Offshore oil and gas producer Sable Offshore’s (SOC) shares enjoyed a massive rally on Friday afternoon, jumping as high as 30%. This comes as Wall Street analysts continue to see an upside from its latest legal victory.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

NGOs Battle Sable Offshore over Pipeline Plan

On December 31, the Ninth Circuit Court of Appeals in San Francisco, California, dismissed an emergency motion filed by a coalition of environmental nonprofits led by the Environmental Defense Center.

The motion had asked the court to temporarily halt an emergency special permit granted by the U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) to Sable Offshore, which allows the company to restart segments 324 and 325 of the Santa Ynez Pipeline System in California.

This system contains several offshore oil and gas drilling platforms, notably Hondo, Harmony, and Heritage. It also includes subsea pipelines running to the Las Flores Canyon onshore processing plant.

What’s the Back Story?

The segments covered by the emergency special permit granted to Sable Offshore were originally part of the Plains All American (PAA) system and were implicated in the 2015 Refugio oil spill that occurred near the Refugio State Beach in Santa Barbara County, California.

In February 2024, Sable acquired the entire system from oil and gas giant ExxonMobil (XOM) for $989 million.

Sable Offshore Aims to Restart Pipeline System

Sable aims to restart the entire system and, in May last year, successfully resumed oil production at the Harmony platform. Sable Offshore announced receiving the emergency special permit from PHMSA on December 23, with its shares jumping 36.32% on that day.

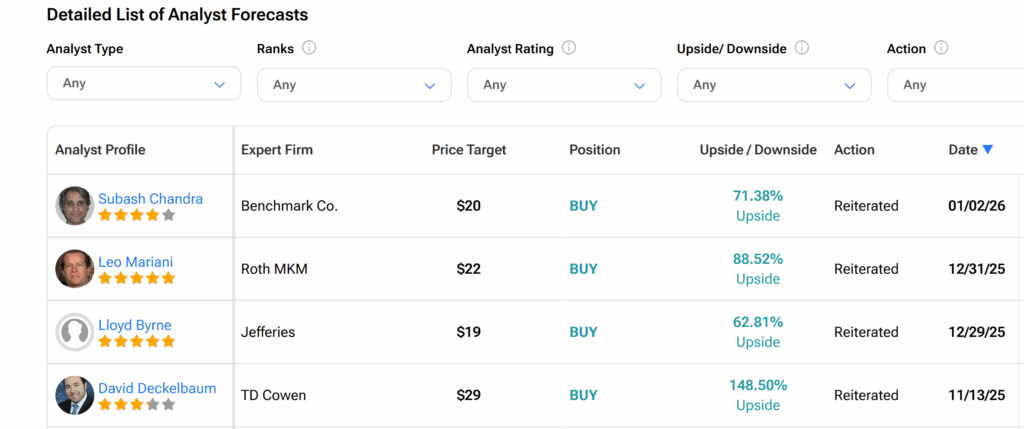

Benchmark analyst Subash Chandra noted that the Santa Ynez Unit — the drilling and production side of the system — is “the closest” Sable Offshore has been to a restart after the court denied the nonprofit coalition’s order. Chandra, however, emphasized that the case was not dismissed, as responses and briefs on the case are due over the next few months.

The analyst reaffirmed his Buy rating and $20 price target on SOC, implying about 72% upside.

Is SOC Stock a Good Buy?

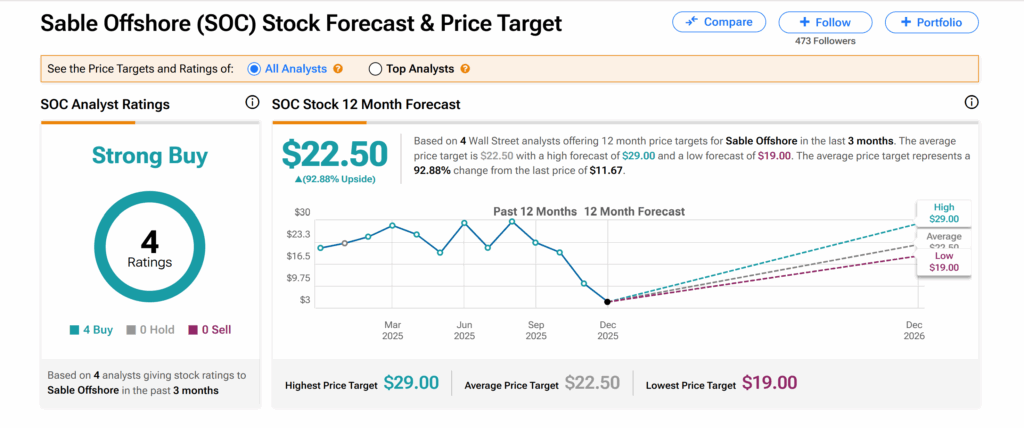

On Wall Street, Sable Offshore’s shares have a Strong Buy consensus rating based on four Buys issued by analysts over the past three months.

In addition, the average SOC price target of $22.50 implies about 93% upside from current trading levels.

See more SOC analyst ratings here.