Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Netflix (NASDAQ:NFLX) has made quite the name for itself over the past few years, reeling in viewers and creating must-see content. Recently, however, Netflix has become part of the story itself, and the drama surrounding its $72 billion takeover bid for Warner Bros. Discovery has pressured its share price.

NFLX is down some 30% since hitting a high point in June. That’s despite turning in a strong earnings report toward the end of October, which reflected growing revenues of 17% year-over-year and an operating margin that would have exceeded the company’s guidance of 31.5% if not for a one-time tax payment to the Brazilian authorities.

Top investor Rick Munarriz can’t fully understand all the negativity, believing that history favors the streaming giant.

“Netflix remains a rock star, boasting more than 300 million paying subscribers,” explains the 5-star investor, who is among the top 4% of stock pros covered by TipRanks.

Munarriz points out that a large chunk of NFLX’s losses flowed from the worries surrounding the potential Warner Brothers takeover. This is a bit of a head-scratcher for the investor, who notes that Netflix doesn’t even need this addition to be considered a success.

“It has achieved critical mass, making it the ultimate tastemaker and launchpad of new properties,” adds Munarriz.

The recent drop has turned NFLX into a bargain, however, one that the investor suggests scooping up while it’s on sale. After all, the company’s track record certainly indicates that it will recover nicely going forward.

“Do you know the last time Netflix’s annual revenue declined?” asks Munarriz, rhetorically. “Never,” the investor emphasizes. He adds that the company has been profitable every single year since it went public more than two decades ago.

“History has taught us that pullbacks are buying opportunities when it comes to Netflix,” concludes Munarriz. (To watch Rick Munarriz’s track record, click here)

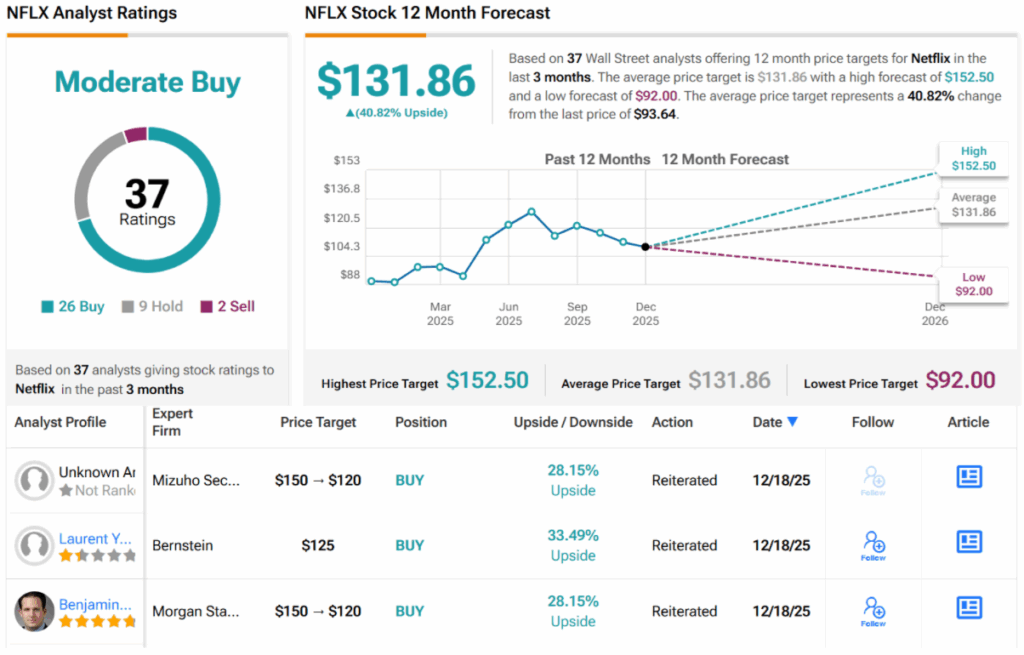

Wall Street is also tuning in for a comeback. With 26 Buys, 9 Holds, and 2 Sells, NFLX carries a Moderate Buy consensus rating. Its 12-month average price target of $131.86 points to an upside of more than 40% in the year ahead. (See NFLX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.