Entertainment giants Walt Disney Co. (DIS), Universal Studios, which is owned by Comcast (CMCSA), and Warner Bros Discovery (WBD) have filed a joint lawsuit against MiniMax, a Chinese AI start-up. The studios accuse MiniMax of “wilful and brazen” copyright theft. This is the first AI copyright lawsuit aimed at a Chinese company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The case targets Hailuo AI, a video app from MiniMax that calls itself a “Hollywood studio in your pocket.” The lawsuit claims Hailuo creates downloadable images and videos of famous characters without permission. The complaint cites ads featuring Disney’s Darth Vader, Universal’s Minions, and Warner Bros.’ Joker, all branded with the Hailuo name and used without approval.

The studios also allege that MiniMax promoted the app to U.S. consumers in a way that falsely suggested it was endorsed by them.

Legal Fight Comes at a Tough Time for MiniMax

The studios are asking for the maximum penalty under U.S. copyright law. They say the use of their characters in ads amounts to false endorsement, which courts often treat as a serious violation.

For MiniMax, the timing could not be worse. The Shanghai-based start-up, backed by HongShan (formerly Sequoia China), Hillhouse, and Alibaba (BABA), is preparing for a Hong Kong listing to fund global expansion. A high-profile lawsuit from Hollywood may weigh on investor sentiment, especially as MiniMax is already up against stronger rivals like Midjourney and Kling AI in the crowded generative video market.

Studios Step Up Fight to Protect Their Brands

For Hollywood, the case is about more than one AI app. Studios have warned that unchecked AI models could threaten the value of their intellectual property. Earlier this year, Disney and Universal filed a similar lawsuit against U.S.-based Midjourney, calling the platform a “bottomless pit of plagiarism.”

For Disney, Comcast, and Warner Bros, the lawsuit is part of a broader effort to protect their brands in the age of AI.

Which Entertainment Stock Is the Better Buy?

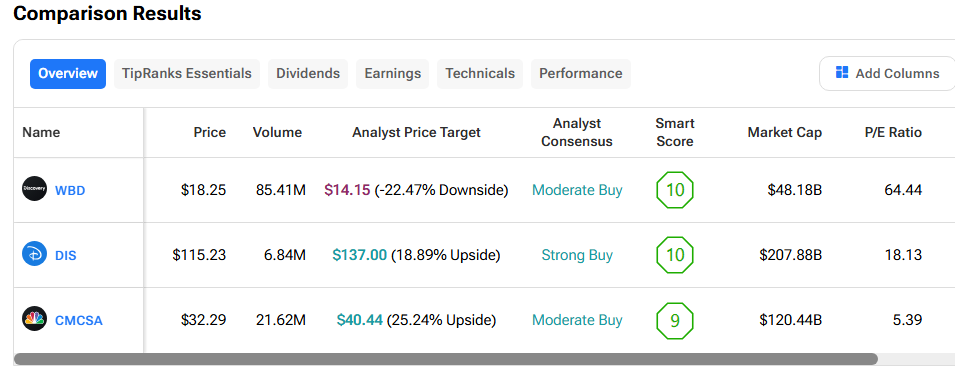

We used the TipRanks Stock Comparison Tool to determine which stock is more favored by analysts. Wall Street has a “Strong Buy” consensus on Disney, supported by a 19% upside potential over the next 12 months. Meanwhile, Comcast carries a “Moderate Buy” rating, with analysts projecting about 25% upside. In contrast, WBD stock has a “Moderate Buy” rating but a price target that implies a 22% downside from current levels.