Stock and bond portfolios have taken a beating in recent weeks, yet American homeowners have found a silver lining in the resilience of housing values. The median home price rose to $403,700 in March, marking a 2.7% increase from one year ago and continuing a remarkable streak of 21 consecutive months of year-over-year price growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, this stability comes despite a housing market that remains surprisingly quiet in terms of transaction volume. According to the National Association of Realtors, existing home sales fell 5.9% in March from February, marking the sharpest monthly decline since November 2022. Sales have been running at an annualized rate of about 4 million units per month since early 2023 – an unprecedented length of time for transaction levels to remain so low.

Factors Driving the Housing Market

The market is experiencing a notable shift in inventory levels, with unsold homes jumping 8.1% from February to 1.33 million units, representing 4.0 months of supply – the highest level since 2020. This growing inventory suggests more sellers are entering the market, though buyers remain cautious.

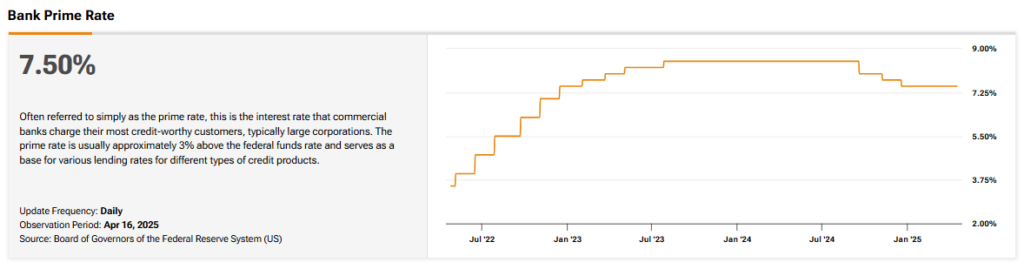

Several factors are contributing to the current housing market dynamics. Mortgage rates remain stubbornly high at around 6.8%, significantly limiting buyer purchasing power. Economic uncertainty, particularly around tariffs and job security, has further dampened enthusiasm. Redfin chief economist Daryl Fairweather notes that some potential buyers have even “lost their down payment in the stock market, or at least a good chunk of it,” forcing them to pause their home buying plans.

The disconnect between buyer and seller expectations continues to be a challenge. “Buyers and sellers are not on the same page yet,” Fairweather explains. “The sellers are still listing at prices that are too high, and the buyers, with high mortgage rates, cannot afford what sellers are asking.” Adding to buyer hesitation are rising homeowners association and insurance costs, especially in markets like Florida.

Economic Context

Despite these challenges, housing equity still represents a stabilizing force for the American middle class. As the largest source of wealth for many households, the continued strength in home values helps explain why consumer spending has remained relatively robust despite other economic pressures. “Homeowners still feel comfortable enough spending money on all these other goods because they hold that equity,” Fairweather observes.

Looking ahead to the remainder of the traditional home-selling season, which runs through summer, housing could offer a safer investment than more volatile assets. If economic concerns lead to a recession, it could result in lower mortgage rates, which would actually improve housing affordability and stimulate the market, providing a counterintuitive advantage during challenging economic times.