Nvidia (NASDAQ:NVDA) shares have been on a tear lately, boosted by Saudi AI investments, easing China trade tensions, and the repeal of the AI diffusion rule. But that doesn’t mean everything is now hunky-dory at the chip giant.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

At least, that’s the view of D.A. Davidson analyst Gil Luria. While he acknowledges the China trade progress and diffusion repeal are “positive,” he thinks they don’t address the bigger, more pressing questions.

“While investors were relieved by progress on China trade, we believe comments from the administration indicate restrictions on sales of AI equipment to China are a separate national security issue,” the 5-star analyst said. “As for the removal of diffusion rules, we believe that GPU demand from countries that would have been limited (e.g. India, UAE and Israel) is much smaller than China, who consumes millions of GPUs a year.”

Due to the proposed legislation, China still presents the greatest uncertainty. A bill introduced by Senator Cotton last Friday would mandate tracking of AI hardware to ensure it doesn’t reach China. Alongside recent discussions surrounding Nvidia’s $5.5 billion write-down, Luria anticipates the administration will soon introduce new export restrictions. These rules are expected to clarify key issues – specifically, the quantity and types of chips that can still be sold to China, and whether companies with ties to the Chinese Communist Party, like Alibaba, Tencent, and Bytedance, will be subject to the new limits. Although Nvidia will probably introduce an even more “degraded product” to replace the restricted H20 chip, Luria believes that demand for these progressively downgraded chips could eventually be overtaken by a new wave of Chinese-made chips, which are “quickly catching up on performance.”

While the China restriction issue remains an “overhang” until new rules are introduced, Luria sees an encouraging trend elsewhere. That is the increasing demand from “power users” like Meta, Tesla and xAI. Since scaling is boosting the performance of their products – advertising and self-driving software – their demand “currently appears insatiable.” Additionally, Luria sees Zuckerberg and Musk as engaged in a data center race that goes beyond simple ROI considerations. OpenAI and Sam Altman might fit into this category as well, but they could struggle to secure the funding needed to keep up.

That positive trend is not enough for Luria to turn bullish, though. He remains on the NVDA sidelines with a Neutral rating and a $120 price target, implying the stock is overvalued by 11%. (To watch Luria’s track record, click here)

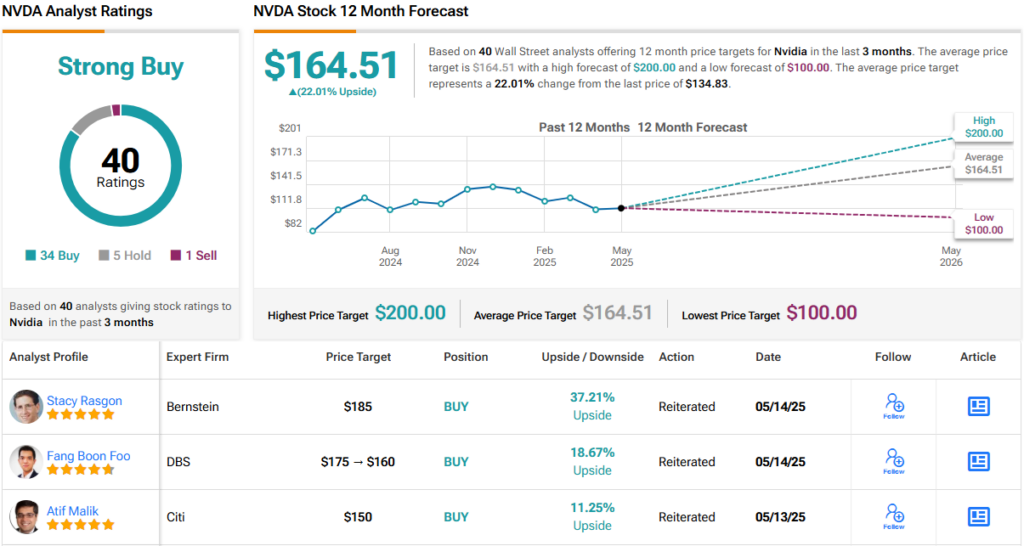

Luria’s stance is far from the most popular one on Wall Street. While 4 others join him on the fence and 1 analyst implores to Sell, with an additional 34 Buy recommendations, the analyst consensus rates NVDA stock a Strong Buy. The average target stands at $164.51, a figure that makes room for 12-month returns of 22%. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.