Telehealth pioneer Hims & Hers Health (HIMS) stock is soaring, with a 12% gain in recent days and a whopping 176% in the last three months. Keeping the positive price momentum going is the company’s latest strategic acquisition of Trybe Labs. This at-home testing facility will permit the company to introduce at-home blood testing to its service offerings.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Expanding Services & Treatments

Hims & Hers aims to provide on-demand care with customized treatments and affordable at-home lab testing, a revolutionary step towards delivering this personal, comprehensive care.

This facility will allow Hims & Hers to offer extensive whole-body testing and home blood draws. By using a blood lancet, a tool that negates the need for needles, customers can learn more about their hormone levels, cardiac risk, stress markers, cholesterol, liver function, thyroid function, and prostate health. The data will be used to determine personalized treatment plans, adding more precision to clinical decision-making and improving the overall healthcare experience.

Expanding testing services will allow Hims & Hers to provide a broader selection of treatments, supplements, and medications for conditions requiring blood work, meaning customers won’t need to visit blood labs. This streamlined process can potentially contribute to customer growth and bolster treatment rates.

The acquisition comes at an opportune time, as Hims & Hers and other telehealth companies currently sell compounded GLP-1 drugs as a temporary measure due to shortage; this revenue source could possibly shrink in the foreseeable future.

The acquisition, funded through cash on hand, is complete, and Hims & Hers expects to roll out at-home testing services to customers within the next year.

Analyst Response

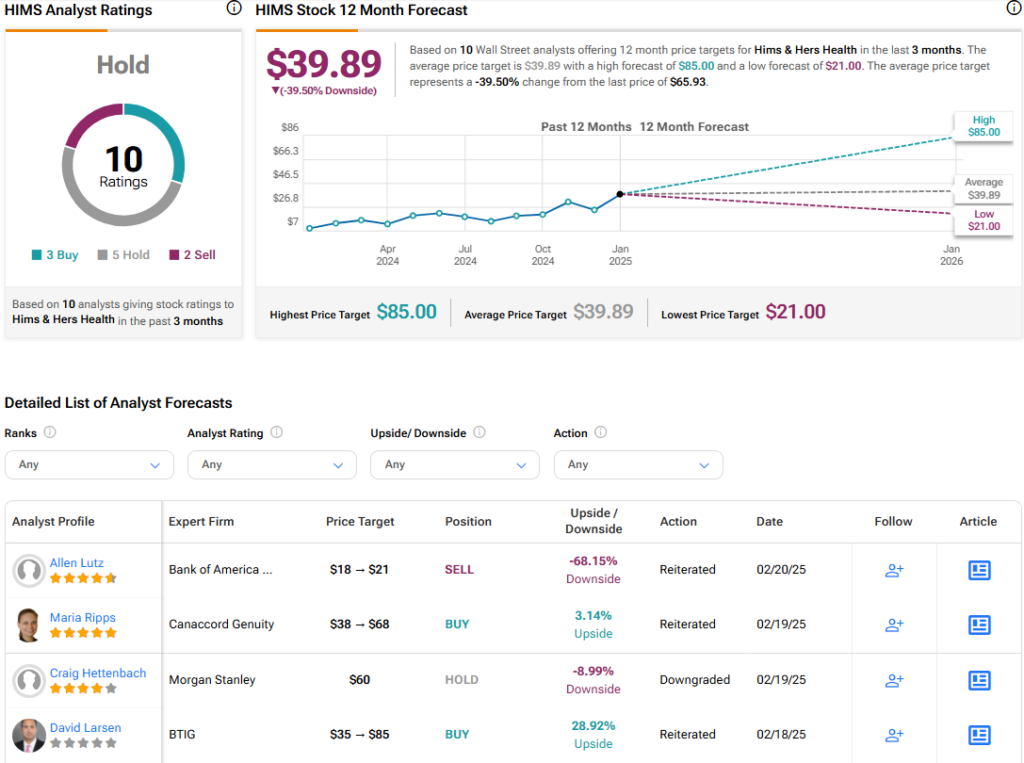

In response to the news, Bank of America analyst Allen Lutz has upgraded the price target for Hims & Hers from $18 to $21 while retaining an Underperform rating on the shares. He notes that increased estimates for Q4 and 2025 revenue and EBITDA have been made based on promising alternative credit card data panels. However, he warns that despite strong Q1 guidance, the faster deceleration of the company’s core business and dependencies on GLP-1 contributions could create potential growth obstacles if weight loss drugs exit the model.

On the other hand, Canaccord’s Maria Ripps has significantly boosted the price target on Hims & Hers shares from $38 to $68, maintaining a Buy rating. This positive outlook is attributed to a successful Super Bowl ad and the confirmation of Robert F. Kennedy as Health and Human Services Secretary, which led to a 140% year-to-date surge in share price. Despite acknowledging the risk of near-term volatility due to inflated growth expectations and uncertainty over the GLP-1 shortage, she remains optimistic about Hims & Hers’ prospects, citing personalized dosing and a more favorable regulatory environment as potential growth drivers after the shortage.