UnitedHealth (NYSE:UNH) investors have had little to shout about in 2025. The stock has shed 40% of its value year-to-date due to a host of negative developments.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A positive early-year narrative began to unravel following underwhelming first-quarter results and a May 13 update, which revealed a CEO transition and the suspension of forward guidance – moves that hinted at deeper structural issues. Chief among the concerns were rising costs tied to Medicare Advantage members at UHC and coding challenges among new Optum enrollees from 2024. The situation deteriorated further when the Wall Street Journal reported that the Department of Justice had launched a Medicare fraud investigation into the company.

Against this troubled backdrop, UNH’s annual meeting on June 2 brought a potential turning point. Returning CEO Stephen Hemsley announced that the company plans to reinstate its 2025 guidance alongside its Q2 earnings report on July 29, while also cautioning that the new outlook would be “prudent.”

That comment alone sent a signal to Wall Street that the revised forecast could come in well below prior expectations. UBS analyst AJ Rice notes that investors have interpreted Hemsley’s tone as a cue to brace for a more conservative guide than the current consensus EPS of $22.50 for 2025. In the days following the meeting, buy-side expectations have drifted lower, with many now anticipating a 2025 EPS closer to $20.

Is that a too pessimistic take? Rice isn’t sure. “In our on-going discussions with the company, we do not get affirmation that such an estimate is correct, but we also do not get discouragement that such a number is out of line,” he explained.

In light of the uncertainty, Rice has adjusted his model to reflect the $20 EPS view. His revised assumptions include a 50 basis point cut to Medicare Advantage margins (now at 1.5%) and a trim to Optum Health’s margin from 5.0% to 4.5%. He also flags potential weakness ahead across the broader risk insurance portfolio. While UNH previously claimed conservative pricing in its commercial book, management has since clarified that this mainly applies to the Exchange business, which has shown weaker enrollment compared to peers. Meanwhile, higher-than-expected costs persist in the core commercial risk book, fueling worries about broader “mis-pricing” – particularly given the volatility already observed in government-related segments.

“Finally,” Rice concludes, “we believe the company wants to offer a new 2025 outlook that it can be assured of delivering and, therefore, we expect the number to be even more conservative than normal, when all is said and done.”

Accordingly, the analyst has lowered his price target from $400 to $385, still implying a 27% upside over the next 12 months. Despite the trimmed outlook, Rice maintains a Buy rating on the stock. (To watch Rice’s track record, click here)

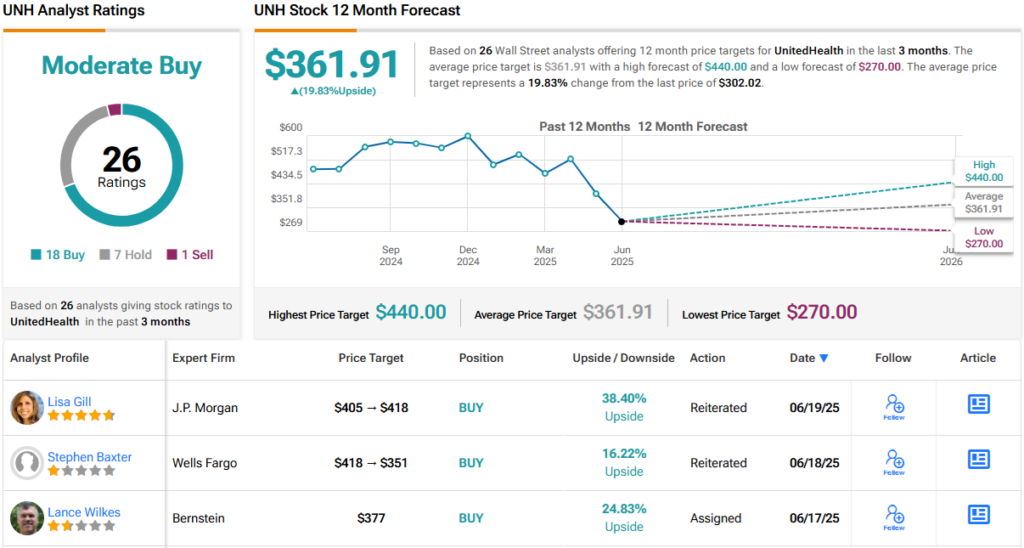

His view is largely echoed across the Street. Of the 26 analysts covering UNH stock, 18 rate it a Buy, with 7 Holds and just 1 Sell, resulting in a Moderate Buy consensus. The average price target stands at $361.91, suggesting potential 12-month returns of ~20%. (See UNH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.