Self-custody remains the gold standard for holding cryptocurrencies, but that doesn’t mean corporate treasuries can’t offer compelling exposure as well. One of the most interesting cases today is BitMine Immersion Technologies (BMNR), a company that has rapidly transformed itself into the largest listed holder of Ethereum (ETH-USD). Understandably, the stock has endured extreme volatility earlier this year, and now stands almost 370% higher year-to-date.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What began as a niche immersion-cooled Bitcoin miner has, under the leadership of chairman and Fundstrat co-founder Thomas Lee, transformed into a full-scale Ethereum-centric treasury vehicle. In just a few months, BitMine has amassed 3,505,723 ETH—an extraordinary milestone that redefines how investors approach corporate crypto exposure.

More importantly, as digital assets continue to secure a permanent place in investor portfolios, companies like BMNR and Strategy (MSTR) are increasingly standing out as legitimate long-term investment vehicles, rather than mere meme-stock proxies for speculative crypto bets. Given the exotic setup, I’m tentatively Bullish on BMNR.

From Miner to Ethereum Balance-Sheet Powerhouse

BitMine’s strategic overhaul took place over the summer, when it shifted away from its mining roots and recast itself as an Ethereum treasury vehicle. The company’s simple proposition: if Ethereum is becoming the base settlement layer for tokenized finance, then ETH isn’t just a digital token—it’s infrastructure equity with a native yield. Ethereum’s proof-of-stake system allows ETH holders to earn staking rewards in the range of 3–4%, and as of mid-2025, nearly 30% of all ETH is locked in staking.

This thesis is anchored in Ethereum’s continued dominance in stablecoins and tokenization. Roughly 70% of all stablecoin supply exists on Ethereum, with stablecoin transactions accounting for about one-third of network fees. The global stablecoin market has already surpassed $300 billion and continues expanding.

Meanwhile, tokenization is surging: tokenized real-world assets have crossed $30 billion, and when including funds, RWAs, and wrapped instruments, estimates place the Ethereum-based tokenized stack near $200 billion. Major financial institutions—BlackRock (BLK), Franklin Templeton (BEN), Fidelity (FNF)—are already building on Ethereum rails. For BitMine, these three pillars—money, capital markets, and staking yield—position ETH as a uniquely powerful treasury asset.

The Ambitious Pursuit of a 5% ETH Supply

Central to BitMine’s thesis is what the company calls the “Alchemy of 5%”: its stated goal to acquire 5% of all Ethereum in existence. With the disclosed 3.5 million ETH stake, BitMine claims to have reached roughly 2.9% of the supply, placing it more than halfway toward its target.

This accumulation has been funded almost entirely through equity issuance. A pivotal $250 million raise at $4.50 per share in June jump-started the strategy, and the company has since layered on at-the-market offerings to steadily buy more ETH. The model is equity-driven and debt-free—no major loans, no bond stack—just relentless issuance to expand the treasury.

However, transparency remains a lingering gap. Unlike MicroStrategy’s weekly BTC disclosures, BitMine provides only periodic press releases, leaving questions around how much ETH is actually staked or deployed on-chain. The company may need to adopt more detailed reporting if its aggressive capital-raising continues, especially should it venture into convertibles or preferred equity.

Assessing BitMine’s Valuation and Net Asset Value

As a treasury-style company, BitMine is best evaluated through its net asset value (NAV). In this week’s update, BMNR reported holdings of:

- 3,505,723 ETH at an average price of $3,639

- 192 BTC

- $61 million in ORBS equity

- $398 million in cash

This amounts to approximately $13.2 billion in crypto, equity stakes, and liquid assets. With about 284.7 million shares outstanding and shares trading around $40–41, the market cap is roughly $11.5 billion.

Using the asset values above yields an NAV around $45–46 per share, which would imply a discount—if the share count were accurate. But BitMine’s infrequent SEC filings leave the true dilution unclear. A more conservative assumption places NAV closer to $38–40 per share, suggesting the stock may actually trade at a slight premium. Critically, BitMine would not issue stock below NAV, which offers investors a directional hint on valuation.

Is BMNR a Good Stock to Buy Now?

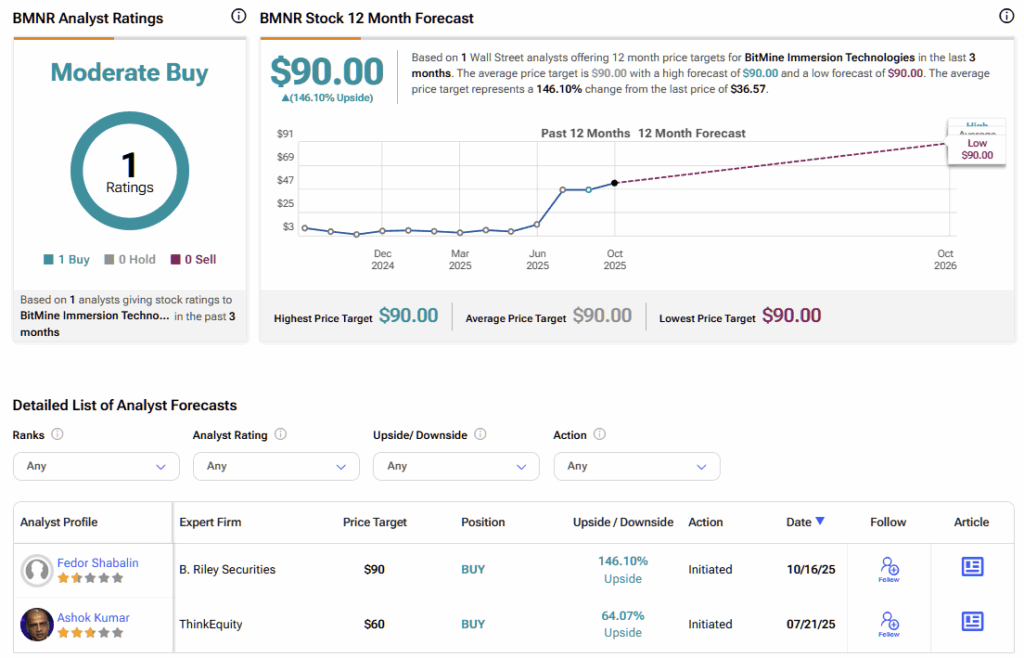

BMNR currently holds a Moderate Buy consensus on Wall Street, based on the view of two analysts. Fedor Shabalin from Riley Securities and Ashok Kumar from ThinkEquity are both bullish on the stock. In a research note published last month, Shabalin initiated coverage of BMNR and set a $90 price target.

Currently, BMNR stock carries an average stock price target of $90, suggesting ~146% potential upside over the coming year. Of course, the coverage is limited, and the company’s rapid dilution means investors must closely track treasury updates.

A Corporate Treasury Built for an On-Chain Future

BitMine Immersion Technologies represents a new breed of corporate balance sheet—one built explicitly around digital monetary infrastructure. The company’s unwavering commitment to Ethereum, its belief in on-chain capital markets, and its aggressive accumulation strategy all point toward a long-term bet on ETH becoming foundational financial collateral.

Execution risks and transparency issues remain real. But for investors seeking ETH exposure through equity rather than direct ownership, BMNR offers a uniquely levered and highly focused vehicle. Whether it proves visionary or overly ambitious, BitMine is undeniably positioning itself at the front edge of the on-chain finance transition—and that alone makes it worth watching. For crypto-curious investors with a firm grasp of risk tolerance, BMNR is a good fit.