Tesla’s (TSLA) Cybertruck made headlines when it received over one million reservations before its launch in November 2023, but actual sales haven’t lived up to the hype. According to Cox Automotive, just over 52,000 units have been sold in the U.S. so far. While the truck’s eye-catching, futuristic design drew praise from those who appreciate bold aesthetics, it hasn’t resonated with most traditional truck buyers. Indeed, many in that market prioritize practicality, and the Cybertruck’s unconventional design choices haven’t met those needs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Beyond the design, the Cybertruck has faced several setbacks. For starters, Tesla’s early promises about performance didn’t fully materialize. In fact, some of the truck’s capabilities fall short of what was advertised, and even lag behind those of standard gas-powered pickups. Furthermore, issues like lower-than-expected towing and payload capacity, a disappointing battery range, and production hiccups have led to eight voluntary recalls within a year. As Cox Automotive Executive Editor Sean Tucker pointed out, the design sacrifices functionality, as its high bed sides and unusual shape make it harder to load and less user-friendly for real-world tasks.

Interestingly, Elon Musk originally pitched the Cybertruck as a bold reinvention of the pickup, with the goal of challenging a market that has remained relatively unchanged for decades. However, it appears that the truck has appealed more to electric vehicle fans and novelty-seekers rather than serious truck users. Stephanie Brinley of S&P Global Mobility explained that while truck buyers have become more open to new tech in recent years, many remain cautious and loyal to proven brands, especially since many use their trucks for work or rugged activities.

What Is the Prediction for Tesla Stock?

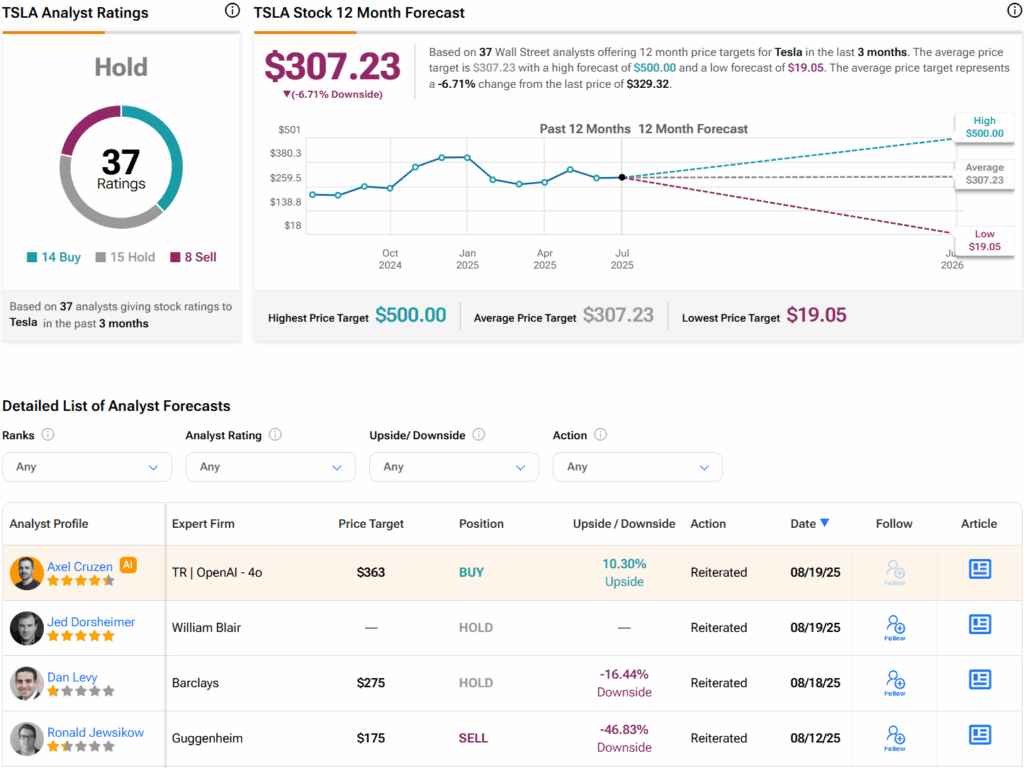

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 15 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $307.23 per share implies 6.7% downside risk.