Zeta Global (ZETA) has announced a major partnership with Microsoft (MSFT)-backed OpenAI to enhance Athena, its superintelligent marketing agent built for enterprise customers. The move comes as marketing platforms race to integrate advanced AI capabilities. The news sent Zeta stock up about 10.6% in after‑hours trading, reflecting investor optimism about the collaboration.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Under the deal, Zeta will integrate OpenAI’s latest models directly into Athena. This will allow more natural, conversational intelligence, powering new agentic tools that help marketers work faster and make better decisions.

The company plans to roll out Athena to all customers by the end of Q1 2026.

Athena Evolves with New Agentic Capabilities

Zeta also expanded beta access to Athena, citing strong demand from enterprises seeking to adopt answer‑driven marketing at scale. As part of this expansion, the company introduced Athena’s first two agentic applications.

First, Insights is a conversational analytics tool that instantly surfaces trends, dashboards, and audience opportunities. Second, Advisor is an optimization engine that recommends or automatically executes marketing actions based on business goals.

Both tools are built to help marketers move from data to action in seconds, reducing the need for manual reporting and analysis.

Early testers, including TKO Group (TKO), reported significant time savings on tasks like segment-based reporting and performance comparisons.

Zeta’s OpenAI Partnership Supercharges Athena

Zeta’s partnership with OpenAI gives the company a major upgrade, bringing more advanced conversational intelligence and agentic capabilities into the platform. With access to OpenAI’s latest models, Athena becomes faster, more intuitive, and better at turning natural‑language questions into instant, decision-ready insights.

Further, the collaboration helps accelerate Athena’s shift from a simple analytics tool to a full operating system for enterprise marketing.

Is ZETA a Good Stock to Buy?

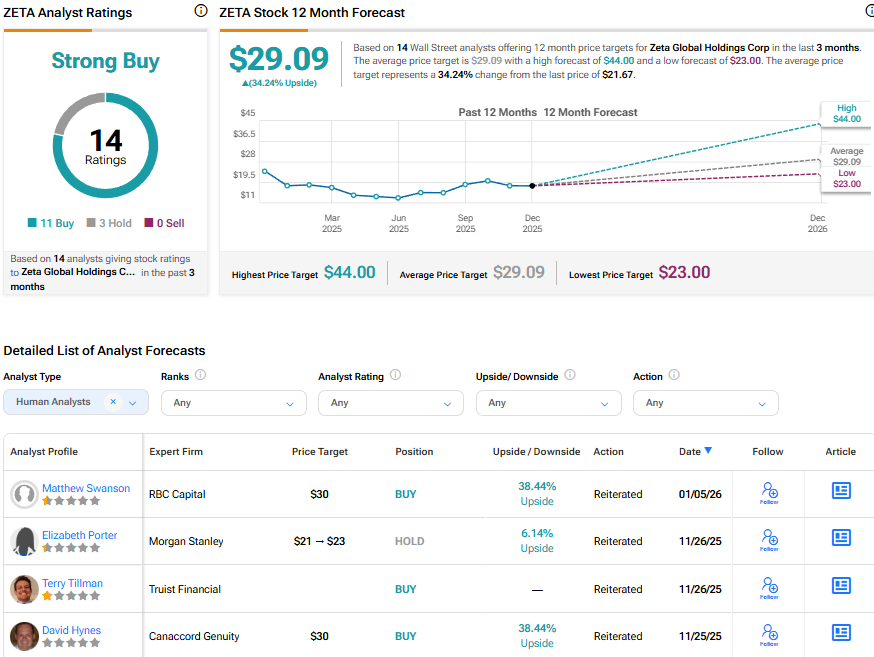

Turning to Wall Street, ZETA stock has a Strong Buy consensus rating based on 11 Buys and three Holds assigned in the last three months. At $29.09, the average Zeta stock price target implies a 34.24% upside potential.