Wall Street analysts are seeing improving prospects for online lodging platform Airbnb (ABNB). On Friday, Barclays analyst Trevor Young upgraded Airbnb stock from Sell to Hold and increased the price target from $107 to $120. Additionally, Wells Fargo analyst Ken Gawrelski upgraded ABNB stock from Sell to Hold and lifted the price target from $118 to $128. Let’s look at the reasons for the rating upgrades.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Barclays Analyst Upgrades Airbnb Stock

Young noted that Airbnb has underperformed the Nasdaq and OTA (online travel agent) peers Booking Holdings (BKNG) and Expedia (EXPE) in each of the last two years, as industry growth normalized following the post-pandemic recovery in travel demand and the company’s massive growth faded.

That said, the analyst now sees “diminished downside risks” to ABNB stock and a few potential catalysts (such as the reserve now, pay later (RNPL) offering and the 2026 FIFA World Cup) that would enable Airbnb to deliver the best room-night growth among the scaled online travel peer group. However, Young cautioned about pressure on margins for some time.

Despite several positives, Young is sidelined on the stock as he thinks that Airbnb is “still largely a monoline business” and hasn’t demonstrated its ability to expand into adjacent growth areas.

Reasons for Wells Fargo’s Rating Upgrade

Gawrelski stated that his rating upgrade for ABNB stock follows two years of underperformance, along with several upside possibilities, such as enhanced hotel supply and sponsored listings opportunities. The 4-star analyst views relative insulation from artificial intelligence (AI) risk as an opportunity.

Also, Gawrelski sees limited downside risk to estimates, given that the company is 12 months or more into the reinvestment period, with limited market expectations for payoff, a healthy travel industry forecast, and the expansion of the RNPL offering.

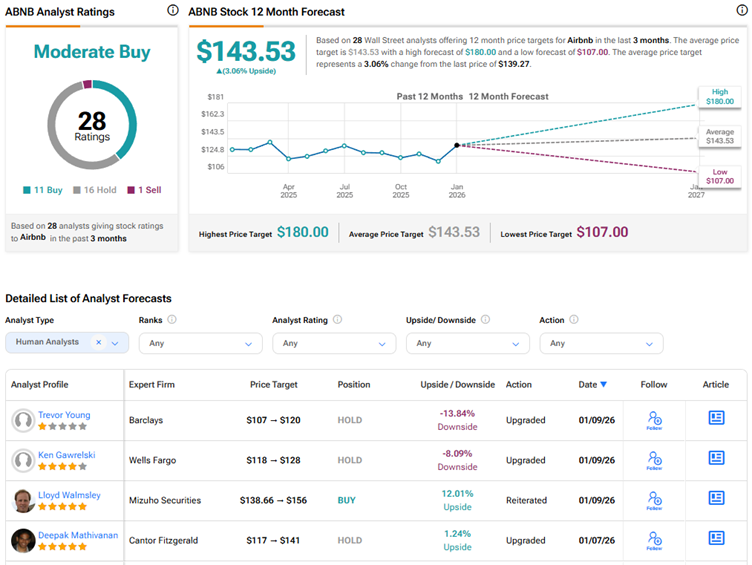

The upgrade by analysts at Barclays and Wells Fargo followed the rating upgrade by Cantor Fitzgerald analyst Deepak Mathivanan to Hold from Sell, with a price target of $141, up from $117. The 5-star analyst believes that ABNB stock’s valuation is “more accommodating” following its underperformance in 2025.

Is ABNB Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Moderate Buy consensus rating on Airbnb stock based on 11 Buys, 16 Holds, and one Sell recommendation. The average ABNB stock price target of $143.53 indicates a modest upside potential of 3.1%. ABNB stock has risen 6.5% over the past year.