Toy and game major Hasbro (NASDAQ:HAS) declined in pre-market trading after its fourth-quarter results missed estimates. The company reported adjusted earnings of $0.38 per diluted share in Q4 compared to earnings of $1.31 per diluted share in the same period last year. This was below consensus estimates of $0.66 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Hasbro’s revenues dropped by 23.2% year-over-year to $1.28 billion in Q4, which was below Street estimates of $1.36 billion. This can be attributed to declines of 25% and 49% in Hasbro’s Consumer Products and Entertainment segments, respectively.

The company’s Board of Directors declared a quarterly cash dividend of $0.70 per common share payable on May 15 to shareholders of record on May 1, 2024.

In FY24, Hasbro continues to expect that its Consumer Products segment will see its revenues decline in the range of 7% to 12% as businesses shift to an “out-license model.” Out-licensing is when the company licenses its products to third parties for promotional and merchandising uses. The company has projected adjusted EBITDA between $925 million and $1 billion.

Is Hasbro a Buy?

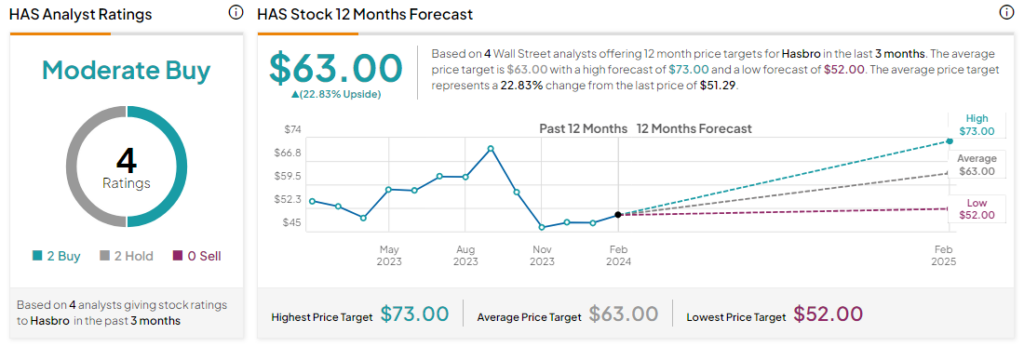

Analysts remain cautiously optimistic about HAS stock with a Moderate Buy consensus rating based on two Buys and two Holds. HAS stock has declined by more than 6% over the past year, and the average HAS price target of $63 implies an upside potential of 22.8% at current levels.