The stock of Hims & Hers Health Inc. (HIMS) fell more than 4% in after-hours trading after the telehealth company issued weaker-than-expected guidance. The cautious outlook overshadowed an impressive 111% year-over-year jump in Q1 revenue, which reached $586 million. Looking ahead, the company expects revenue between $530 million and $550 million in Q2, falling below analysts’ forecast of $563.9 million.

Year-to-date, HIMS stock has climbed more than 70%. Notably, shares have surged over 40% following Novo Nordisk’s (NVO) recent announcement to distribute its weight-loss drug Wegovy through telehealth platforms like Hims & Hers.

Hims & Hers Delivers Big Numbers

In Q1 2025, the company delivered solid growth in key metrics. The subscribers grew by 38% year-over-year to 2.4 million. It was further boosted by a 53% increase in monthly online revenue per subscriber, now at $84.

Hims & Hers hit key profit milestones, with net income rising over 300% to $49.5 million and adjusted EBITDA jumping 182% to $91.1 million.

Big Growth, Bigger Worries

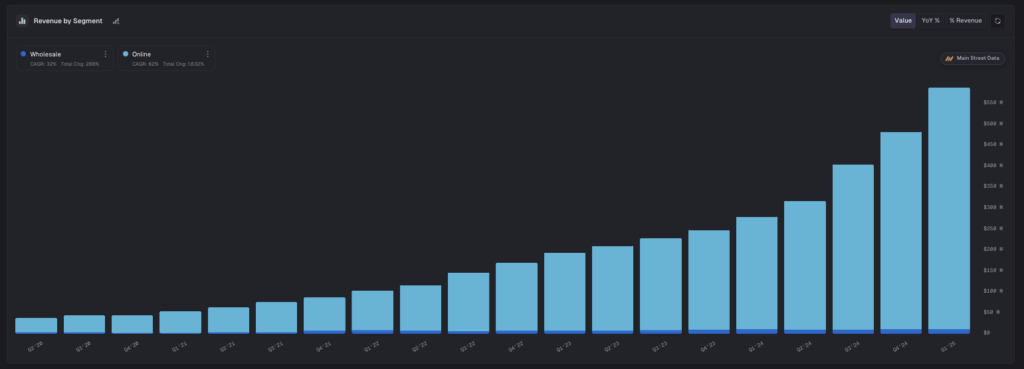

One area of concern in the results was the wholesale segment. Revenue from wholesale fell 7% to $9.6 million, making up just 1.65% of total revenue. In contrast, online revenue surged 115% to $576 million in Q1. See the graph from Main Street Data below for reference.

Additionally, gross margin dropped from 82% to 73% year-over-year. As the company scales quickly, investors are also focusing on operating leverage or how well the company can increase revenue while keeping costs in check to boost profits. In the first quarter, operating expenses jumped 70% from the previous year to $372 million in Q1 2025.

The breakdown of operating expenses shows that marketing costs are the biggest expense, reaching $231 million in Q1 2025. This reflects Hims & Hers’ aggressive strategy to acquire new customers. The chart below from Main Street Data shows how marketing spending has increased over the last few quarters. While this spending supports growth, it raises concerns about long-term sustainability and margin pressure, something investors should keep an eye on.

Is HIMS a Good Stock to Buy Right Now?

Overall, Wall Street analysts have a Hold consensus rating on HIMS stock based on four Buys, seven Holds, and two Sells assigned in the last three months. The average HIMS stock price target of $41.67 is almost similar to the current trading level.