Gold (GLD) and silver (SLV) prices moved lower on Wednesday as investors locked in profits following an extraordinary year for precious metals. The pullback was also triggered by contract-markets operator CME Group (CME), which raised margin requirements on precious metals futures for the second time in a week. This type of move often puts pressure on prices in the short term.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

CME Group said the latest margin increase for gold, silver, and other metals was part of its regular review of market volatility to make sure that there was enough collateral. Higher margins mean traders must post more cash to hold positions, which contributed to sharp declines in futures earlier in the week. Despite the volatility, both metals are coming off a historic run.

Gold is up more than 64% this year in its strongest annual performance since 1979 and its third straight year of gains. The rally has been fueled by U.S. rate cuts, tariff concerns, and strong buying from ETFs and central banks. Meanwhile, silver has outperformed gold in 2025, with a 150% year-to-date rally. This is also its best year since 1979. The surge has been driven by tight supply, strong demand from India, rising industrial use, and trade-related pressures.

Is Silver a Good Buy?

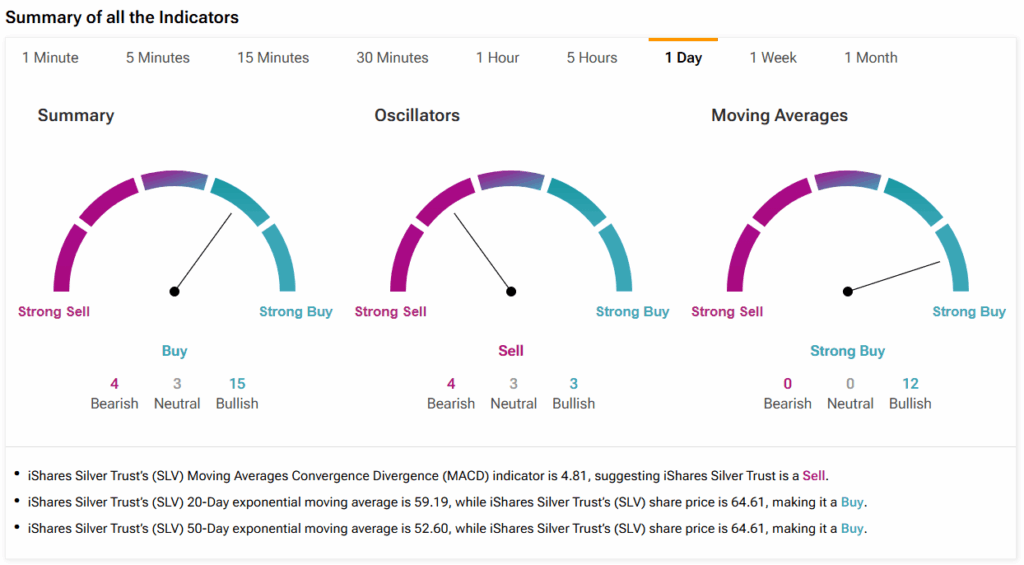

Using TipRanks’ technical analysis tool, the indicators seem to point to a positive outlook for silver. Indeed, the summary section pictured below shows that 15 indicators are Bullish, compared to three Neutral and four Bearish indicators.