Pharma giant Eli Lilly (LLY) is steadily positioning itself as a core infrastructure for obesity and diabetes treatment on a global scale. Its injectable GLP-1 therapies already define the first wave, but the more compelling story lies ahead.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The next phase, in my view, is a scalable oral GLP-1 pill paired with a meaningful expansion into AI-driven drug discovery. Layer that innovation engine on top of explosive earnings growth, and Lilly emerges as a premium-valued compounder with substantial upside—even after an extended rally. For these reasons, I remain bullish on LLY stock.

Oral GLP-1 for the Mass Market

Eli Lilly’s most exciting new catalyst today is orforglipron, its once-daily oral small-molecule GLP-1 receptor agonist. In the Phase 3 ATTAIN-2 study of adults with obesity and type 2 diabetes, treatment with orforglipron resulted in an average weight loss of ~10.5% over 72 weeks. Moreover, participants also experienced reductions in A1c and improvements across various cardiometabolic measures compared with placebo.

The safety profile was consistent with the GLP-1 class, with gastrointestinal symptoms as the most common adverse events. While its weight-loss efficacy does not match that of the highest-dose injectable agents, the magnitude of benefit is still clinically meaningful.

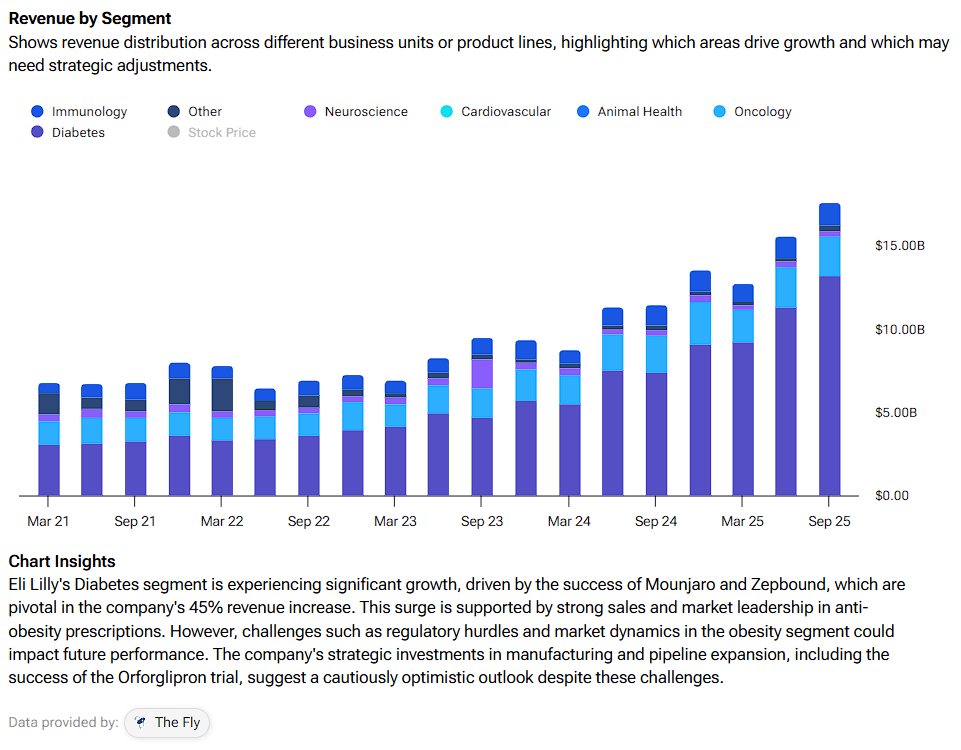

Eli Lilly then asked whether the pill could “carry the baton” after injections. In its ATTAIN-MAINTAIN study, people who had already lost weight on semaglutide or tirzepatide were switched to orforglipron. The pill largely maintained prior weight loss over a year with only modest regain and no new safety issues. That, in my view, makes it a credible maintenance strategy for patients who do not want to stay on injections indefinitely. Diabetes is Eli Lilly’s largest revenue driver, creating significant room for growth.

It’s worth noting that regulators have put a fast-track label on the drug. Eli Lilly has filed for obesity and secured a Commissioner’s National Priority Voucher in December last year. This can cut FDA review times to roughly 3 months, according to analysts. The company also pointed investors to an expected U.S. decision by March 2026. If approval lands on time, the current year becomes the first meaningful revenue year and the point at which a pill can begin to attract injection-averse patients — and so too with primary-care prescribers that the current GLP-1 franchise does not fully reach.

AI as Lilly’s Quiet Force Multiplier

But beyond orforglipron, the much more interesting, and potentially multi-year tailwind is AI. Just last September, Eli Lilly launched TuneLab, an AI and machine-learning platform that lets selected biotechs run Eli Lilly’s trained discovery models on their own data via federated learning. The data stays with the partner, but the models are updated for everyone.

The company then added real compute scale. A collaboration with Nvidia (NVDA) is building what both describe as pharma’s most powerful AI supercomputer, using DGX SuperPOD systems to train large biomedical foundation models on millions of experimental data points. Those models will support target identification, molecule design, and even manufacturing, pushing discovery toward the “self-driving lab” approach highlighted in recent reviews of AI-enabled R&D.

Around that core, Eli Lilly is bolting on external AI engines. An outstanding example is the up to $1.3 billion Superluminal Medicines collaboration, which uses an AI-driven GPCR platform to identify next-generation obesity and cardiometabolic drugs. Another is the newer deal with Insilico Medicine, whose generative-AI platform has already cut early discovery timelines to roughly 12–18 months in other programs. While this doesn’t guarantee a blockbuster, it clearly raises the odds that today’s GLP-1 wave is followed by a broader metabolic and cardiovascular franchise rather than a long fade.

Valuation: Expensive, But Maybe Not Irrational

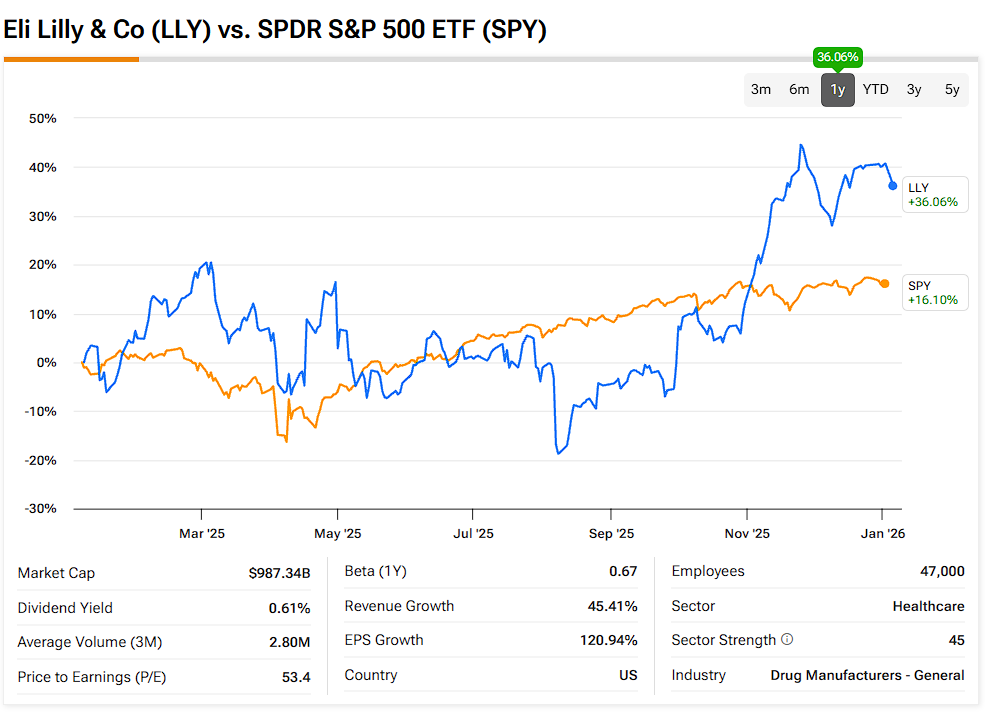

Valuation-wise, note that LLY has historically been a pricey stock. Rightfully so, considering its growth has consistently impressed quarter after quarter. Yet, I see no signs of a slowdown ahead. Consensus pegs 2025 EPS at $23.66, implying about 82% growth versus 2024, then rising to roughly $32.6 in 2026 and around $40 in 2027 – around 38% and 23% growth in those years. With the stock near $1,080, that works out to about 46x 2025 earnings and 33x 2026, levels that would be hard to justify for a business growing slowly, but not for Lilly.

GLP-1 revenue has been compounding at extraordinary rates, and management has repeatedly raised guidance. In the meantime, Wall Street still sees earnings CAGR of around 20% a year beyond the aforementioned estimate window. In that context, I believe the stock is like a scarce structural-growth asset with a credible multi-year EPS expansion path. The AI story only strengthens this narrative.

The risks I would highlight here are potential manufacturing bottlenecks, pricing and reimbursement fights, rival oral GLP-1s, and any safety scare could all knock the story off course. But if orforglipron wins early-2026 approval, if the AI stack begins to show up in a broader late-stage pipeline, and if next-wave assets like retatrutide deliver anything close to recent trial data, today’s multiples are most certainly going to look cheap in retrospect.

Is LLY a Good Stock to Buy Now?

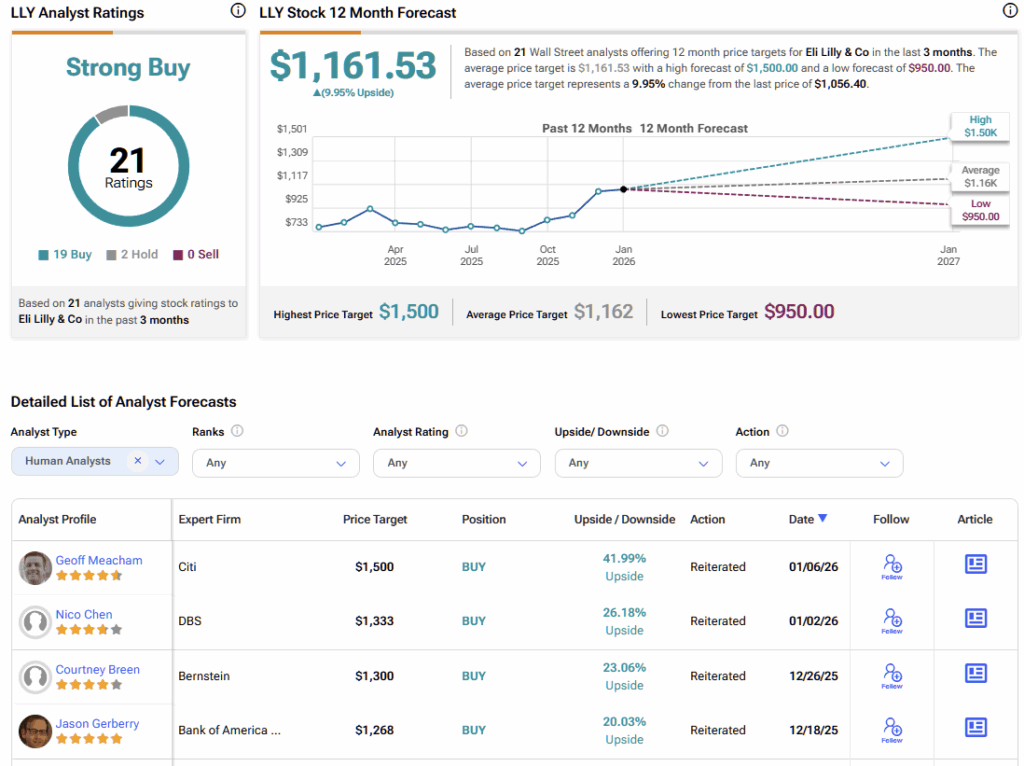

On Wall Street, LLY stock features a Strong Buy consensus rating, based on 19 Buy and two Hold ratings. No analyst rates the stock a Sell. Furthermore, Eli Lilly’s average stock price forecast of $1,161.53 implies almost 10% upside for 2026.

A High-Conviction Compounder Despite the Volatility

Overall, I remain bullish on LLY. The investment case blends near-term visibility from a potential oral GLP-1 with longer-term optionality from an AI-driven drug discovery engine. This is unlikely to be a smooth ride, and periods of volatility should be expected. But for investors willing to tolerate that turbulence, the greater risk may be staying on the sidelines while the compounding unfolds.