Few stock market turnarounds have been as dramatic as Carvana’s (CVNA). The online used-car retailer came close to falling apart in 2022, when rising interest rates and high inflation abruptly reversed eight straight years of margin improvement. This happened even as vehicle sales had more than doubled from 2019 levels. More specifically, losses swelled to nearly $2.9 billion, and worries about a possible bankruptcy spread among investors as confidence in the business collapsed.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Since then, however, Carvana has clawed its way back. In fact, the company stabilized operations, improved efficiency, and ultimately returned to growth by posting record revenue and gross profit per vehicle. That recovery ultimately led to Carvana being added to the S&P 500 (SPY) in December. Impressively, this achievement capped a stunning rally of more than 10,000% from its 2022 lows and marked one of the most painful reversals for short sellers in recent market history.

Indeed, S3 Partners’ Ihor Dusaniwsky noted that short sellers have lost $8.44 billion since the stock’s 2022 bottom. As a result, Wall Street’s view of Carvana has shifted just as dramatically. For instance, four-star Morgan Stanley (MS) analyst Adam Jonas, who once warned that the stock could fall to as low as $0.10 per share, upgraded Carvana to a Buy rating in May and called it a potential “Amazon of auto retail.” Additionally, in October, he said that the company could grow its share of the used-car market to 12% by 2040, up from about 1.5% today.

Is CVNA Stock a Good Buy?

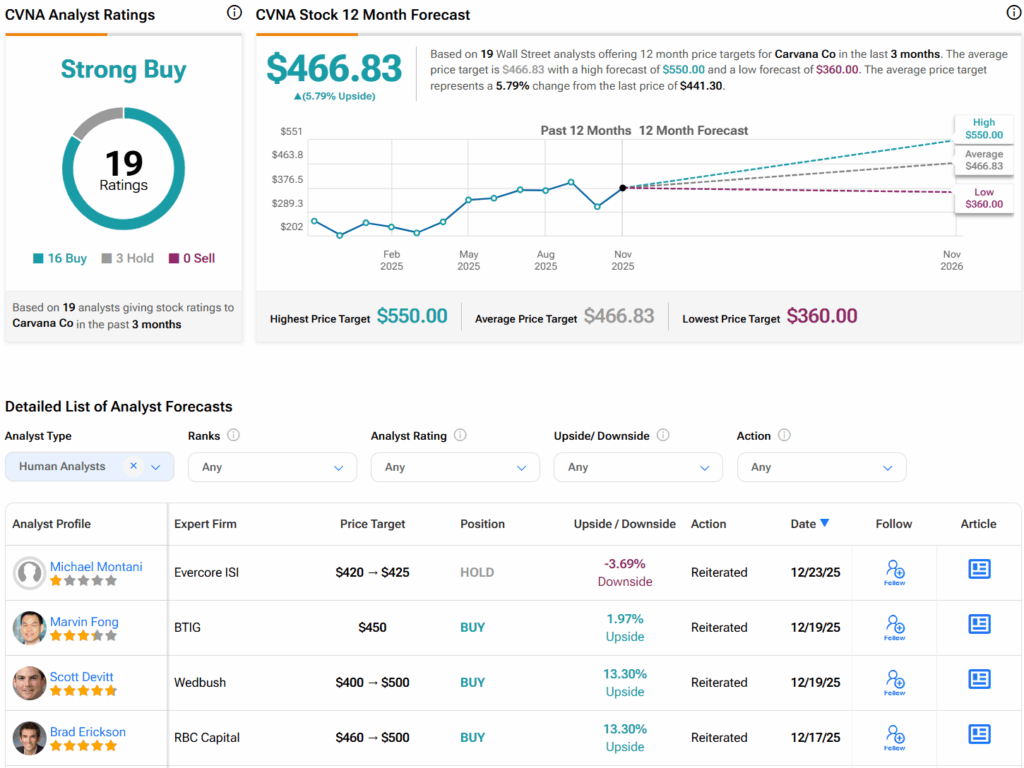

Overall, analysts have a Strong Buy consensus rating on CVNA stock based on 16 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average CVNA price target of $466.83 per share implies 5.8% upside potential.