Hewlett Packard Enterprise (NYSE:HPE) will release its Q2 Fiscal 2024 financial results on Tuesday, June 4. Weakness in networking product demand, graphics processing unit (GPU) supply concerns, and extended deal timing will likely hurt its top- and bottom-line growth. Nonetheless, strong artificial intelligence (AI), its diversified portfolio, and tight cost management will likely cushion its revenue and earnings in Q2.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Hewlett Packard Enterprise is an edge-to-cloud company offering Cloud Services, Server, Software, and Intelligent Edge.

With this backdrop, let’s delve into analysts’ estimates for Q2.

HPE: Q2 Estimates

Analysts expect HPE to report sales of $6.82 billion, down about 3% year-over-year. This reflects a moderation in the decline rate compared to Q1. For instance, HPE’s Q1 revenue fell 14% year-over-year. The company’s annual recurring revenue (ARR) will likely benefit from AI server orders.

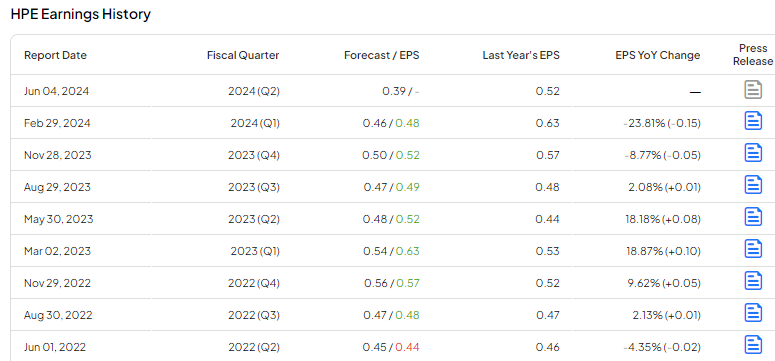

Wall Street expects HPE to report adjusted earnings of $0.39 per share, down about 25% year-over-year. Lower sales will likely weigh on the company’s bottom line. Nonetheless, the shift toward high growth, high-margin business, and cost-control measures will cushion its EPS.

According to TipRanks’ earnings page, HPE has surpassed Street’s EPS expectations in the past seven consecutive quarters.

Options Traders Expect a Large Move

Using TipRanks’ Options tool, we can observe traders’ expectations for the stock’s movement following its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. While this may seem complex, the Options tool simplifies the process. This indicates that options traders expect a significant 11.44% movement in either direction.

Is HPE Stock a Good Buy?

Wall Street remains sidelined on HPE stock ahead of Q2 earnings. It has one Buy and six Hold recommendations for a Hold consensus rating.

HPE stock is up about 21% in one year. The average HPE stock price target of $18 per share implies about 2% upside potential.