When Disney (DIS) joined the Dow Jones Industrial Average (RYDAX) in May 1991, it didn’t just replace U.S. Steel, it rewired the DNA of the index. For the first time, a pure entertainment company sat at the table with industrial giants. It marked Wall Street’s shift from smokestacks to storytelling. Disney brought Mickey Mouse, Marvel, theme parks, and merchandising power into the 30-stock club, reflecting America’s transition into a service-led economy.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Disney Stock Struggles to Stay a Dow Darling

Over the past decade, Disney has lagged. From the end of 2014 to mid-2025, DIS climbed just 35% with dividends, while the S&P 500 (SPY) more than doubled. Once a powerhouse, the stock was among the Dow’s worst performers by 2023. Even after a dramatic 2021 run-up to nearly $200 per share, the following years saw brutal sell-offs and a retreat to the $110s by mid-2025.

Pandemic and Streaming Turmoil Break the Spell

Disney’s magic stumbled during COVID-19. Theme parks shut down, movie sets emptied, and leadership chaos took center stage. Streaming looked like the next frontier, but Disney+ became a mixed blessing, a subscriber magnet that bled money. At its worst, Disney’s streaming division lost $1.5 billion in a single quarter. Bob Chapek’s leadership faltered, and the return of Bob Iger in 2022 marked a major course correction.

Iger Cuts Costs, Raises Stakes, and Defends ESPN

Bob Iger didn’t waste time. He slashed $7.5 billion in costs, tightened content budgets, and revamped Disney+ and Hulu pricing. ESPN, long seen as a cash cow in decline, saw renewed focus, with Iger fending off spinoff rumors and pushing for strategic partnerships instead. By early 2025, ESPN’s ad revenues bounced back 15%, suggesting there may be life in the sports giant yet.

Theme Parks Bounce Back, but Clouds Linger

The parks division, Disney’s crown jewel, rebounded impressively. Revenue hit $8.3 billion in Q3 2023, up 13%, with operating income rising 11%. Shanghai’s full reopening helped, but rising costs and uncertain travel trends kept expectations in check. Still, a proposed $30 billion investment through 2033 suggests Disney’s not done dreaming.

Disney Stock Is a Dow Veteran with Work to Do

Despite holding a modest 1.7% Dow weighting due to its share price, Disney’s brand brings vital media and consumer presence to the index. But investor trust needs rebuilding. The forecast range for DIS by end-2025 is wide: $100 to $148. Analysts are split, and activist investors are circling. The stock trades at a lower P/E than peers, signaling doubt but also potential upside.

Is Disney Stock a Buy Right Now?

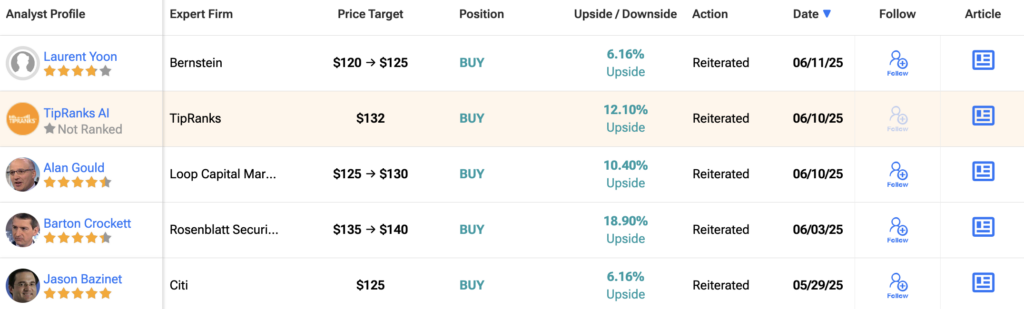

According to TipRanks, Disney currently holds a consensus rating of Strong Buy, based on 15 Buys, four Holds, and zero Sells from analysts. The average DIS price target sits at $125.12, implying 6% upside from current levels. Investors are betting on Iger’s reforms and the return of profit in streaming and parks. If the strategy sticks, DIS could reawaken, but it’s a stock that still has to earn back the fairy dust.