Home improvement retailer Home Depot (NYSE:HD) will release its fourth-quarter earnings on Tuesday, May 14. The strong demand momentum from its professional customers, who are largely contractors, is expected to have driven sales during the quarter. However, persistently high inflation might have impacted consumers’ big-ticket discretionary spending to some extent.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Investors should note that Home Depot stock has gained nearly 22% in the past six months, outperforming the S&P 500 Index (SPX) rally of about 18%.

Encouraging Website Traffic Trends

Investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

According to the tool, total visits to homedepot.com in February and March increased by 60.76% on a year-over-year basis. Given the consistent growth pattern in the past few months, it is reasonable to assume a potential uptick in website traffic for April as well.

The increasing traffic suggests that the company’s products had strong demand throughout the quarter, which could have supported revenue growth.

Learn how Website Traffic can help you research your favorite stocks.

HD – Q1 Expectations

Analysts expect Q1 earnings of $0.6 per share, down 5.8% year-over-year. Further, the company is expected to post revenue of $36.65 billion, down 1.6% from the prior-year quarter.

Ahead of Q1 results, the Five-star analyst Seth Basham from Wedbush maintained a Buy rating on HD stock with a price target of $410, implying 18.4% upside potential.

Another analyst, Steven Zaccone from Citi, expects HD to report Q1 results in line with or slightly above the Street’s estimates. However, he expects the performance of the company’s pet retail and electronics categories to have remained weak in Q1.

Is HD Stock a Good Buy?

Wall Street is cautiously optimistic about Home Depot. It has a Moderate Buy consensus rating based on 19 Buy, five Hold, and two Sell ratings. The analysts’ average price target on HD stock of $385.83 implies 11.4% upside potential.

Insights from Options Trading Activity

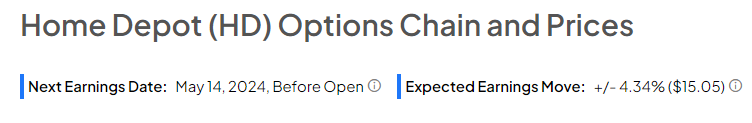

Options traders are pricing in a +/- 4.34% move on HD’s earnings. The anticipated earnings move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.