The issue of tariffs has been front and center for a lot of companies lately. Toy maker Hasbro (HAS) is no exception here, and it already has a few plans in mind to work around the tariffs taking aim at China. That was good news for investors, who sent shares blasting up over 13% in Thursday afternoon’s trading.

Since a lot of toys are produced in the various factories of China, reports note, Chinese tariffs could have an outsized impact on the profits of a toymaker like Hasbro. But Hasbro, like many other companies, has been shifting production away from China and looking into other ports to handle their production needs.

Better yet, while competitor Mattel (MAT) is looking to potentially hike prices, Hasbro is instead looking to leverage its supply chain, which may help it keep prices down and thus draw more shoppers who want a new toy, but do not want to pay inflated prices for them. Since Hasbro has no sourcing operations in Canada, and only a few in Mexico, the end result is a likely potential win herein.

A Tentpole Franchise to be Named Later

And of course, there is the issue of video games to consider. It turns out that Hasbro is stepping into this field once more by hooking up with Saber Interactive, the team behind recently-released game Warhammer 40,000: Space Marine 2. Saber will be putting together a title around one of Hasbro’s biggest intellectual properties, though reports stopped short of naming which.

That fired up a lot of speculation: would Magic: the Gathering get a go? Would Dungeons and Dragons get themselves a new Skyrim-style adventure? Would Transformers make a comeback? It has been a while since the last movie, after all. Or, somehow, would the once-great colossus of My Little Pony come round once more for another chance at the brass ring of the younger female market?

Is Hasbro Stock a Good Buy?

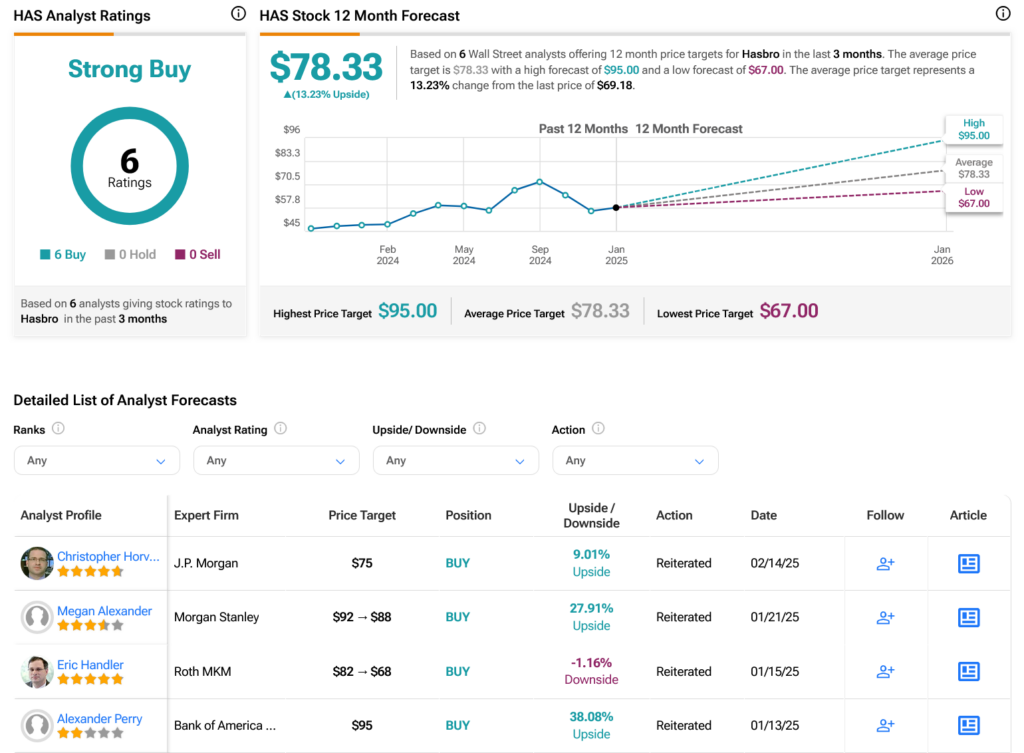

Turning to Wall Street, analysts have a Strong Buy consensus rating on HAS stock based on six Buys assigned in the past three months, as indicated by the graphic below. After an 41.97% rally in its share price over the past year, the average HAS price target of $78.33 per share implies 13.23% upside potential.