Five Below (NASDAQ:FIVE) stock gained about 6% in yesterday’s extended trade despite reporting mixed results for the fiscal first quarter (ended April 29, 2023). Perhaps investors are impressed with the discount retailer’s focus on store expansion and positive commentary of management on transaction growth expectations in Q2 based on performance so far.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Five Below’s Q1 sales increased 13.5% to $726.2 million but missed analysts’ expectations of $728.2 million. Comparable sales rose 2.7% and transactions climbed 3.9% from the year-ago quarter. Meanwhile, earnings per share (EPS) rose 13.6% year-over-year to $0.67 and also surpassed the Street’s estimate of $0.63.

Five Below opened 27 new stores, ending the quarter with 1,367 stores across 43 states. This reflects 11.6% growth from the same period last year.

Looking ahead, management expects revenue for Q2 FY23 to be in the range of $755 million to $765 million. EPS is expected to be between $0.80 and $0.85.

For the full year, Five Below expects revenue between $3.50 billion and $3.57 billion, supported by the launch of 200 new stores and an increase in comparable sales of between 1% and 3%. EPS is expected to be between $5.31 and $5.71.

Is FIVE a Good Stock to Buy?

Five Below scores the Street’s Strong Buy consensus rating based on 13 Buys and one Hold. The average FIVE stock price target of $225 implies 32.9% upside potential. Shares have declined 1.5% year-to-date.

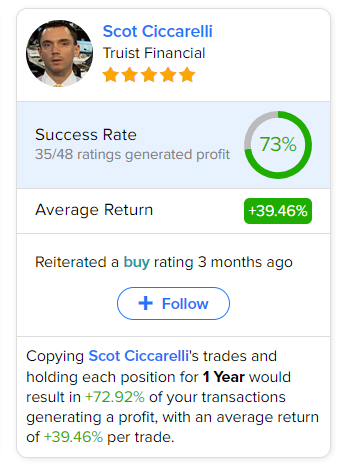

Investors looking for the most accurate and profitable analyst for FIVE could follow Truist Financial analyst Scot Ciccarelli. Copying the analyst’s trades on this stock and holding each position for one year could result in 73% of your transactions generating a profit, with an average return of 39.5% per trade.