Shares of Helen of Troy (NASDAQ: HELE) tanked in pre-market trading on Wednesday, as the consumer products company lowered its FY23 outlook. In FY23, HELE expects net revenues to range between $2 billion and $2.05 billion, which implies a drop of 10% to 7.8% year-over-year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Adjusted diluted earnings are forecasted to be in the range of $9.00 to $9.40 per share, indicating a decline in the range of 27.2% to 23.9%.

Julien R. Mininberg, Helen of Troy’s CEO, stated that even as its Q2 results came in line with its expectations, the company is observing “consumers increasingly adjusting their spending patterns in response to rising inflation and the impact of higher interest rates, particularly in our premium segments in some categories.”

Mininberg added that HELE expects “the current external operating environment to remain highly challenging, causing us to lower our fiscal year 2023 outlook.”

HELE’s Fiscal Q2 Results

However, the company announced better-than-expected fiscal second-quarter results today.

HELE generated revenues of $521.4 million, up 9.7% year-over-year and surpassing analysts’ estimates of $523.7 million.

The company reported adjusted diluted earnings of $2.27 per share in Q2, down by 14.3% year-over-year but still coming in ahead of Street estimates of $2.19 per share.

Is Helen of Troy Stock a Buy, Sell or Hold?

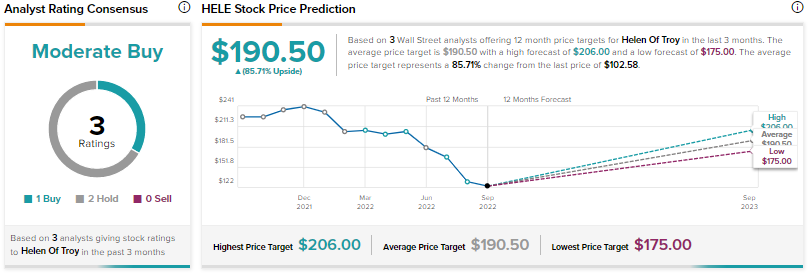

Analysts are cautiously optimistic about Helen of Troy, with a Moderate Buy consensus rating based on one Buy and two Holds.

The average price forecast for HELE stock is $190.50, implying an upside potential of 85.7% at current levels.