Shares of healthcare company Hims & Hers Health (HIMS) tanked around 13% at the time of writing after CEO Andrew Dudum disclosed a large stock sale. According to an SEC filing, Dudum sold roughly $11 million worth of shares on Thursday alone, totaling 175,661 shares. However, it appears that the transaction was part of a pre-set investment plan, not a sudden decision, as about 125,000 came from stock options, and the rest were from restricted stock that had recently vested.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, the filing also revealed that between mid-July and mid-September, Dudum and a related trust sold an additional $29.3 million worth of shares. This brings his total sales to over $40 million in just a few months, which can understandably raise eyebrows among investors. While large insider sales often lead to worries, it’s important to note that executives frequently sell shares for a variety of reasons, such as tax planning, diversification, or simply cashing out a portion of their compensation.

Therefore, not all insider sales are red flags. And in this case, because the sales appear to follow a predetermined plan and involve vested stock and options, they may not be a signal of low confidence in the company. Nonetheless, investors should keep an eye on future filings and company commentary in order to determine whether the selling is routine or part of a trend that might suggest something deeper.

Is HIMS Stock a Good Buy?

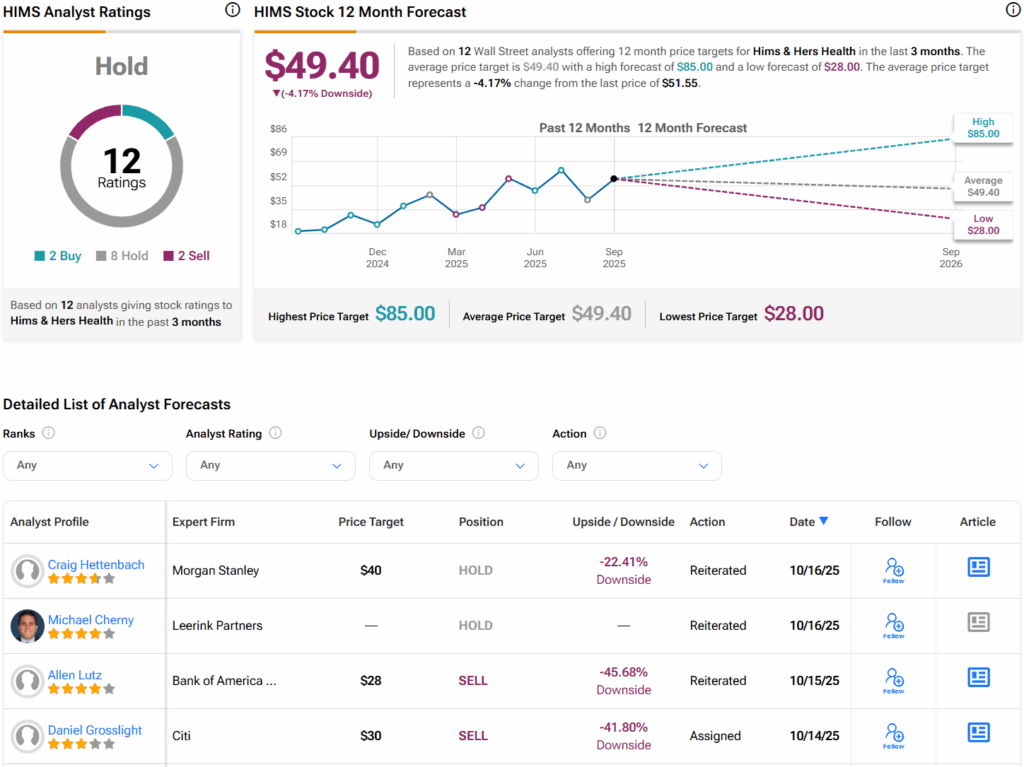

Turning to Wall Street, analysts have a Hold consensus rating on HIMS stock based on two Buys, eight Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average HIMS price target of $49.40 per share implies 4.2% downside risk.