Buying stocks of companies in markets with secular trends can be a winning strategy, as they enjoy significant growth catalysts to generate reliable revenue and earnings growth. So long as fundamentals aren’t overshadowed by steep valuations, this can lead to respectable capital appreciation for shareholders. The point-of-sales systems and digital wallet service company Block (SQ) is an example of a growth stock with potential.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I believe the company’s recent moves can help it maintain the operating momentum beyond its recently reported third-quarter earnings results. Block’s admirable financial positioning and cheap valuation are additional positives. For these reasons, I’m beginning coverage of SQ stock with a Buy rating.

Block Had a Decent Q3

On November 7, Block released a decent third-quarter earnings report, supporting my Buy rating. The company’s total net revenue grew 6.4% year-over-year to nearly $6 billion in Q3 2024. Excluding Bitcoin (BTC-USD) revenue, the topline expanded by 11% over the year-ago period for the quarter. Block’s revenue growth was mostly driven by a 20% uptick in subscription and services-based net revenue to $1.8 billion in the quarter. Fueling this growth were Cash App’s financial service-related products such as the Cash App Card and the Afterpay buy now, pay later platform.

Block’s adjusted EPS soared 76% year-over-year to $0.88 during the third quarter. Prudent cost management led to a 370 basis point expansion in the non-GAAP net profit margin to 9.3% for the quarter. This is how adjusted EPS growth far exceeded net revenue growth in the quarter.

The Best Is Yet to Come for Block

As impressive as Block’s results were in the third quarter, the even better news is that the company has the tailwinds to keep generating vigorous growth in the quarters and years to come. This is because it’s taking the steps necessary for future growth. The most recent example of that came when Block announced that it was integrating Afterpay with Google Pay ahead of the holiday season. This is key because customers checking out through Google Pay will now be able to elect Afterpay to spread their purchases out in installment payments. As Afterpay rolls out to more merchants on Google Pay’s digital wallet in the coming months, this should bring additional growth for Block.

Another potential boost to the company is the single app experience being made available to new sellers. Block expects this to be made more broadly available in 2025. Already, the company has grown Square brand and performance marketing investments by more than 20% over the year-ago period. As the company ramps up sales hiring into next year, this is expected to translate into additional topline growth. Although an explicit timeline wasn’t provided, Block also plans on transforming 24 million Cash App Cards into better alternatives to credit cards with the upcoming launch of Afterpay on Cash App Cards.

As a result, the analyst consensus is that Block’s adjusted EPS will soar 96.5% to $3.54 in 2024. For 2025, another 27.4% rise in adjusted EPS to $4.51 is the consensus. In 2026, an additional 24.3% jump in adjusted EPS to $5.60 is the current analyst consensus. For a company with a $50 billion-plus market capitalization, these are enticing growth prospects from my perspective.

A Financially Healthy Business

Another advantage that Block has is that its balance sheet could allow it to be active on the M&A front if opportunities arose just like it did with Afterpay in 2022. The company had a $2.7 billion net cash and short-term investments balance as of September 30, 2024. Additionally, Block has a $775 million revolving credit facility at its disposal. Simply put, the company’s financial positioning is sufficient that it can use bolt-on acquisitions to complement its business and further boost growth prospects.

Block’s stock is also arguably an excellent pick for growth at a reasonable price. Shares are trading at a forward P/E ratio of 20.2x. Adjusting for Block’s net cash position, this forward valuation multiple is below 20x. That is for a company with a realistic path to generate 20%-plus annual adjusted EPS growth for the foreseeable future. For perspective, this is a price-to-earnings-growth (PEG) ratio below one. That further bolsters my buy case for Block.

Is Block a Buy, According to Analysts?

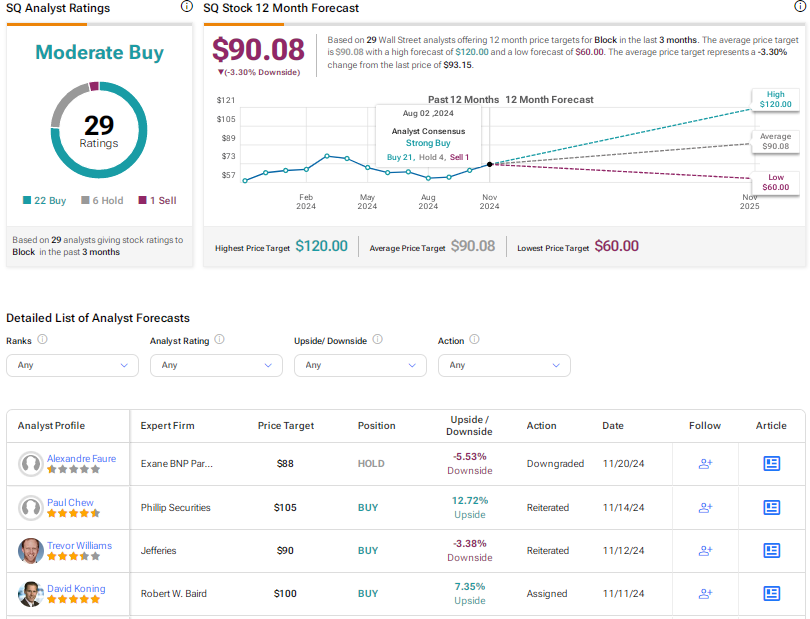

Turning to Wall Street, analysts have a Strong Buy rating on Block stock. Among 29 analysts, 22 have assigned Buy ratings, six have issued Hold ratings, and one has assigned a Sell rating in the past three months. The average SQ stock 12-month price target of $90.08 implies a 3.3% downside from the current share price.

Conclusion

Block is a business that looks poised to keep firing on all cylinders, backed by its growth initiatives. Its balance sheet provides it the flexibility to complete opportunistic acquisitions to drive future growth. At the current valuation levels, SQ stock doesn’t seem to be getting the recognition that it deserves from the market. This is why I’m issuing a Buy rating.