United States Steel (X), an American business icon and the 24th largest steelmaker in the world, has found itself a victim of politics, with both presidential candidates – Donald Trump and Kamala Harris – opposing the $15 billion offer from Nippon Steel Corporation (JP:5401) to acquire the company. This bipartisan opposition will hurt U.S. Steel investors, given that the company was relying on an influx of cash from Nippon Steel to revive growth, hire more workers, and acquire new technologies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I am neutral on U.S. Steel stock, as I believe the firm’s recent progress pales in comparison to the negative impact of a failed merger with Nippon Steel.

The Deal Faces Massive Challenges

Nippon Steel’s $15 billion offer to acquire U.S. Steel converts to $55 per U.S. Steel share, which represents a substantial premium to the current price of around $35. When the merger was announced last December, U.S. Steel stock traded close to the deal price but has since declined dramatically due to two main reasons.

First, both presidential candidates agree that a foreign business should not own the majority of U.S. Steel shares. Donald Trump pledged in January that he would block this deal if he wins the Presidential election in November to safeguard the interests of Americans and to ensure Americans would own this business icon. Kamala Harris also pledged to do the same last Monday, confirming that the deal would be in jeopardy regardless of who is elected as the next U.S. President.

Second, United Steelworkers, a union that represents 1.2 million working and retired members, has opposed this deal on the grounds that a merger would negatively impact the job safety of union members and violate existing labor agreements. According to the official statements released by the union, Nippon Steel may lay off workers and consider the closure of several factories post-acquisition to inflate the company’s short-term financial performance.

Although U.S. Steel shareholders voted in favor of this deal last April, the two obstacles discussed above paint a gloomy outlook for this deal. The Committee on Foreign Investment in the United States is currently evaluating this deal and is likely to announce its decision before the Presidential election.

The Proposed Deal Stands to Create Value

Nippon Steel’s $15 billion deal to acquire U.S. Steel came at a time when the latter was struggling to revive growth due to several challenges. An analysis of Nippon Steel’s investment pledges and the dire state of U.S. Steel reveals this deal would have created value for long-term shareholders.

U.S. Steel is an iconic American industrial giant that became the first billion-dollar corporation in the world before reaching peak steel production in the 1970s. Since then, the company has succumbed to competitive pressures with China, which currently accounts for more than half of the global steel production.

A few decades ago, U.S. Steel was the largest steelmaker in the world, but today, Baowu, a Chinese state-owned enterprise, dominates the global steel market, generating annual revenue of more than $150 billion compared to just $18 billion for U.S. Steel in 2023. For context, Nippon Steel is the fifth-largest steel company in the world in terms of revenue and recorded $59 billion in sales for the most recent financial year.

In addition to increasing competition, U.S. Steel has faced several other challenges. This includes declining domestic demand for steel products as the U.S. pivoted from a manufacturing economy to a more service-oriented economy, poor management decisions, lackluster technological investments, and pressure from strong unions.

All these growth obstacles have taken a toll on U.S. Steel stock, which is down more than 10% in the last 10 years compared to domestic rival Nucor Corporation (NUE), which has seen its stock almost triple during the same period.

The Nippon Steel deal, if approved, is likely to address many of these challenges, and there are a few reasons to think so.

Nippon Plans to Invest $1.4 Billion

First, Nippon has pledged to invest at least $1.4 billion in U.S. Steel’s integrated steel mills, expanding the manufacturing capabilities of the latter and increasing operational efficiency through the adoption of modernized production technologies. Since Nippon Steel has deep pockets and substantial balance sheet leverage, the Japanese company feels comfortable with these aggressive investments. However, U.S. Steel is highly unlikely to be able to carry out these investments as a standalone entity due to its poor financial standing.

Second, the merger would create the third-largest steel company in the world, allowing it to compete with its Chinese counterparts and win market share. Compared to U.S. Steel’s annual production capacity of around 23 million tons, Nippon Steel is a much larger corporation with a steel production capacity of almost 70 million tons. Together, these two companies would pose a major threat to the market leaders.

Third, Nippon Steel has promised to honor existing union contracts, ensure job security for American workers, and even establish a board of directors made up mostly of American citizens. In addition, the company confirmed today that the core senior management of the combined entity would be Americans. Furthermore, U.S. Steel would be owned by Nippon Steel North America, the U.S. arm of Nippon Steel, which has been operating in the U.S. for more than 50 years.

Overall, a merger with Nippon Steel would set the stage for U.S. Steel to remain committed to its American roots while enjoying fresh funding to execute its turnaround strategy. Failure to complete this deal, on the other hand, is likely to deteriorate U.S. Steel’s fundamentals, as the company lacks the financial resources to boost spending on technological advancements that are required to compete in the global steel industry.

Although the company may see a recovery aided by the integration of Big River Steel EAF and other investments in mini-mill assets, I believe a deal with Nippon would have accelerated this recovery meaningfully, boosting the company’s competitiveness.

Is U.S. Steel a Buy, According to Wall Street Analysts?

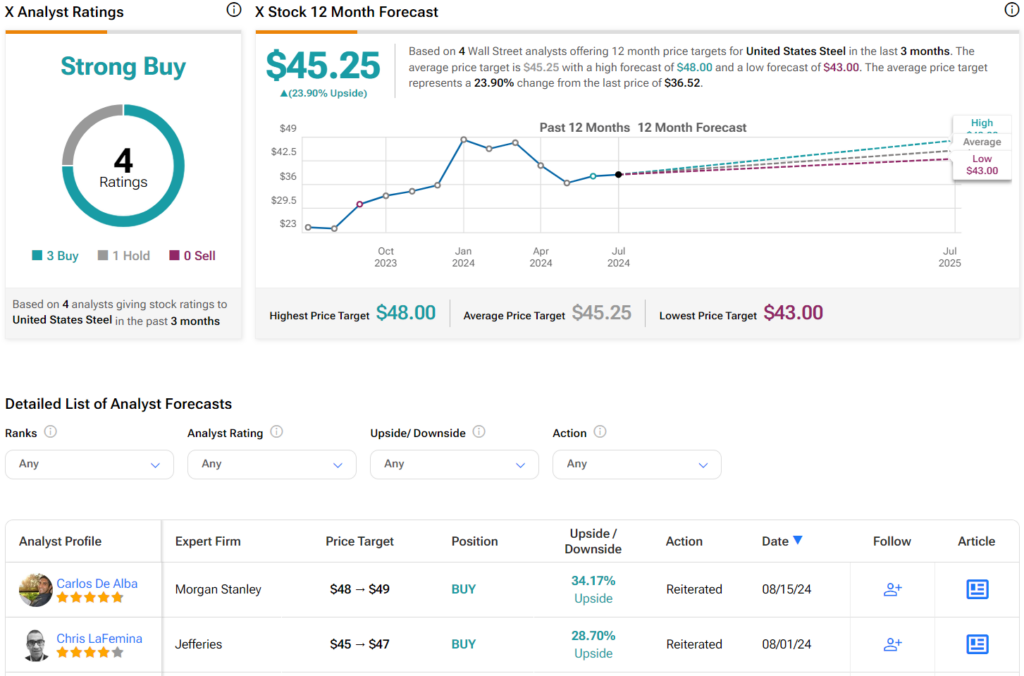

Despite the worsening odds of a merger with Nippon Steel, some Wall Street analysts believe U.S. Steel is too cheaply valued to ignore today. For instance, Morgan Stanley analyst Carlos De Alba believes the company is worth at least $49 per share, given the value of the company’s recently announced growth initiatives, including the acquisition of the Big River Steel EAF. The analyst also believes U.S. Steel will benefit from some stabilization in global steel prices.

BMO Capital analyst Katja Jancic, who has a price target of $43 for U.S. Steel, shares a similar view and expects the company’s mini-mill investments to translate to improved profitability starting in 2025.

Overall, based on the ratings of 4 Wall Street analysts, the average United States Steel price target is $45.25, which implies an upside of 23.9% from the current market price.

Although I acknowledge that U.S. Steel’s recent investments have the potential to deliver long-term gains, I believe a merger with Nippon Steel would have steered the company back into growth mode immediately, paving the way for market share gains, which the company may never enjoy without combining with another steelmaker.

Takeaway – U.S. Steel May Never Achieve Its Former Glory without Nippon

The $15 billion merger between Nippon Steel and U.S. Steel may never come to fruition, given the bipartisan opposition to this deal. However, this business combination has the potential to address many of the growth challenges U.S. Steel has been grappling with in the last decade, and Nippon Steel has pledged to remain true to core American values. A failure to complete this deal is likely to hurt investors in the long term, as U.S. Steel may never achieve its former glory without access to Nippon’s advanced technologies and deep pockets.