Hims & Hers Health (HIMS) stock enjoyed a 10% jump in price last week on news that the company plans to continue offering compounded versions of Ozempic and Wegovy. This approach is in response to recent changes in FDA regulations marking the official end of obesity-drug shortages and curtailing bulk production of generic versions. It exploits existing laws permitting compounding pharmacies to create custom drug versions, offering a cost-effective alternative for patients unable to afford the branded medications. This will allow for personalized prescriptions, accommodating patients requiring alterations in dosage or additional components like vitamins.

503A Compounding Exemption

Hims & Hers Health (HIMS) operates in the telehealth sector, offering digital health and wellness solutions through a subscription model. The company provides access to licensed healthcare professionals and personalized treatment plans, addressing various health issues such as sexual health, hair loss, dermatology, mental health, and primary care.

HIMS stock experienced a significant rise, increasing in value by over 100% within six months. It reached a high of $72.98 in February, propelled by the increased sales of its GLP-1 injection, a compounded version of Semaglutide. The FDA allowed such alternatives due to a shortage of the original drug until pharmaceutical giants Eli Lilly (LLY) and Novo Nordisk (NVO) indicated the shortage window had closed. HIMS stock suffered a sharp decline of nearly 50% after the FDA announced that it would no longer approve the compounded GLP-1 injections under the current regulations. This announcement led to a swift exit by investors, given that the GLP-1 drug accounted for 15% of HIMS’s revenue in 2024. However, there is potential upside due to the 503A compounding exemption for Semaglutide, and there is speculation that the FDA might reverse its decision, as it has done previously, which could potentially allow HIMS’s stock to recover substantially.

In 2024, the company experienced a substantial financial upturn, with revenue increasing by 69% to $1,476.5 million compared to $872.0 million in 2023. Despite a slight decrease in gross margin to 79% from 82%, the company turned a net loss of $23.5 million in 2023 into a net income of $126.0 million. Adjusted EBITDA rose significantly to $176.9 million from $49.5 million, while net cash from operating activities increased from $73.5 million to $251.1 million. Free cash flow improved dramatically to $198.3 million from $47.0 million the previous year.

Analysts Remain Cautious

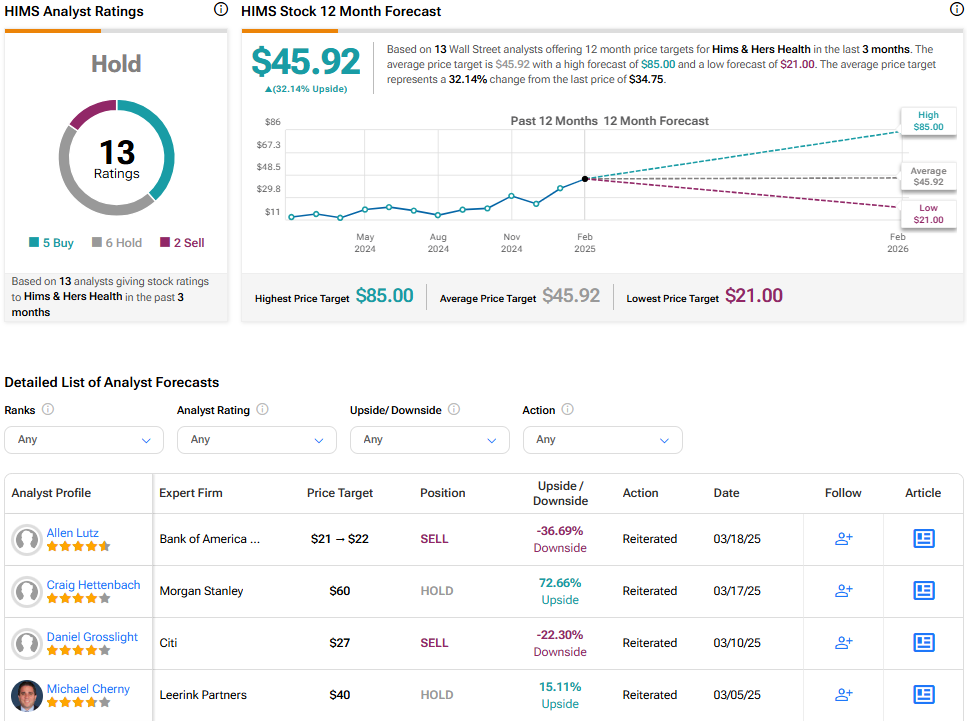

Analysts following the company have taken a cautious stance on the stock. For instance, Bank of America’s Allen Lutz has responded to the recent news by increasing the price target for HIMS to $22, up from $21, while maintaining a Sell rating, noting GLP-1s currently make up 45% of the company’s gross online sales, posing a risk to revenue due to potential changes in this segment.

Hims & Hers Health is rated a Hold overall, based on the recent recommendations of 13 analysts. The average price target for HIMS stock is $45.92, which represents a potential upside of 32.14% from current levels.

See more HIMS analyst ratings.

Questions or Comments about the article? Write to editor@tipranks.com