On Monday, analysts at Melius Research upgraded Boeing (BA) stock to Buy from Hold following the aerospace and defense company’s win over Lockheed Martin (LMT) for the Air Force’s sixth-gen fighter program to build the latest fighter jets. Meanwhile, analysts at Melius Research and Bank of America downgraded Lockheed Martin stock due to the loss of this key program to Boeing and other reasons. BA stock rose about 1.6% yesterday, while LMT stock fell 1.1%.

Under the crucial program won by Boeing, the company will develop a next-generation combat aircraft, called F-47, that will anchor the Air Force’s Next Generation Air Dominance (NGAD) family of systems.

Melius Upgrades Boeing Stock

Melius upgraded Boeing stock and raised the price target to $204 from $189, reflecting a 16% upside potential. Aside from the company’s success in winning the Air Force’s sixth-gen fighter program, Melius is bullish on BA stock as he believes in CEO Kelly Ortberg’s leadership to turn around Boeing. The research firm added that the new CEO has empowered employees to provide “brutal” feedback on Boeing’s leadership and culture, enabling him to take the necessary actions and drive improvements.

Melius expects the Boeing Defense Phantom Works arm’s NGAD win to provide the company with $20 billion of profitable cost-plus defense sales over the next five years. It also noted the faster-than-anticipated 737 delivery ramp following the strike and said that Boeing is “entering a period of positive newsflow that can drive the stock higher.”

Further, Melius expects strong order activity at June’s Paris Air Show, which should result in cash deposits and present another catalyst for BA stock.

Is Boeing Stock a Buy, Sell, or Hold?

Wall Street has a Moderate Buy consensus rating on Boeing stock based on 15 Buys, four Holds, and one Sell recommendation. The average BA stock price target of $197.83 implies 9.4% upside potential. BA stock is up by a modest 2% so far this year.

Melius and Bank of America Analysts Downgrade LMT Stock

Melius Research analyst Robert Spingarn downgraded Lockheed Martin stock to Hold from Buy and slashed the price target to $483 from $603, citing the loss of the Air Force’s sixth-generation fighter program to Boeing. The 5-star analyst also noted competitive losses and growing concerns over Europe’s efforts to reduce its dependence on U.S. defense contractors for the rating downgrade of LMT stock.

Likewise, Bank of America analyst Ronald Epstein downgraded LMT stock to Hold from Buy and reduced the price target to $485 from $685 due to the loss of the key program to Boeing. Epstein said that he, along with industry experts and investors, had placed significantly higher odds on Lockheed winning the program. The 5-star analyst expects LMT stock to be essentially rangebound due to this unfavorable development.

Epstein added that while he expects defense budgets to rise, he remains cautious about LMT’s recent quality of earnings, the loss of all 6th-Gen manned tactical aircraft programs, and a lack of company-specific catalysts over the near term.

Is LMT Stock a Good Buy?

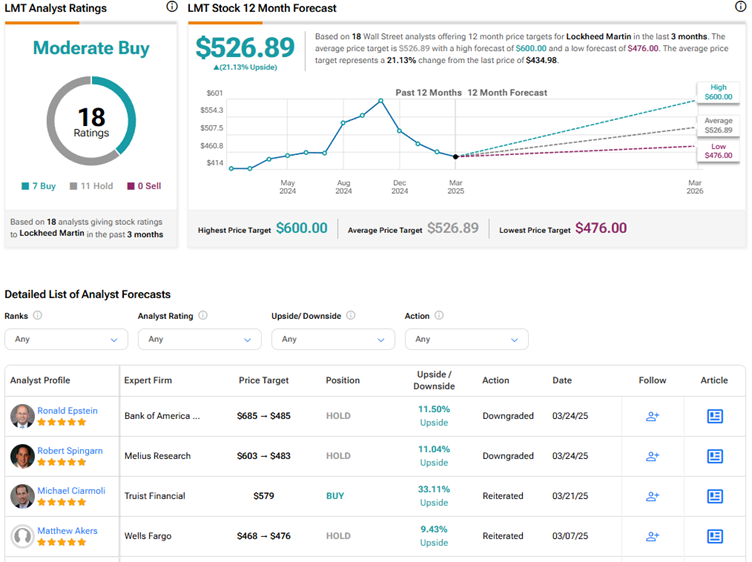

With seven Buys and 11 Holds, Wall Street has a Moderate Buy consensus rating on Lockheed Martin stock. The average LMT stock price target of $526.89 indicates 21.1% upside potential. LMT stock has declined 10.5% year to date.

Questions or Comments about the article? Write to editor@tipranks.com