Honeywell International (HON) stock declined over 2% in the pre-market trading session after the company lowered its full-year 2024 outlook. The downward revision stems from Honeywell’s new deal with Canadian business jet maker Bombardier (BDRBF), which is expected to affect HON’s short-term performance.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

HON offers solutions in aerospace, buildings, specialty chemicals, and industrial safety equipment.

Honeywell and Bombardier Partner on Advanced Tech

Under the partnership, Honeywell will supply Bombardier aircraft with advanced avionics, propulsion, and satellite communications technology. Importantly, HON estimates that the deal could generate up to $17 billion in sales in the long term.

Interestingly, the deal comes a month after activist investor Elliott Investment Management pressured the company and pushed for a breakup of Honeywell.

Honeywell Cuts Outlook Due to Increased Spending

While Honeywell remains optimistic about the long-term benefits of the deal, the initial investment costs are expected to impact its near-term results.

As a result, the company has lowered its full-year sales and earnings guidance. The company now expects full-year sales of $38.2 billion to $38.4 billion, down from the previous forecast of $38.6 billion to $38.8 billion. Further, adjusted EPS is expected to be in the range of $9.68 and $9.78, lower than prior guidance of $10.15 and $10.25.

Is HON a Good Stock to Buy?

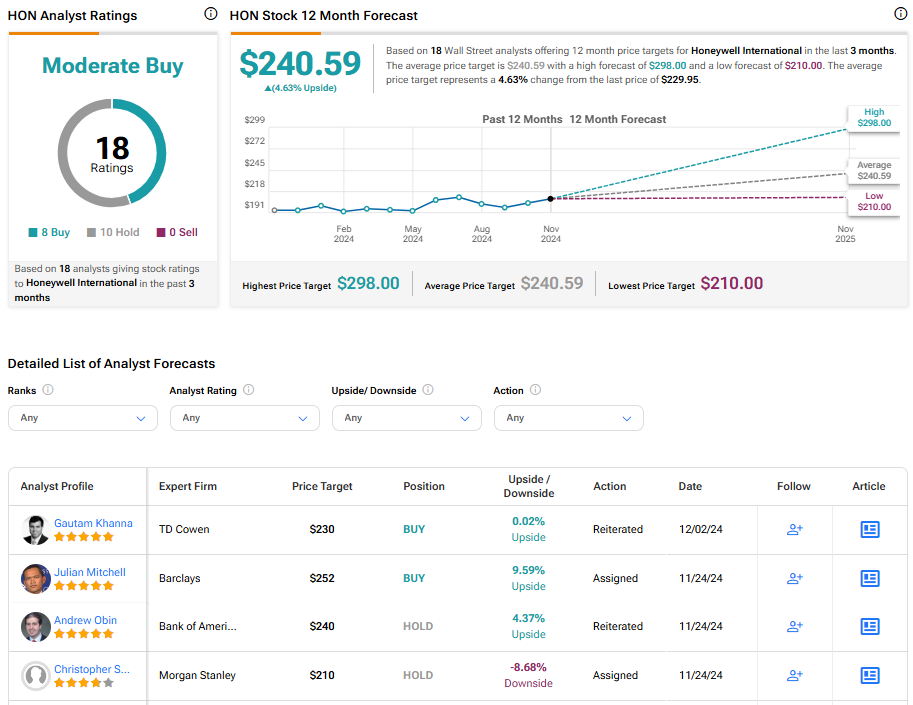

Turning to Wall Street, HON has a Moderate Buy consensus rating based on eight Buys and 10 Holds assigned in the last three months. At $240.59, the average Honeywell price target implies a 4.63% upside potential. Shares of the company have gained about 12% year-to-date.