ZIM Integrated Shipping Services (ZIM) is set to announce its Q2 2024 results on August 19. Wall Street analysts expect the company to report earnings of $1.92 per share for Q2, a notable increase from the $1.79 per share loss in the same quarter last year. Additionally, they project that revenues will reach $1.78 billion, reflecting a 35.9% increase year-over-year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Based in Israel, ZIM is a global container liner shipping company.

It’s crucial to note that though analysts predict strong Q2 results compared to the same quarter last year, the company has a track record of disappointing earnings surprises. ZIM has missed earnings estimates in four of the last five quarters, as pictured below.

Key Insights to Watch Ahead of Q2

Despite ongoing political unrest in the country, ZIM turned profitable in the first quarter of 2024. If ZIM sustains its positive performance and posts strong earnings for Q2, a boost in its share price could be on the horizon. The stock has gained 95% year-to-date.

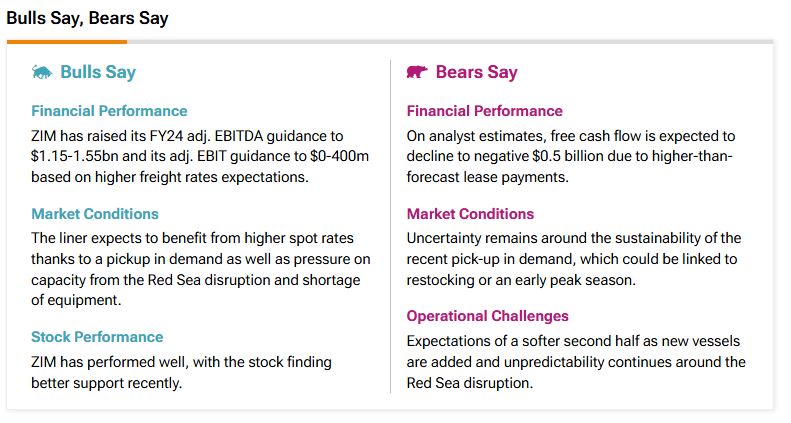

Also, according to TipRanks’ Bulls Say, Bears Say tool, bulls noted that ZIM’s stock has shown recent improvement. They highlight ZIM’s raised FY24 adjusted EBITDA and EBIT guidance, driven by higher freight rates. The company expects to benefit from rising spot rates due to increased demand, disruptions in the Red Sea, and equipment shortages.

It’s also important to consider the bearish arguments. Bears note that ZIM’s free cash flow is expected to decline to a negative $0.5 billion due to higher lease payments. They also highlight uncertainty about the sustainability of recent demand gains and anticipate operational challenges.

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.98% move in either direction.

Is ZIM a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Sell consensus rating on ZIM stock based on one Buy and three Sells assigned in the past three months, as indicated by the graphic below. The analysts’ average price target on ZIM stock of $14.18 implies a downside potential of 25.6%.