Shares in Security Matters (SMX), the Ireland-based track-and-trace and authentication tech firm, plunged by 68.22% on the last trading day of 2025. The fall came after the firm filed paperwork with the U.S. securities regulator to permit its current shareholders to resell up to 13.02 million ordinary shares.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Security Matters Amends Equity Structure

The move is one of the most recent actions taken by Security Matters in relation to its shares. In early December, SMX stock jumped more than 135% after shareholders in Dubai approved major changes to its share structure at the company’s annual meeting.

One such change is the approval for the issuance of fresh shares and the elimination of a huge block of deferred ordinary shares — this type of stock holds minimal economic value. In late October, the authentication tech firm revised its 2022 Incentive Equity Plan, allowing it to sharply increase the number of shares available under the program.

Moreover, Security Matters recently disclosed plans to raise up to $111.5 million by selling new shares and a convertible loan to an investor called Target Capital. The company intends to deploy the proceeds to fund its operations and hold certain digital assets as a reserve.

Security Matters Pushes into Glove and Cannabis Markets

Security Matters has positioned itself as a trusted player in the verification market. The firm develops technology designed to detect and manage risks and fraud in the precious metals market.

The Ireland-based company recently promoted its verification technology for the cannabis industry and has just extended its industrial rubber traceability platform into the latex and rubber glove market. The goal is to tackle the global waste stream from used versions of these items.

Is SMX a Good Stock to Buy?

On Wall Street, Security Matters’ shares do not have analyst coverage.

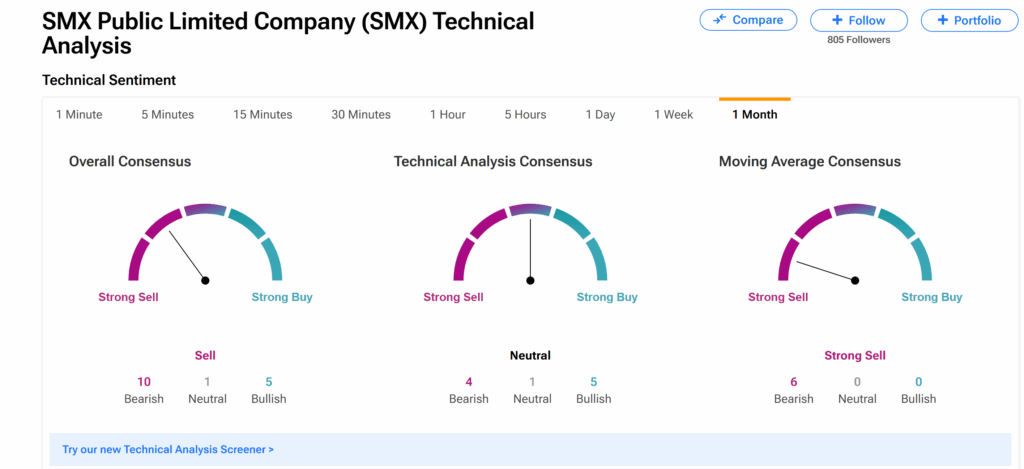

However, TipRanks’ Technical Analysis page indicates that the stock’s Overall Consensus/Technical Sentiment over the past month is a Sell. This is based on 10 Bearish, one Neutral, and five Bullish signals.