Kioxia Holdings Corp. (TSE:285A) has become the world’s best-performing stock in 2025. The Japanese memory maker is up about 536% for the year on the Tokyo Stock Exchange, outperforming the MSCI World Index. However, the rally is less about AI excitement and more about a known chip cycle pattern. When demand surges into a tight memory market, prices and stocks tend to move fast.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This is exactly what is happening now. AI systems require substantial data storage to train and operate. As a result, demand for memory chips has jumped across data centers. Meanwhile, supply has not kept pace. Building new memory capacity takes time and heavy spending, which limits quick expansion.

Kioxia supplies NAND flash memory used in servers and cloud systems. Its customers include Apple (AAPL) and Microsoft (MSFT). The company was listed on the Tokyo Stock Exchange in late 2024 and now has a market capitalization of nearly $36 billion. Since then, investors have focused on rising memory prices and strong order trends.

Why the Setup Still Matters for 2026

Meanwhile, concerns about valuation have started to appear. In November, Kioxia shares fell about 23% in one day after earnings missed high expectations. Still, the larger trend has remained intact. Memory demand continues to exceed supply, which supports pricing power into next year.

In addition, even if AI spending slows at the margin, memory prices are set by supply gaps, not short-term demand shifts. For this reason, analysts expect memory makers to remain supported in 2026. Related firms, such as wafer suppliers, may also benefit as memory output rises.

In simple terms, GPUs get most of the attention in AI markets. However, memory is where demand meets real limits. Kioxia’s rise reflects how markets react when a key part of AI infrastructure stays scarce.

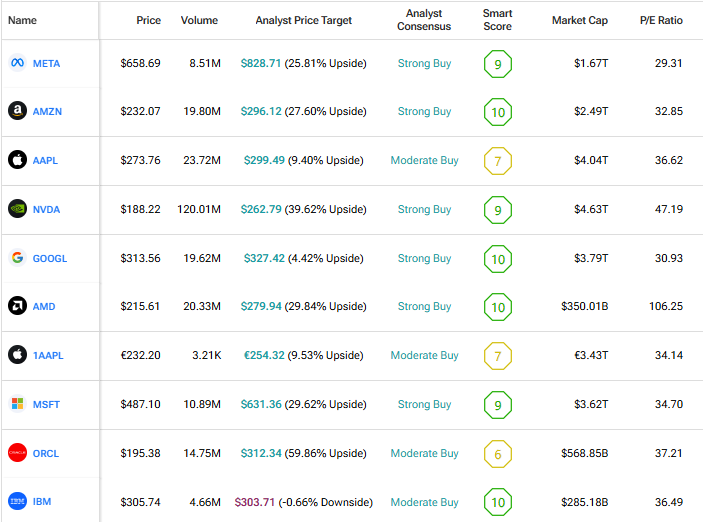

We used TipRanks’ Comparison Tool to identify major companies that are heavily reliant on a consistent supply of memory chips. This comparison chart will emphasize why companies like Kioxia are thriving in the current landscape.