Computer hardware giant Hewlett Packard Enterprise (HPE) is set to release its fiscal Q3 2024 financials on September 4. Wall Street analysts expect the company to report earnings of $0.47 per share for Q3, down 4% year-over-year. However, analysts expect revenues to increase 9% from the year-ago figure to $7.66 billion, according to TipRanks’ data.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It’s important to highlight that the company has surpassed the consensus EPS estimates in eight out of the last nine quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool shown below, analysts are encouraged by HPE’s strong Q2 performance and raised FY24 guidance. They highlight HPE’s efforts to simplify AI adoption with its new private cloud AI solution developed with Nvidia (NVDA). Additionally, the bulls noted that HPE’s cloud services platform, HPE GreenLake, added around 3,000 new customers in Q2.

Meanwhile, bears are concerned that HPE is lagging behind competitors such as Super Micro Computer (SMCI) and Dell Technologies (DELL) in selling servers for AI data centers. They also point out that the company faces operational challenges, leading to weaknesses in a few of its revenue segments.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can gauge what options traders anticipate for Hewlett Packard stock right after its earnings report. The expected earnings move is calculated by evaluating the at-the-money straddle of options that are set to expire soon after the announcement.

At present, the Options tool indicates that options traders are predicting an 8.83% swing in either direction for HPE stock.

Is Hewlett Packard Enterprise a Buy?

HPE stock has risen about 15% year-to-date, driven by rising demand for its cloud services and AI offerings. Nevertheless, mounting competition and operational challenges have left Wall Street cautious about HPE’s stock.

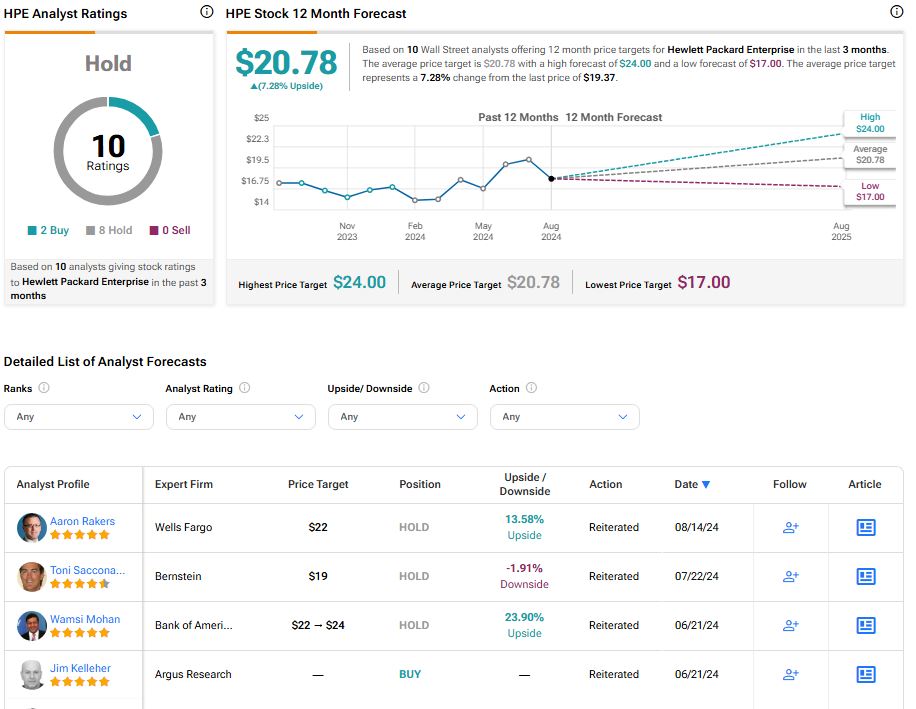

With two Buys and eight Hold recommendations, HPE has a Hold consensus rating. The analysts’ average price target on HPE stock of $20.78 implies a 7.28% upside potential from current levels.