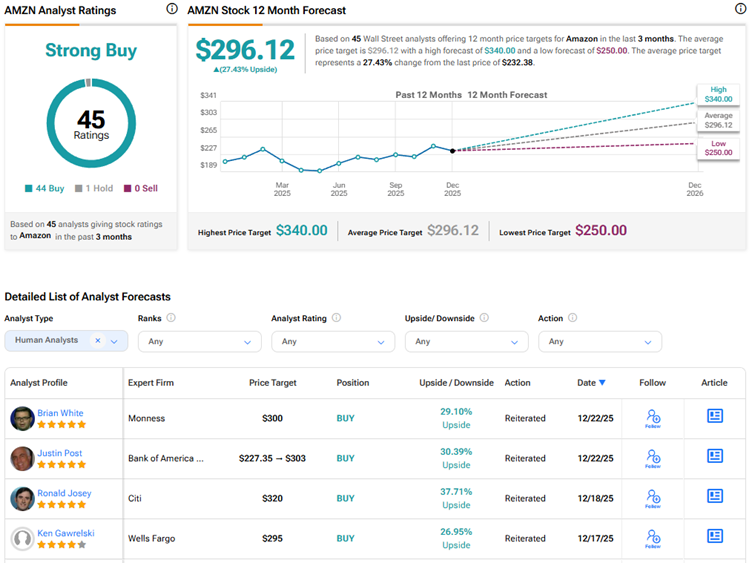

Amazon (AMZN) stock has risen only 6% year-to-date, underperforming the broader market and several mega-cap tech stocks. Concerns about the impact of tariffs on the retail business, elevated capital spending, and stiff competition faced by the Amazon Web Services (AWS) unit from Microsoft’s (MSFT) Azure business and Alphabet’s (GOOGL) Google Cloud have impacted investor sentiment about the e-commerce and cloud computing giant. Nonetheless, Wall Street is bullish on AMZN stock and sees solid upside potential in 2026.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The optimistic view of analysts is supported by Amazon’s market-beating third-quarter performance, with AWS’ growth of 20.2% surpassing consensus estimates. Analysts continue to believe in the long-term growth story of Amazon based on its dominant position in e-commerce, artificial intelligence (AI)-led growth prospects of the AWS unit, and rapid growth in its advertising business.

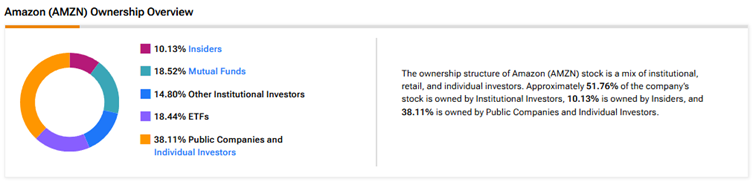

Now, according to TipRanks’ Ownership Tool, public companies and individual investors own 38.11% of Amazon. They are followed by mutual funds, exchange-traded funds (ETFs), other institutional investors, and insiders at 18.52%, 18.44%, 14.80%, and 10.13%, respectively.

Digging Deeper into Amazon’s Ownership Structure

Looking closely at Amazon’s top shareholders, founder and executive chair Jeffrey Bezos owns the highest stake, which has fallen below 10% following recent sale transactions. He is followed by Vanguard with a 6.72% holding.

Among the top ETF holders, the Vanguard Total Stock Market ETF (VTI) owns a 2.82% stake in AMZN, while the Vanguard S&P 500 ETF (VOO) owns 2.29%.

Moving to mutual funds, Vanguard Index Funds holds about 5.98% of Amazon. Meanwhile, Fidelity Concord Street Trust owns 1.55% of the company.

Is AMZN Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Strong Buy consensus rating on Amazon stock based on 44 Buys versus one Hold recommendation. The average AMZN stock price target of $296.12 indicates 27.4% upside potential.