Well, the Canadian election has come and gone, and like a lot of people thought—even hoped—would happen, the Liberals took the day and kept Canada in place. And now, there are signs that the Bank of Canada will start slowing down on rate cuts now that one major source of uncertainty is settled. But another source could be brewing in the background. As a result, the iShares S&P / TSX 60, (TSE:XIU) kept its collective cool, and gained fractionally in Tuesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Though in the end, newly-minted Prime Minister Mark Carney will likely be leading a minority government, it does still put one major issue to rest. The Liberal party is back in charge, firmly now—no interim Prime Minister this—and that in turn should open a path to Liberal fiscal plans. All Carney et al will need is a little help from Bloc Quebecois or the NDP, and that should be enough to bump the needle to good.

That in turn will likely prompt the Bank of Canada to start tightening up on liquidity in anticipation of the red budget ink that will likely flow in response. No one wants to go back to the polls any time soon, though that will likely mean more spending for health care and metals market support in order to get the NDP and the Bloc’s support, respectively. Even if trade negotiations go well and there is no recession, deficits are still likely to rise about 2% of GDP, reports noted.

An Unsettled Alberta

Meanwhile, the Liberal victory has not quelled secessionist rhetoric in Alberta. If anything, it has ramped it up substantially. Cameron Davies, who was a former UCP organizer, noted, “Hockey and nostalgia doesn’t pay the bills…that hockey and nostalgia, it’s not going to keep Canada together.”

Indeed, a Liberal victory all but ensures “Western alienation” will continue. With President Trump’s own rhetoric laying out the welcome mat for Alberta to join up with the United States, the idea that Alberta may not be part of Canada—whether becoming its own country or a new state—soon seems increasingly likely.

Is the iShares S&P / TSX 60 Index ETF a Good Buy Right Now?

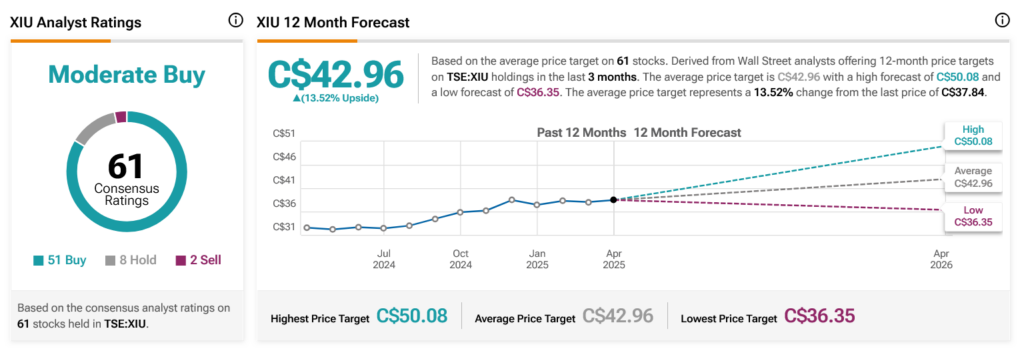

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:XIU shares based on 51 Buys, eight Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 17.99% rally in its share price over the past year, the average TSE:XIU price target of $42.96 per share implies 13.52% upside potential.