Home improvement giant Home Depot (HD) has been eagerly awaiting interest rate cuts for some time now, in the hopes that this will spur homeowners to take out cheap loans again and upgrade their living spaces. But while the Federal Reserve seems less than enthusiastic about the idea, a new plan from the Trump administration may be ready to step in. The news gave Home Depot stock a fractional boost in Monday morning’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Instead of waiting for the Fed to move—which is proving to be a bit of a lost cause—Trump is instead turning to a pile of cash reserves at Fannie Mae and Freddie Mac to buy mortgage-backed securities. This move, reports suggest, will help drive down mortgage rates and, in turn, spur new homebuilding as more customers are willing to take on loans at lower interest rates.

This would also likely drive up homeowner projects, as they would either fix up their spaces ahead of sale, or just fix up their spaces to remain therein. This in turn is a huge deal for Home Depot, which counts on a lot of this business for day-to-day operations.

Trouble Down the Street

But this kind of program also helps other home improvement stores like Lowe’s (LOW), and Lowe’s is about to put some significant improvement into at least some of its stores. Some Lowe’s locations will include what reports are calling a “rural showroom,” the fifth of which is going into a Lowe’s in Manning, South Carolina.

The “rural showroom,” the reports noted, will include key points for rural dwellers, including outdoor equipment, livestock feed, automotive merchandise, and more. While the “rural showroom” concept is still very much in its early stages—Manning’s is the first in South Carolina—it is also the kind of thing that could probably be exported to other locations quickly. In turn, it could also distinguish Lowe’s from Home Depot, and pull revenue accordingly.

Is Home Depot a Good Long-Term Buy?

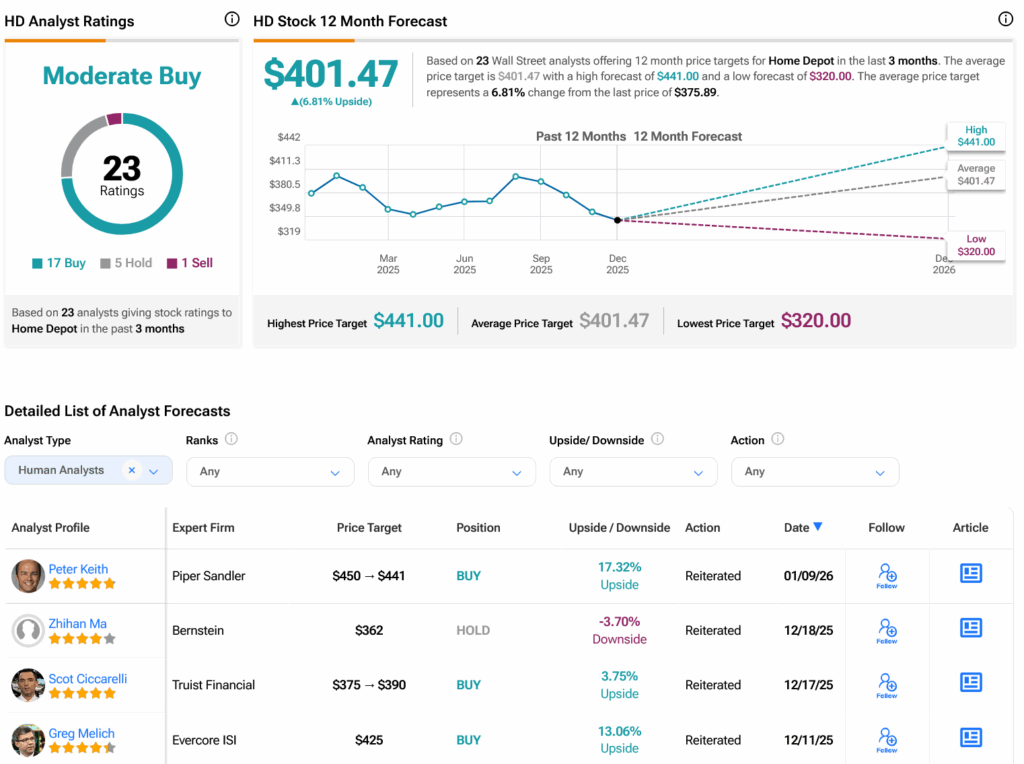

Turning to Wall Street, analysts have a Moderate Buy consensus rating on HD stock based on 17 Buys, five Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 3.74% loss in its share price over the past year, the average HD price target of $401.47 per share implies 6.81% upside potential.