Investors may be wondering how the stock market performed this week. Although Friday isn’t over yet, stock markets have already finished their run this week due to Good Friday. Markets in the U.S. are closed for the holiday, including the New York Stock Exchange and the Nasdaq. As such, traders can already measure the performance of the stock market this week.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Investors will note this week is a bit of a mixed bag when measuring stock market performance by the major indices. The S&P 500 (SPX) increased by 0.73% over the last five days, while the Dow Jones Industrial Average (DJIA) dropped 0.71%, and the Nasdaq 100 (NDX) slipped 0.08% during that same period.

This caused exchange-traded funds (ETFs) that track these stock indices to rise and fall as well this week. That includes the SPDR S&P 500 ETF Trust (SPY), SPDR Dow Jones Industrial Average ETF Trust (DIA), and Invesco QQQ Trust (QQQ).

This Week’s Biggest Stock Market Winners and Losers

With stock market volatility high alongside economic uncertainty, plenty of stocks have seen massive gains and losses throughout the week. That’s especially true of penny stocks, which are more subject to extreme market volatility.

Here’s a quick breakdown of the biggest stock market winners this week.

- Elong Power Holding (ELPW) stock rocketed 268.22%.

- Motorsport Games (MSGM) stock surged 217.65%.

- Splash Beverage Group (SBEV) stock soared 190.97%.

Now for the biggest stock market losers over the last week.

- Click Holdings Limited (CLIK) stock plummeted 88.62%.

- Mullen Automotive (MULN) stock dove 50.67%.

- XChange TECINC (XHG) stock plunged 38.77%.

What’s Next for the Stock Market?

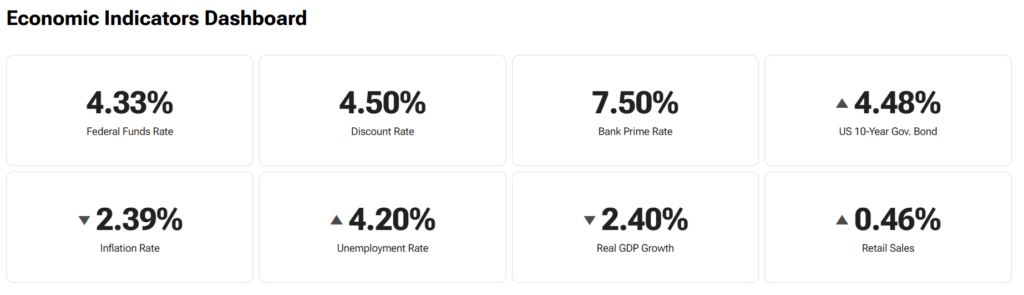

Stock market volatility will likely continue as tariffs and the trade war continue to affect companies. Investors can stay on top of all of this with the TipRanks Economic Calendar and Economic Indicators Dashboard.