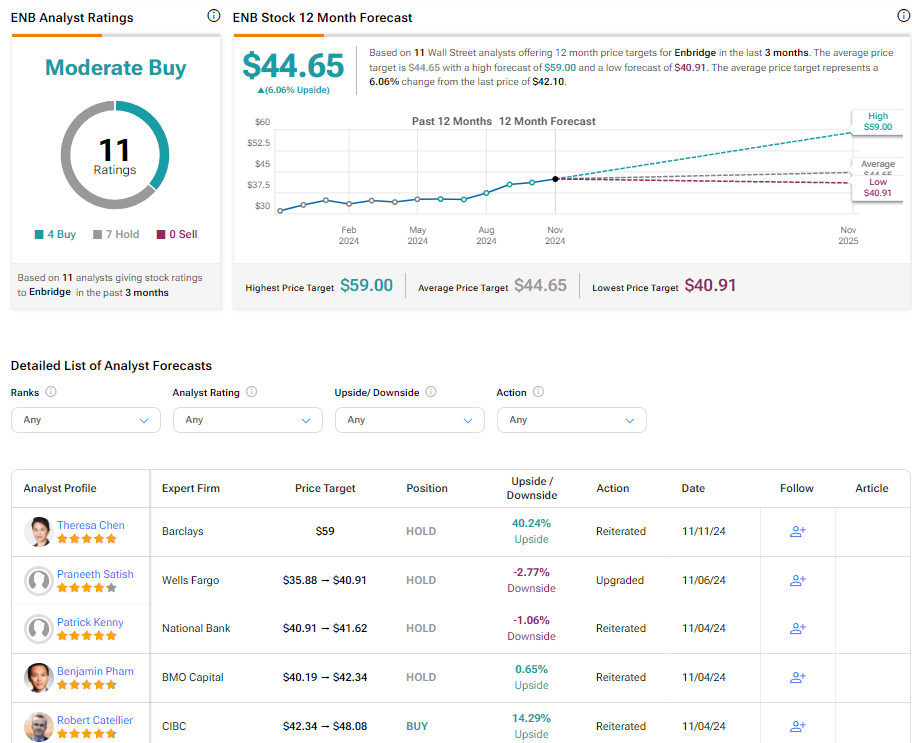

Shifting our attention to Wall Street, analysts have a Moderate Buy rating on Enbridge stock. Out of 11 analysts, seven have issued Hold ratings and four have assigned Buy ratings in the past three months. At $42.09, the average ENB price target of $44.65 indicates that Enbridge stock could have 6.11% upside from current levels.

Read more analyst ratings on ENB stock

Conclusion

Enbridge is among the most consistent dividend payers in the investment universe. No matter the price of the crude oil and natural gas that moves through its pipelines, the company’s toll-booth business model helps it to report relatively predictable revenue. Enbridge is also investing billions to sustain its growth. Accordingly, I am bullish on this stock.