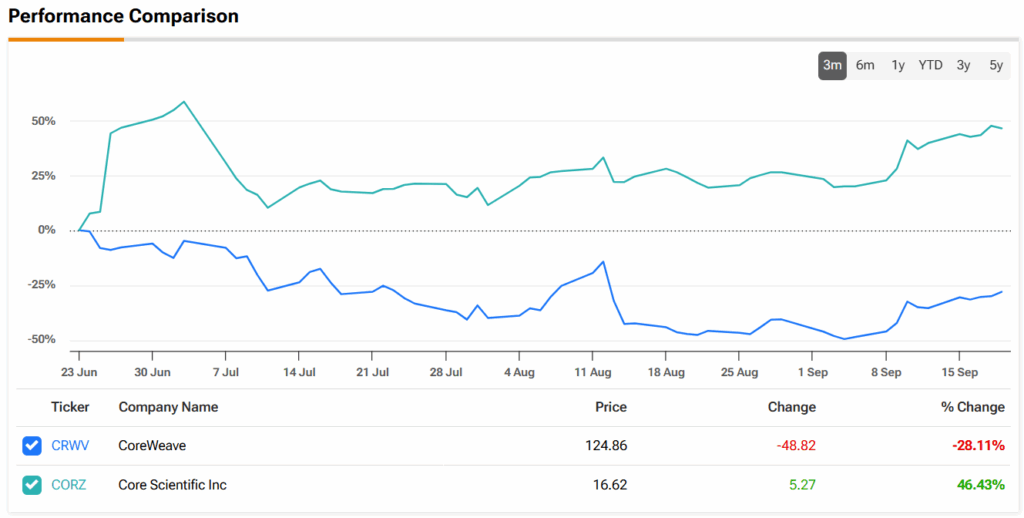

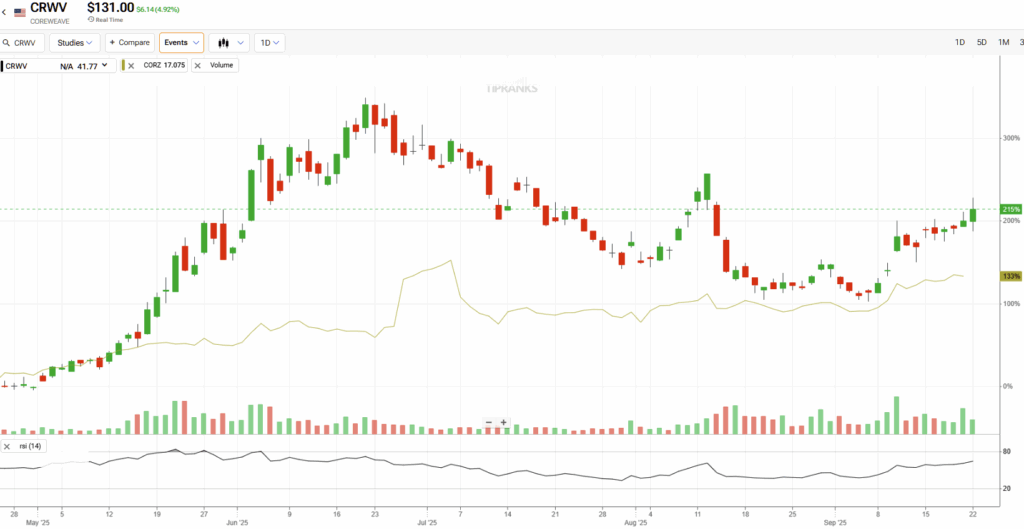

Cloud platform provider CoreWeave’s (CRWV) planned $9 billion acquisition of crypto-mining legacy company Core Scientific (CORZ) has looked shaky from the start, with CRWV shares plunging right after the July 25 announcement. The stock has since bounced ~30% over the past two months and has now clawed its way above pre-deal highs of ~$118. By contrast, CORZ shares have surged from $11 pre-deal to ~$16, having traded as high as $18.15 per share, clearly buoyed by the hefty acquisition premium.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The deal’s reliance on CoreWeave’s stock makes its recent decline a problem for both parties. While CRWV could capture meaningful upside if the acquisition succeeds, the greater risk lies with CORZ shareholders, whose downside may not be fully priced in. Given the uncertainty surrounding the transaction, I’m staying on the sidelines with a Neutral view on both stocks.

Former Bitcoin Miners Team Up

Both companies began as cryptocurrency miners but shifted their focus to AI infrastructure when demand for computing power skyrocketed. Core Scientific recently emerged from bankruptcy in early 2024 with a clean balance sheet and a new strategy to transform its Bitcoin mining facilities into data centers that host AI computing workloads.

CoreWeave took a similar path, though much earlier, pivoting away from crypto mining to data center infrastructure in 2019. The company purchases advanced graphics processing units from Nvidia (NVDA) and leases them to large technology companies that require substantial computing power for their AI applications. It went public in March this year and immediately became a favorite among AI investors, with its shares jumping from the $40 IPO to $183/share by late June.

When CoreWeave announced the acquisition in July, the deal seemed promising for both parties. The two companies have already worked closely together, with CoreWeave having signed billions of dollars in lease agreements with Core Scientific to utilize its data center facilities, making it an attractive acquisition target.

The Original Deal Logic Falls Into Jeopardy

At first, the deal looked like a win-win. CoreWeave stood to eliminate $10 billion in costly leases by owning facilities outright, with projected savings of $500 million annually by 2027. For Core Scientific investors, the all-stock transaction promised immediate value: a $9 billion valuation, more than 60% above the company’s market price at the time.

Under the terms, Core Scientific holders would receive 0.1235 CoreWeave shares for each of their own—a fixed ratio that would reward them if CoreWeave’s stock kept rising. Instead, shares have fallen sharply, dropping about $40 since the deal was announced.

That slide has gutted the implied acquisition value for Core Scientific, cutting it from over $20 per share to under $13. Unsurprisingly, several major shareholders are now voicing opposition and pressing for improved terms before backing the deal.

Why This Deal May Still Get Done

CoreWeave faces several challenges that make owning Core Scientific’s facilities attractive. The company carries substantial debt and complex financial obligations from its lease agreements. Acquiring Core Scientific would eliminate these costly commitments and give CoreWeave direct control over critical infrastructure.

Further, access to power has become a bottleneck for AI companies. Core Scientific owns facilities with 1.3 gigawatts of total contracted power capacity across multiple states. This infrastructure could help CoreWeave meet growing demand from its customers.

Core Scientific also needs the deal to succeed. The company faces significant capital requirements in the second half of 2025 and has no guarantee it could obtain the necessary financing independently. Its relationship with CoreWeave as its largest customer makes the acquisition particularly important for its long-term financial health (lest CoreWeave find another deal partner and phase out its relationship altogether).

Will CoreWeave Buy Core Scientific?

Wall Street analysts believe a renegotiation is likely. For instance, Jefferies’ Jonathan Peterson values Core Scientific at $16 to $23 per share on a standalone basis. To reach the low end of this range, CoreWeave would need to offer a substantial increase from the current 0.1235 ratio, closer to 0.16 to 0.20 of its shares for each Core Scientific share.

While the overall sentiment for Core Scientific remains cautiously optimistic, with the stock receiving a Moderate Buy rating, many analysts have recently shifted their recommendations to a Hold based on seven Buy, nine Hold, and zero Sell ratings over the past three months.

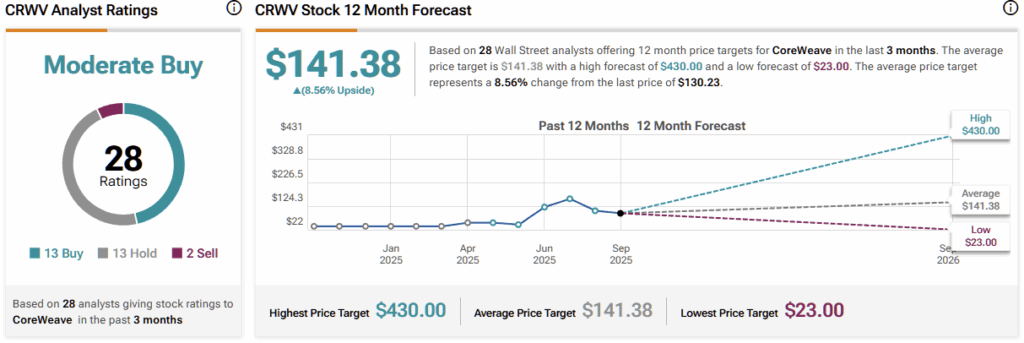

Meanwhile, while CoreWeave sports a similar Moderate Buy rating overall, recent analyst activity reflects a more positive tone, with several analysts upgrading their price targets for the shares to an average of $141.38, based on 13 Buy, 13 Hold, and two Sell ratings over the past three months.

According to Wall Street analysts, CORZ is expected to gain a further 6% over the next twelve months, while CRWV is expected to gain 8.5%.

CoreWeave–Core Scientific Deal on the Brink

The next few months will determine whether these companies can salvage their deal. CoreWeave must decide whether to improve its offer or risk losing access to critical infrastructure. Core Scientific shareholders must weigh the risks of remaining independent against accepting a lower-than-hoped acquisition price.

For investors anxiously watching this situation; the deal’s success or failure will reflect both companies’ management teams’ ability to demonstrate the flexibility to navigate this challenge, shareholders’ willingness to go along with the deal, and market participants not adding to the turmoil by depressing the share price of CRWV any further…which is no sure bet.